Neobank reconciliation involves matching digital banking transactions with internal records to ensure accuracy and detect discrepancies in financial accounts. Inventory reconciliation focuses on verifying physical stock levels against recorded quantities to maintain accurate inventory data and optimize supply chain management. Explore more to understand how these reconciliation processes enhance financial integrity and operational efficiency.

Why it is important

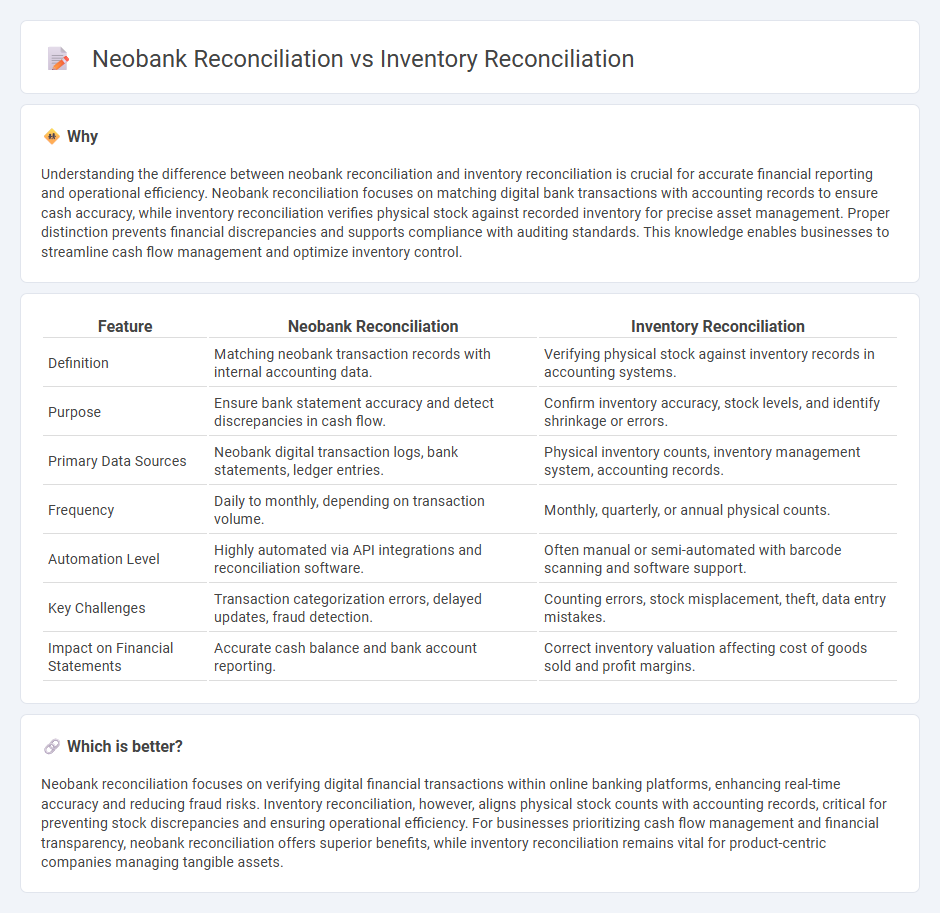

Understanding the difference between neobank reconciliation and inventory reconciliation is crucial for accurate financial reporting and operational efficiency. Neobank reconciliation focuses on matching digital bank transactions with accounting records to ensure cash accuracy, while inventory reconciliation verifies physical stock against recorded inventory for precise asset management. Proper distinction prevents financial discrepancies and supports compliance with auditing standards. This knowledge enables businesses to streamline cash flow management and optimize inventory control.

Comparison Table

| Feature | Neobank Reconciliation | Inventory Reconciliation |

|---|---|---|

| Definition | Matching neobank transaction records with internal accounting data. | Verifying physical stock against inventory records in accounting systems. |

| Purpose | Ensure bank statement accuracy and detect discrepancies in cash flow. | Confirm inventory accuracy, stock levels, and identify shrinkage or errors. |

| Primary Data Sources | Neobank digital transaction logs, bank statements, ledger entries. | Physical inventory counts, inventory management system, accounting records. |

| Frequency | Daily to monthly, depending on transaction volume. | Monthly, quarterly, or annual physical counts. |

| Automation Level | Highly automated via API integrations and reconciliation software. | Often manual or semi-automated with barcode scanning and software support. |

| Key Challenges | Transaction categorization errors, delayed updates, fraud detection. | Counting errors, stock misplacement, theft, data entry mistakes. |

| Impact on Financial Statements | Accurate cash balance and bank account reporting. | Correct inventory valuation affecting cost of goods sold and profit margins. |

Which is better?

Neobank reconciliation focuses on verifying digital financial transactions within online banking platforms, enhancing real-time accuracy and reducing fraud risks. Inventory reconciliation, however, aligns physical stock counts with accounting records, critical for preventing stock discrepancies and ensuring operational efficiency. For businesses prioritizing cash flow management and financial transparency, neobank reconciliation offers superior benefits, while inventory reconciliation remains vital for product-centric companies managing tangible assets.

Connection

Neobank reconciliation and inventory reconciliation intersect through the accurate tracking of financial transactions and asset availability, ensuring synchronized records across digital banking platforms and inventory systems. Precise reconciliation of neobank accounts guarantees correct cash flow data, which directly impacts the valuation and reporting of inventory assets. Integrating both reconciliations enhances overall financial integrity, reduces discrepancies, and supports effective audit trails in accounting processes.

Key Terms

**Inventory Reconciliation:**

Inventory reconciliation involves systematically comparing physical stock counts with recorded inventory data to identify discrepancies and ensure accurate financial reporting. It utilizes barcode scanning, cycle counting, and software integration to detect losses, theft, or data entry errors in supply chain management. Explore in-depth methods and benefits of inventory reconciliation for optimizing operational efficiency and reducing costs.

Stock Count

Inventory reconciliation involves verifying physical stock counts against recorded quantities to identify discrepancies and ensure accurate inventory records, critical for supply chain efficiency. Neobank reconciliation focuses on matching transaction records within digital banking platforms to maintain accurate financial statements but does not directly handle stock counts. Discover how precise stock count reconciliation impacts warehouse management and retail operations.

Discrepancies

Inventory reconciliation identifies discrepancies by comparing recorded stock levels against physical counts, highlighting issues like theft, damage, or data entry errors. Neobank reconciliation uncovers mismatches between transaction records and bank statements, revealing unauthorized transactions or processing errors. Learn more about how these reconciliations address discrepancies in their respective domains.

Source and External Links

How to reconcile inventory - AccountingTools - Inventory reconciliation is the detailed process of comparing physical inventory to recorded amounts, identifying discrepancies, understanding root causes, and adjusting records accordingly to maintain accurate inventory control and valuation.

How to Reconcile Your Inventory in 6 Steps (2024) - Shopify - Inventory reconciliation involves verifying physical counts against inventory records and updating the system to resolve any discrepancies so inventory data matches reality.

Inventory Reconciliation: How to Reconcile Your Inventory in 5 Steps - Proper inventory reconciliation requires physically counting stock, comparing counts to recorded inventory, analyzing discrepancies for causes, and adjusting processes and records to maintain accuracy.

dowidth.com

dowidth.com