Supply chain finance improves cash flow by optimizing payment terms between buyers and suppliers through financial solutions like invoice factoring and reverse factoring. Inventory financing provides businesses with working capital by using stored inventory as collateral for loans, helping manage liquidity during stock accumulation or seasonal demand. Explore more to understand which financing option best suits your business needs.

Why it is important

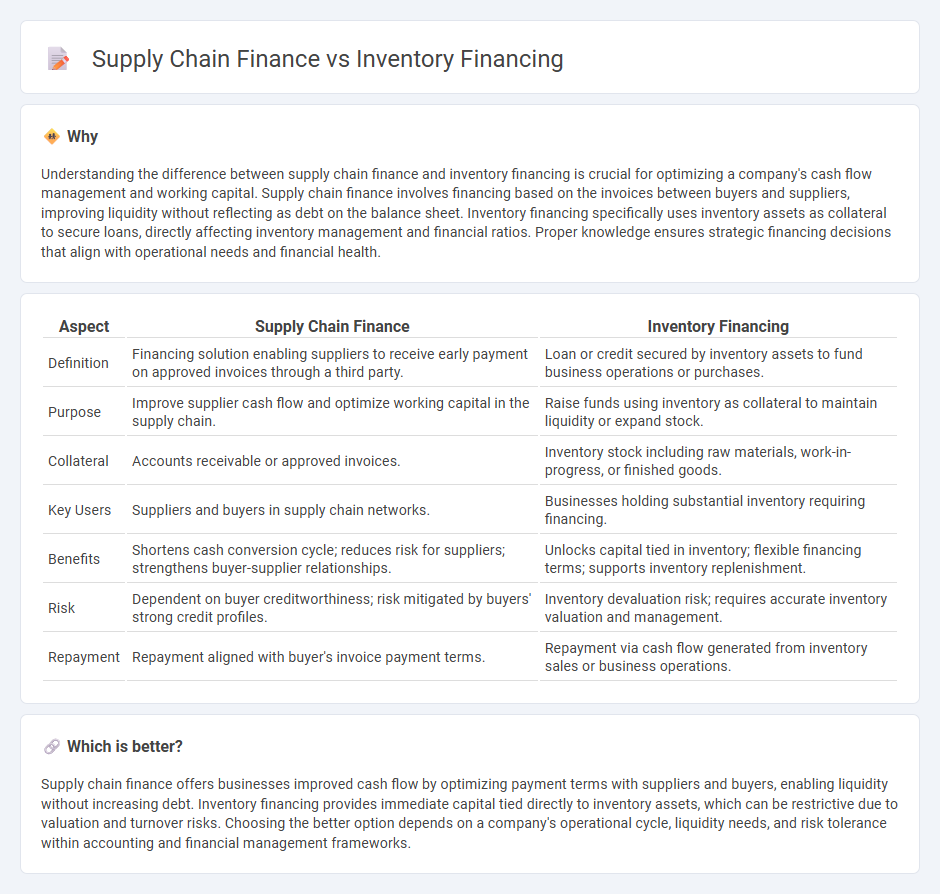

Understanding the difference between supply chain finance and inventory financing is crucial for optimizing a company's cash flow management and working capital. Supply chain finance involves financing based on the invoices between buyers and suppliers, improving liquidity without reflecting as debt on the balance sheet. Inventory financing specifically uses inventory assets as collateral to secure loans, directly affecting inventory management and financial ratios. Proper knowledge ensures strategic financing decisions that align with operational needs and financial health.

Comparison Table

| Aspect | Supply Chain Finance | Inventory Financing |

|---|---|---|

| Definition | Financing solution enabling suppliers to receive early payment on approved invoices through a third party. | Loan or credit secured by inventory assets to fund business operations or purchases. |

| Purpose | Improve supplier cash flow and optimize working capital in the supply chain. | Raise funds using inventory as collateral to maintain liquidity or expand stock. |

| Collateral | Accounts receivable or approved invoices. | Inventory stock including raw materials, work-in-progress, or finished goods. |

| Key Users | Suppliers and buyers in supply chain networks. | Businesses holding substantial inventory requiring financing. |

| Benefits | Shortens cash conversion cycle; reduces risk for suppliers; strengthens buyer-supplier relationships. | Unlocks capital tied in inventory; flexible financing terms; supports inventory replenishment. |

| Risk | Dependent on buyer creditworthiness; risk mitigated by buyers' strong credit profiles. | Inventory devaluation risk; requires accurate inventory valuation and management. |

| Repayment | Repayment aligned with buyer's invoice payment terms. | Repayment via cash flow generated from inventory sales or business operations. |

Which is better?

Supply chain finance offers businesses improved cash flow by optimizing payment terms with suppliers and buyers, enabling liquidity without increasing debt. Inventory financing provides immediate capital tied directly to inventory assets, which can be restrictive due to valuation and turnover risks. Choosing the better option depends on a company's operational cycle, liquidity needs, and risk tolerance within accounting and financial management frameworks.

Connection

Supply chain finance and inventory financing are interconnected by their focus on improving cash flow and liquidity within the supply chain ecosystem. Supply chain finance provides suppliers with early payment options based on approved invoices, while inventory financing offers working capital by leveraging stock as collateral. Together, these financial solutions optimize operational efficiency and reduce funding gaps for businesses managing both supplier obligations and inventory levels.

Key Terms

Collateralization

Inventory financing involves using physical stock as collateral to obtain short-term loans, allowing businesses to leverage tangible inventory assets for immediate capital. Supply chain finance optimizes working capital by financing payables and receivables within the supply chain, often without requiring direct collateral but relying on creditworthiness and invoice verification. Discover the key distinctions and benefits of each approach to enhance your working capital strategy.

Receivables

Inventory financing focuses on leveraging physical stock as collateral to obtain short-term loans, often tied to the value of goods held in inventory. Supply chain finance, particularly receivables financing, centers on optimizing cash flow by allowing businesses to sell outstanding invoices to financial institutions at a discount, enhancing liquidity without increasing debt. Discover more about how receivables-based solutions can transform your working capital management.

Working capital

Inventory financing provides businesses with funds secured against stock, improving working capital by converting inventory into liquidity. Supply chain finance optimizes working capital by enabling early payments to suppliers through third-party financing, enhancing cash flow across the supply chain network. Explore the differences and benefits of both financing options to strengthen your working capital strategy.

Source and External Links

Inventory Financing: A Step by Step Guide - Inventory financing uses inventory as collateral to help retailers, wholesalers, manufacturers, distributors, and e-commerce businesses purchase necessary stock without straining cash flow, allowing them to meet customer demand and grow their operations.

The Founder's Guide to Inventory Financing in 2024 - Arc - As a subset of asset-based financing, inventory financing provides loans or lines of credit secured by existing inventory, making it especially useful for startups, e-commerce, and seasonal businesses that need to purchase inventory ahead of demand but lack current capital.

Inventory Financing: Defined, How It Works, Types | TAB Bank - Inventory financing is a flexible, short-term loan or line of credit that lets businesses buy inventory for future sale using those goods as collateral, helping them manage cash flow, prepare for busy seasons, and respond to increased customer demand.

dowidth.com

dowidth.com