Fractional CFO services provide strategic financial leadership by offering part-time executive expertise focused on budgeting, forecasting, and financial planning, tailored for growing businesses. Accounting consulting primarily addresses system improvements, compliance, and process optimization to enhance accuracy and efficiency in financial reporting. Explore the key differences and benefits to determine which solution aligns best with your company's financial goals.

Why it is important

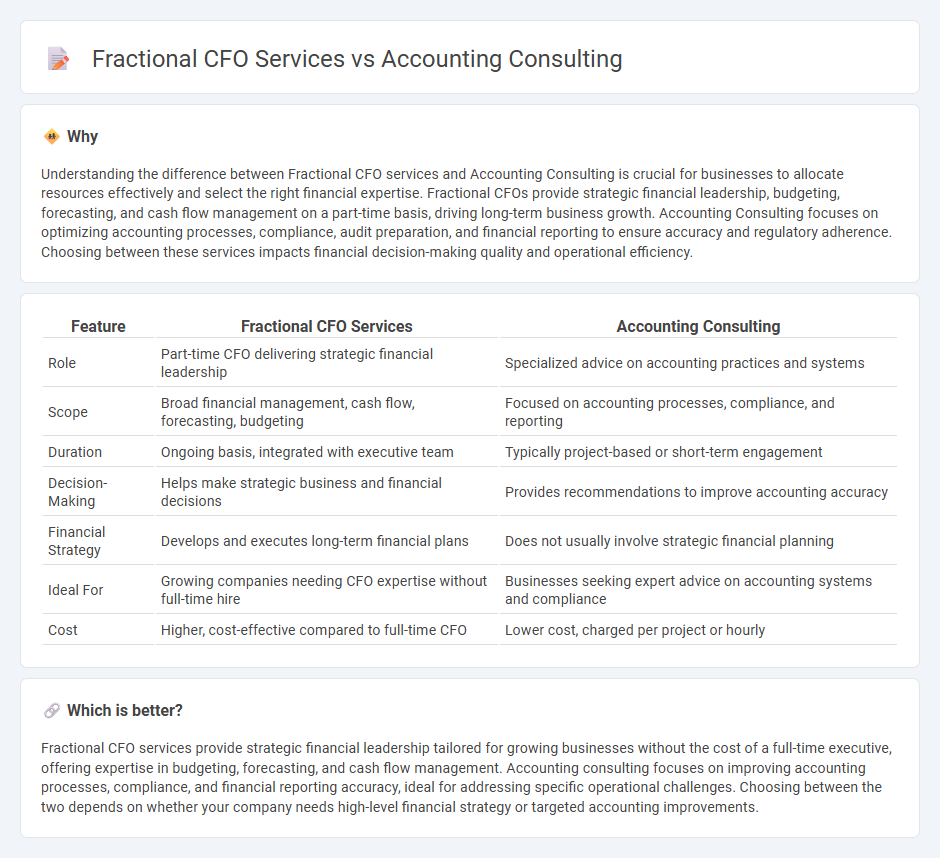

Understanding the difference between Fractional CFO services and Accounting Consulting is crucial for businesses to allocate resources effectively and select the right financial expertise. Fractional CFOs provide strategic financial leadership, budgeting, forecasting, and cash flow management on a part-time basis, driving long-term business growth. Accounting Consulting focuses on optimizing accounting processes, compliance, audit preparation, and financial reporting to ensure accuracy and regulatory adherence. Choosing between these services impacts financial decision-making quality and operational efficiency.

Comparison Table

| Feature | Fractional CFO Services | Accounting Consulting |

|---|---|---|

| Role | Part-time CFO delivering strategic financial leadership | Specialized advice on accounting practices and systems |

| Scope | Broad financial management, cash flow, forecasting, budgeting | Focused on accounting processes, compliance, and reporting |

| Duration | Ongoing basis, integrated with executive team | Typically project-based or short-term engagement |

| Decision-Making | Helps make strategic business and financial decisions | Provides recommendations to improve accounting accuracy |

| Financial Strategy | Develops and executes long-term financial plans | Does not usually involve strategic financial planning |

| Ideal For | Growing companies needing CFO expertise without full-time hire | Businesses seeking expert advice on accounting systems and compliance |

| Cost | Higher, cost-effective compared to full-time CFO | Lower cost, charged per project or hourly |

Which is better?

Fractional CFO services provide strategic financial leadership tailored for growing businesses without the cost of a full-time executive, offering expertise in budgeting, forecasting, and cash flow management. Accounting consulting focuses on improving accounting processes, compliance, and financial reporting accuracy, ideal for addressing specific operational challenges. Choosing between the two depends on whether your company needs high-level financial strategy or targeted accounting improvements.

Connection

Fractional CFO services and accounting consulting are interconnected through their focus on enhancing financial decision-making and strategic planning for businesses. Fractional CFOs provide part-time executive financial leadership, leveraging accounting consulting insights to optimize budgeting, cash flow management, and financial reporting. Together, these services drive improved fiscal efficiency and support scalable business growth by integrating expert accounting analysis with high-level financial expertise.

Key Terms

Advisory Services

Accounting consulting primarily concentrates on financial reporting, compliance, and bookkeeping accuracy, ensuring businesses meet regulatory standards efficiently. Fractional CFO services provide strategic advisory on financial planning, cash flow management, and long-term growth, offering executive-level insights without a full-time commitment. Explore the distinct benefits of advisory services to determine which solution best supports your company's financial goals.

Financial Strategy

Accounting consulting primarily targets accurate financial reporting, compliance, and bookkeeping, ensuring businesses maintain proper financial records and meet regulatory standards. Fractional CFO services provide strategic financial leadership, including cash flow management, budgeting, forecasting, and long-term financial planning that drive business growth and profitability. Discover how integrating both approaches can optimize your financial strategy for sustainable success.

Interim Leadership

Accounting consulting primarily offers specialized expertise in financial reporting, compliance, and process improvements, ensuring accurate and efficient accounting operations. Fractional CFO services provide interim leadership by managing overall financial strategy, cash flow, budgeting, and advising on growth initiatives to bridge gaps during CFO transitions. Explore the distinct advantages of both services to determine which best suits your company's immediate financial leadership needs.

Source and External Links

Hire the best Accounting Consultants - This webpage provides information on hiring accounting consultants for tasks such as budgeting, tax planning, and financial risk management.

Accounting Consulting: How to Become an Accounting Consultant - This resource explains the role of accounting consultants, including services like financial forecasting and financial health evaluation.

A Guide to the Accounting Consultant Career - This article discusses the career path of accounting consultants, highlighting their role in advising clients on financial management and compliance.

dowidth.com

dowidth.com