Real-time expense management enables businesses to track expenditures instantly, improving cash flow visibility and budget adherence. Transaction categorization automates the sorting of financial activities into predefined groups, enhancing reporting accuracy and simplifying tax preparation. Explore these methods to optimize your financial operations and maintain precise accounting records.

Why it is important

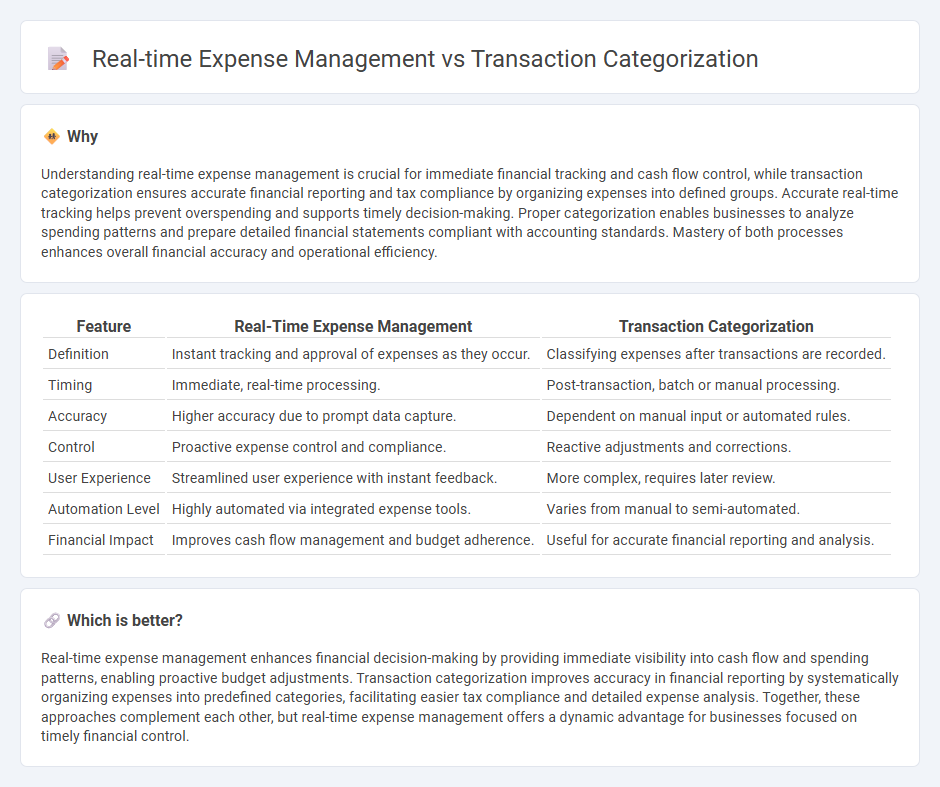

Understanding real-time expense management is crucial for immediate financial tracking and cash flow control, while transaction categorization ensures accurate financial reporting and tax compliance by organizing expenses into defined groups. Accurate real-time tracking helps prevent overspending and supports timely decision-making. Proper categorization enables businesses to analyze spending patterns and prepare detailed financial statements compliant with accounting standards. Mastery of both processes enhances overall financial accuracy and operational efficiency.

Comparison Table

| Feature | Real-Time Expense Management | Transaction Categorization |

|---|---|---|

| Definition | Instant tracking and approval of expenses as they occur. | Classifying expenses after transactions are recorded. |

| Timing | Immediate, real-time processing. | Post-transaction, batch or manual processing. |

| Accuracy | Higher accuracy due to prompt data capture. | Dependent on manual input or automated rules. |

| Control | Proactive expense control and compliance. | Reactive adjustments and corrections. |

| User Experience | Streamlined user experience with instant feedback. | More complex, requires later review. |

| Automation Level | Highly automated via integrated expense tools. | Varies from manual to semi-automated. |

| Financial Impact | Improves cash flow management and budget adherence. | Useful for accurate financial reporting and analysis. |

Which is better?

Real-time expense management enhances financial decision-making by providing immediate visibility into cash flow and spending patterns, enabling proactive budget adjustments. Transaction categorization improves accuracy in financial reporting by systematically organizing expenses into predefined categories, facilitating easier tax compliance and detailed expense analysis. Together, these approaches complement each other, but real-time expense management offers a dynamic advantage for businesses focused on timely financial control.

Connection

Real-time expense management relies heavily on accurate transaction categorization to provide businesses with instant visibility into their spending patterns and financial health. By automatically classifying transactions as they occur, companies can monitor budgets, detect anomalies, and ensure compliance with accounting standards more efficiently. This seamless connection minimizes manual errors and accelerates financial reporting processes, enhancing overall accounting accuracy.

Key Terms

**Transaction categorization:**

Transaction categorization involves automatically sorting financial transactions into predefined categories such as groceries, utilities, or entertainment, enabling precise tracking and analysis of spending patterns. This process leverages AI and machine learning to enhance accuracy and reduce manual effort in expense management. Explore how advanced transaction categorization tools can optimize your financial insights and budgeting strategies.

Chart of Accounts

Transaction categorization organizes financial data into predefined Chart of Accounts categories, enabling accurate financial reporting and analysis. Real-time expense management integrates these categorizations to provide instantaneous tracking and control of spending, ensuring budgets align with actual expenditures. Explore how optimizing your Chart of Accounts can enhance both transaction categorization and real-time expense management.

Classification Rules

Transaction categorization relies heavily on predefined classification rules to accurately sort financial data into relevant categories, enhancing budget tracking accuracy. Real-time expense management utilizes these rules dynamically to provide immediate insights and timely spending control, reducing overspending risks. Explore how integrating advanced classification rules can revolutionize your financial management strategy.

Source and External Links

What is Transaction Categorization, and How Does it Work? - Transaction categorization is the process of organizing and grouping financial transactions into defined categories based on their nature, purpose, or type, facilitating accurate tracking, reporting, and analysis for financial institutions.

What is transaction categorization? - Transaction categorization, also known as transaction taxonomy, involves classifying financial transactions--such as income, expenses, and investments--into logical groups to improve budgeting, financial analysis, and decision-making for both individuals and businesses.

Why Automatic Transaction Categorization Is Vital for Your Treasury Management - Automated transaction categorization uses predefined rules to classify transactions by analyzing details like descriptions, amounts, and dates, enabling organizations to quickly understand cash flow and make informed financial decisions without manual review.

dowidth.com

dowidth.com