Digital asset valuation focuses on determining the fair market value of intangible resources such as cryptocurrencies, NFTs, and other blockchain-based assets, using methods like discounted cash flow and market comparison. Revenue recognition involves the process of accurately recording income generated from business activities according to accounting standards like ASC 606 or IFRS 15. Explore the critical differences and intersections between these accounting concepts to enhance financial reporting accuracy.

Why it is important

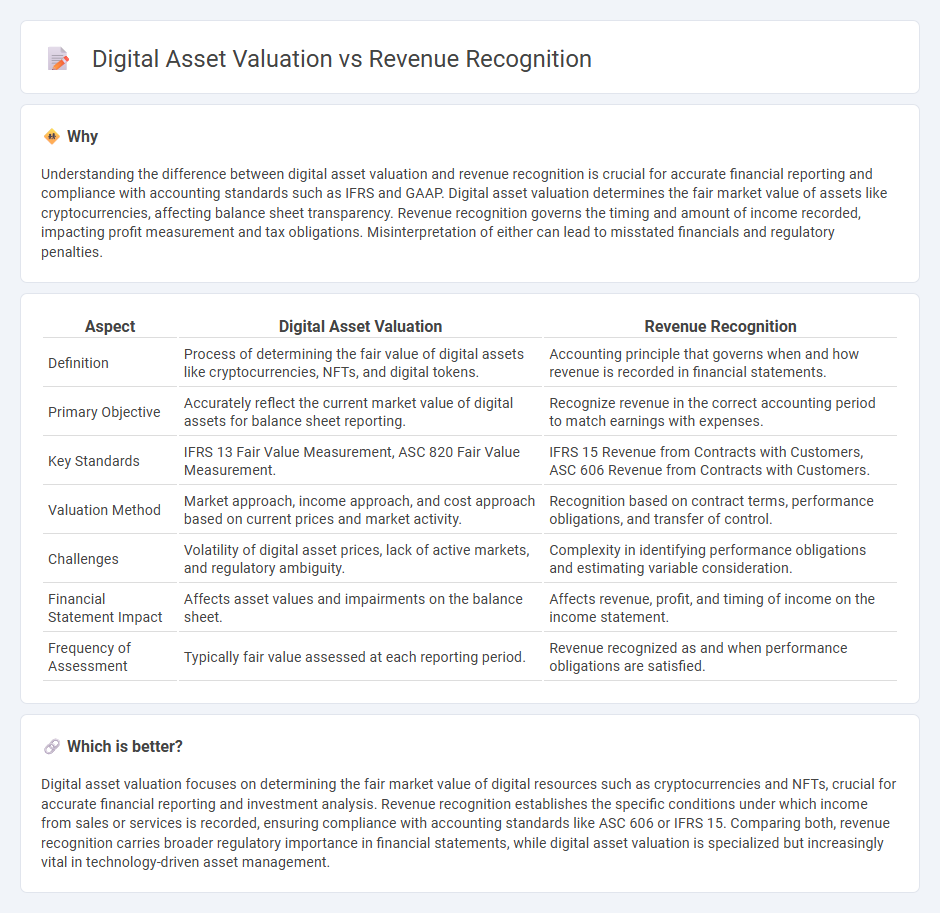

Understanding the difference between digital asset valuation and revenue recognition is crucial for accurate financial reporting and compliance with accounting standards such as IFRS and GAAP. Digital asset valuation determines the fair market value of assets like cryptocurrencies, affecting balance sheet transparency. Revenue recognition governs the timing and amount of income recorded, impacting profit measurement and tax obligations. Misinterpretation of either can lead to misstated financials and regulatory penalties.

Comparison Table

| Aspect | Digital Asset Valuation | Revenue Recognition |

|---|---|---|

| Definition | Process of determining the fair value of digital assets like cryptocurrencies, NFTs, and digital tokens. | Accounting principle that governs when and how revenue is recorded in financial statements. |

| Primary Objective | Accurately reflect the current market value of digital assets for balance sheet reporting. | Recognize revenue in the correct accounting period to match earnings with expenses. |

| Key Standards | IFRS 13 Fair Value Measurement, ASC 820 Fair Value Measurement. | IFRS 15 Revenue from Contracts with Customers, ASC 606 Revenue from Contracts with Customers. |

| Valuation Method | Market approach, income approach, and cost approach based on current prices and market activity. | Recognition based on contract terms, performance obligations, and transfer of control. |

| Challenges | Volatility of digital asset prices, lack of active markets, and regulatory ambiguity. | Complexity in identifying performance obligations and estimating variable consideration. |

| Financial Statement Impact | Affects asset values and impairments on the balance sheet. | Affects revenue, profit, and timing of income on the income statement. |

| Frequency of Assessment | Typically fair value assessed at each reporting period. | Revenue recognized as and when performance obligations are satisfied. |

Which is better?

Digital asset valuation focuses on determining the fair market value of digital resources such as cryptocurrencies and NFTs, crucial for accurate financial reporting and investment analysis. Revenue recognition establishes the specific conditions under which income from sales or services is recorded, ensuring compliance with accounting standards like ASC 606 or IFRS 15. Comparing both, revenue recognition carries broader regulatory importance in financial statements, while digital asset valuation is specialized but increasingly vital in technology-driven asset management.

Connection

Digital asset valuation directly impacts revenue recognition by determining the fair value assigned to cryptocurrencies, tokens, or NFTs on financial statements. Accurate valuation ensures compliance with accounting standards such as ASC 606 or IFRS 15, which require revenue to be recognized based on measurable and reliable data. Firms that integrate robust digital asset appraisal methods improve transparency and reduce the risk of misstated revenue in financial reporting.

Key Terms

Accrual basis

Revenue recognition under the accrual basis records income when earned, regardless of cash receipt, ensuring accurate matching of revenues with related expenses. Digital asset valuation also relies on accrual principles by recognizing gains or impairments based on market value fluctuations during the reporting period, not merely transactions. Explore in-depth how accrual accounting principles impact both revenue recognition and digital asset valuation processes.

Fair value measurement

Fair value measurement plays a crucial role in both revenue recognition and digital asset valuation by ensuring assets and liabilities are recorded at their most accurate market value. In revenue recognition, fair value determines the transaction price to recognize revenue appropriately under accounting standards like IFRS 15, while in digital asset valuation, it provides a basis for reflecting the true market worth of cryptocurrencies and NFTs amid high volatility. Explore the complexities of fair value measurement to enhance your understanding of its impact on financial reporting and asset management.

Intangible assets

Revenue recognition for intangible assets involves recording income when control transfers, ensuring compliance with ASC 606 or IFRS 15 standards, which focus on the timing and amount of revenue related to licenses, patents, or trademarks. Digital asset valuation requires assessing the fair value of intangible digital assets, such as cryptocurrencies or NFTs, often guided by IFRS or GAAP frameworks, accounting for volatility and market demand. Explore detailed methodologies and best practices for accurately managing intangible assets in both revenue recognition and digital valuation.

Source and External Links

Revenue Recognition: Principles and 5-Step Model - Discusses the five-step model for revenue recognition under GAAP and IFRS, ensuring consistent and accurate revenue reporting across various industries and transaction types.

Revenue recognition principles & best practices - Explains revenue recognition as an aspect of accrual accounting that requires businesses to recognize revenue when it is earned rather than when payment is received.

Revenue recognition examples: 4 different ways to - Provides examples of how revenue should be recognized for different business types, highlighting the distinction between cash and revenue.

dowidth.com

dowidth.com