Revenue recognition automation streamlines financial reporting by accurately capturing earned income based on established accounting standards, reducing errors and enhancing compliance. Audit trail automation ensures transparent and tamper-proof tracking of all transactions, facilitating regulatory audits and internal controls. Explore how integrating these automation solutions can optimize your accounting processes and safeguard financial integrity.

Why it is important

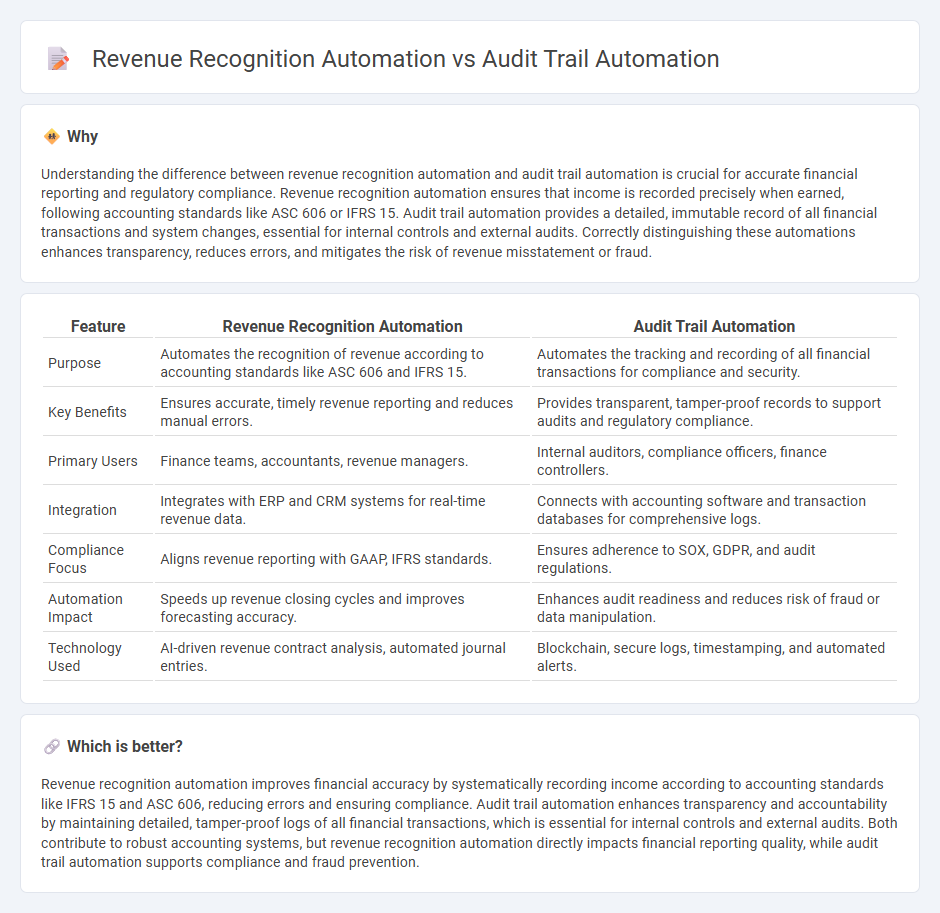

Understanding the difference between revenue recognition automation and audit trail automation is crucial for accurate financial reporting and regulatory compliance. Revenue recognition automation ensures that income is recorded precisely when earned, following accounting standards like ASC 606 or IFRS 15. Audit trail automation provides a detailed, immutable record of all financial transactions and system changes, essential for internal controls and external audits. Correctly distinguishing these automations enhances transparency, reduces errors, and mitigates the risk of revenue misstatement or fraud.

Comparison Table

| Feature | Revenue Recognition Automation | Audit Trail Automation |

|---|---|---|

| Purpose | Automates the recognition of revenue according to accounting standards like ASC 606 and IFRS 15. | Automates the tracking and recording of all financial transactions for compliance and security. |

| Key Benefits | Ensures accurate, timely revenue reporting and reduces manual errors. | Provides transparent, tamper-proof records to support audits and regulatory compliance. |

| Primary Users | Finance teams, accountants, revenue managers. | Internal auditors, compliance officers, finance controllers. |

| Integration | Integrates with ERP and CRM systems for real-time revenue data. | Connects with accounting software and transaction databases for comprehensive logs. |

| Compliance Focus | Aligns revenue reporting with GAAP, IFRS standards. | Ensures adherence to SOX, GDPR, and audit regulations. |

| Automation Impact | Speeds up revenue closing cycles and improves forecasting accuracy. | Enhances audit readiness and reduces risk of fraud or data manipulation. |

| Technology Used | AI-driven revenue contract analysis, automated journal entries. | Blockchain, secure logs, timestamping, and automated alerts. |

Which is better?

Revenue recognition automation improves financial accuracy by systematically recording income according to accounting standards like IFRS 15 and ASC 606, reducing errors and ensuring compliance. Audit trail automation enhances transparency and accountability by maintaining detailed, tamper-proof logs of all financial transactions, which is essential for internal controls and external audits. Both contribute to robust accounting systems, but revenue recognition automation directly impacts financial reporting quality, while audit trail automation supports compliance and fraud prevention.

Connection

Revenue recognition automation integrates seamlessly with audit trail automation by ensuring every transaction is accurately recorded and timestamped, enabling transparent tracking from initial sale to financial reporting. This connection reduces errors and enhances compliance with accounting standards such as ASC 606 and IFRS 15. Real-time automation of both processes facilitates faster audits and strengthens internal controls across financial operations.

Key Terms

**Audit Trail Automation:**

Audit trail automation enhances financial transparency by systematically recording and storing every transaction, ensuring compliance with regulatory standards such as SOX and GDPR. It significantly reduces human error and fraud risks through real-time monitoring and immutable logs, enabling faster and more accurate audits. Explore how audit trail automation can strengthen your organization's controls and improve audit readiness.

Transaction Logs

Transaction logs play a crucial role in both audit trail automation and revenue recognition automation by providing detailed records of financial activities. Audit trail automation leverages these logs to ensure compliance, traceability, and fraud detection, while revenue recognition automation analyzes transaction data to accurately match revenue with corresponding expenses and contractual terms. Explore how integrating transaction log management enhances accuracy and regulatory adherence in financial processes.

Data Integrity

Audit trail automation ensures comprehensive and tamper-proof records of all financial transactions, enhancing data integrity by providing transparent and verifiable logs for compliance and internal controls. Revenue recognition automation systematically applies accounting standards to recognize revenue accurately and consistently, reducing errors and discrepancies that could compromise financial data integrity. Explore how these automation solutions improve data integrity and optimize financial reporting accuracy.

Source and External Links

Automated audit trails: why they're so important and how to ... - Automates request and approval workflows within payment systems, capturing who, when, and why for every transaction directly in the platform.

10 Best Automated Audit Trail Software for 2024 - Automatically records, in real time, every user action and transaction, creating an unchangeable, chronological digital log for accuracy and compliance.

What is an Audit Trail and How to Automate it? - Centralizes audit trail data in a single platform with automated workflows, enforcing user accountability and enabling real-time compliance monitoring.

dowidth.com

dowidth.com