Blockchain reconciliation ensures transaction accuracy by leveraging an immutable ledger that records every transaction in real-time, significantly reducing errors and fraud risks. Spreadsheet reconciliation depends on manual data entry and cross-referencing, which increases the likelihood of discrepancies and delays in financial reporting. Discover the key differences and benefits of these reconciliation methods to optimize your accounting processes.

Why it is important

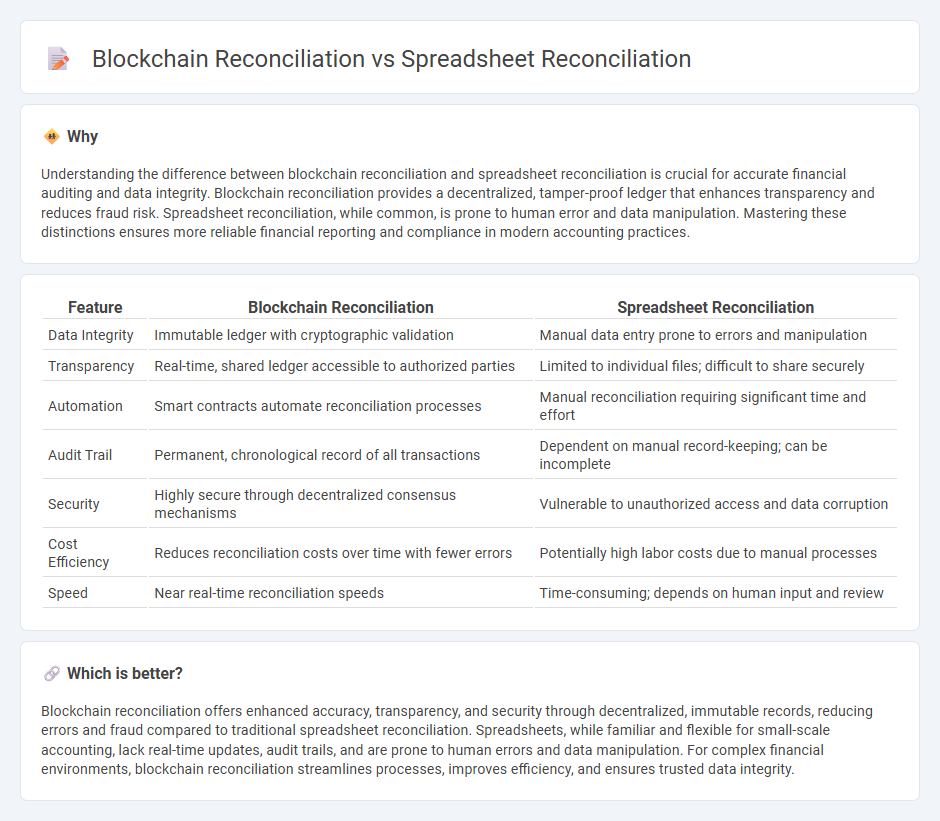

Understanding the difference between blockchain reconciliation and spreadsheet reconciliation is crucial for accurate financial auditing and data integrity. Blockchain reconciliation provides a decentralized, tamper-proof ledger that enhances transparency and reduces fraud risk. Spreadsheet reconciliation, while common, is prone to human error and data manipulation. Mastering these distinctions ensures more reliable financial reporting and compliance in modern accounting practices.

Comparison Table

| Feature | Blockchain Reconciliation | Spreadsheet Reconciliation |

|---|---|---|

| Data Integrity | Immutable ledger with cryptographic validation | Manual data entry prone to errors and manipulation |

| Transparency | Real-time, shared ledger accessible to authorized parties | Limited to individual files; difficult to share securely |

| Automation | Smart contracts automate reconciliation processes | Manual reconciliation requiring significant time and effort |

| Audit Trail | Permanent, chronological record of all transactions | Dependent on manual record-keeping; can be incomplete |

| Security | Highly secure through decentralized consensus mechanisms | Vulnerable to unauthorized access and data corruption |

| Cost Efficiency | Reduces reconciliation costs over time with fewer errors | Potentially high labor costs due to manual processes |

| Speed | Near real-time reconciliation speeds | Time-consuming; depends on human input and review |

Which is better?

Blockchain reconciliation offers enhanced accuracy, transparency, and security through decentralized, immutable records, reducing errors and fraud compared to traditional spreadsheet reconciliation. Spreadsheets, while familiar and flexible for small-scale accounting, lack real-time updates, audit trails, and are prone to human errors and data manipulation. For complex financial environments, blockchain reconciliation streamlines processes, improves efficiency, and ensures trusted data integrity.

Connection

Blockchain reconciliation enhances traditional spreadsheet reconciliation by providing an immutable ledger for verifying transaction data, significantly reducing errors and fraud risks. Integrating blockchain technology with spreadsheet reconciliation automates data validation processes, increasing accuracy and efficiency in financial reporting. This connection streamlines audit trails and simplifies compliance with regulatory standards by ensuring real-time data integrity across accounting systems.

Key Terms

**Spreadsheet Reconciliation:**

Spreadsheet reconciliation involves comparing and matching data across multiple spreadsheets to ensure accuracy and consistency, often used in finance for account balances and transaction records. This process relies heavily on manual input, which can lead to errors and inefficiencies in large datasets. Explore how advanced spreadsheet reconciliation tools can automate workflows and enhance data integrity.

Manual Data Entry

Manual data entry in spreadsheet reconciliation often leads to human errors, data inconsistencies, and time-consuming cross-checking processes, reducing overall accuracy and efficiency. Blockchain reconciliation automates data validation through decentralized ledger technology, minimizing human intervention, enhancing transparency, and ensuring real-time synchronization across all parties. Explore how these technologies transform financial accuracy and streamline operational workflows.

Error Detection

Spreadsheet reconciliation relies heavily on manual error detection, often leading to overlooked discrepancies due to human limitations and data complexity. Blockchain reconciliation uses decentralized, tamper-proof ledgers with automated validation protocols to ensure real-time, accurate identification of errors, minimizing reconciliation risks. Explore the benefits of blockchain reconciliation for enhanced error detection and operational efficiency.

Source and External Links

Account Reconciliation Spreadsheet - This webpage provides best practices for creating and using account reconciliation spreadsheets to compare internal financial records with external statements.

Reconcile Data with Financial Reconciliation Agent - This resource explains how to use a financial reconciliation agent in Excel to simplify the process of reconciling two data sets.

Monthly Bank Reconciliation Worksheet - It offers a specially designed worksheet to help streamline the bank reconciliation process by automating some clerical tasks.

dowidth.com

dowidth.com