Zero trust accounting implements stringent verification processes for every financial transaction, minimizing risks of fraud by ensuring no implicit trust is placed on internal or external entities. Fund accounting organizes financial resources into separate accounts or funds, enabling precise tracking and reporting of specific objectives, often used by nonprofit organizations. Explore these accounting methods to understand their applications and enhance financial integrity in your operations.

Why it is important

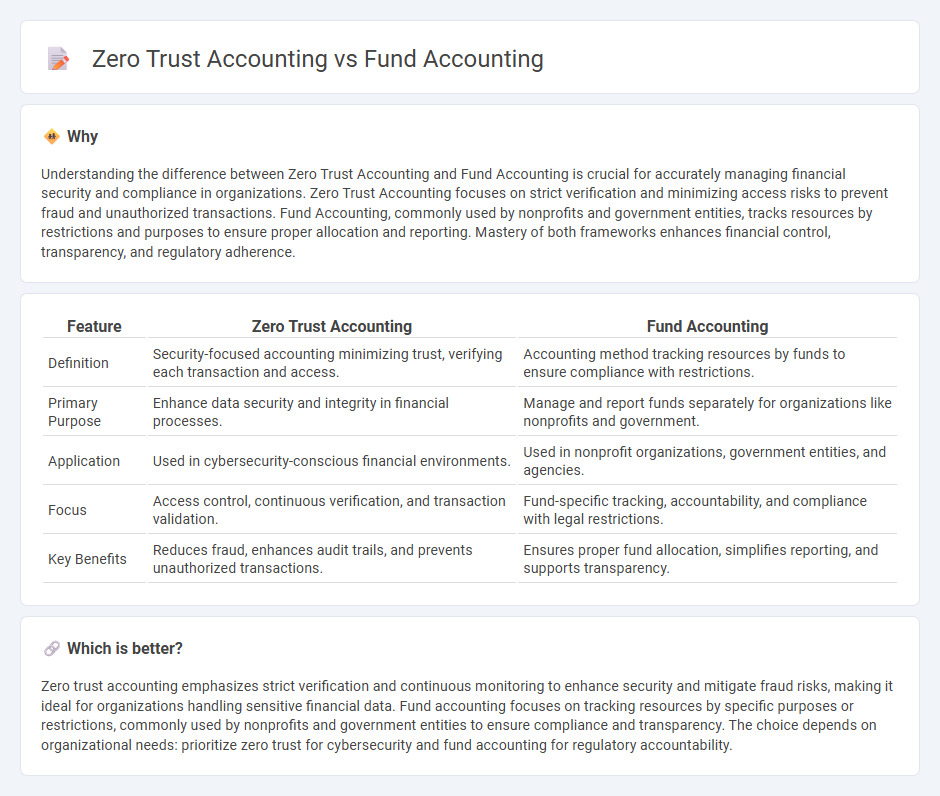

Understanding the difference between Zero Trust Accounting and Fund Accounting is crucial for accurately managing financial security and compliance in organizations. Zero Trust Accounting focuses on strict verification and minimizing access risks to prevent fraud and unauthorized transactions. Fund Accounting, commonly used by nonprofits and government entities, tracks resources by restrictions and purposes to ensure proper allocation and reporting. Mastery of both frameworks enhances financial control, transparency, and regulatory adherence.

Comparison Table

| Feature | Zero Trust Accounting | Fund Accounting |

|---|---|---|

| Definition | Security-focused accounting minimizing trust, verifying each transaction and access. | Accounting method tracking resources by funds to ensure compliance with restrictions. |

| Primary Purpose | Enhance data security and integrity in financial processes. | Manage and report funds separately for organizations like nonprofits and government. |

| Application | Used in cybersecurity-conscious financial environments. | Used in nonprofit organizations, government entities, and agencies. |

| Focus | Access control, continuous verification, and transaction validation. | Fund-specific tracking, accountability, and compliance with legal restrictions. |

| Key Benefits | Reduces fraud, enhances audit trails, and prevents unauthorized transactions. | Ensures proper fund allocation, simplifies reporting, and supports transparency. |

Which is better?

Zero trust accounting emphasizes strict verification and continuous monitoring to enhance security and mitigate fraud risks, making it ideal for organizations handling sensitive financial data. Fund accounting focuses on tracking resources by specific purposes or restrictions, commonly used by nonprofits and government entities to ensure compliance and transparency. The choice depends on organizational needs: prioritize zero trust for cybersecurity and fund accounting for regulatory accountability.

Connection

Zero trust accounting enhances fund accounting by implementing stringent access controls and continuous verification to protect financial data integrity. Fund accounting relies on accurate segregation and tracking of resources, which benefits from zero trust principles ensuring only authorized personnel access sensitive fund records. This integration reduces the risk of fraud and errors in managing restricted funds, supporting transparent and compliant financial reporting.

Key Terms

Fund Accounting:

Fund accounting is a specialized accounting system used primarily by non-profit organizations and government entities to track and manage resources according to specific purposes or restrictions, ensuring transparency and accountability. It segregates resources into funds to demonstrate compliance with donor and regulatory requirements, enhancing financial reporting accuracy. Explore more about fund accounting principles and their impact on organizational financial health.

Restricted Funds

Fund accounting allocates and tracks financial resources with a focus on restricted funds to ensure compliance with donor and grantor restrictions, maintaining transparency and accountability in nonprofit organizations. Zero trust accounting emphasizes continuous verification and strict access controls across financial systems to protect against unauthorized access and cyber threats, safeguarding restricted fund data integrity. Explore how integrating fund accounting principles with zero trust security models can enhance the management and protection of restricted funds.

Fund Balance

Fund accounting emphasizes tracking and managing fund balances to ensure resources are allocated according to donor restrictions and organizational priorities. Zero trust accounting applies strict verification and continuous monitoring to financial data access, enhancing security and preventing unauthorized changes to fund balances. Explore further to understand how these approaches impact financial integrity and control.

Source and External Links

What Is Fund Accounting? | Xero US - Fund accounting is an accounting method primarily used by nonprofit organizations to track how money is spent according to its designated purpose, using accrual accounting and separate fund accounts for different revenue sources like grants and donations.

Fund accounting - Wikipedia - Fund accounting is a system focusing on accountability rather than profitability, tracking resources restricted by donors or authorities, and is widely used by nonprofits and governments through self-balancing sets of accounts classified by restriction categories.

Fund Accounting 101 : Office of Budgeting & Financial Analysis - Fund accounting classifies resources into self-balancing funds with their own revenues, expenditures, assets, liabilities, and fund balances, ensuring accountability for funds based on usage limitations set by providers.

dowidth.com

dowidth.com