Real-time auditing leverages continuous data monitoring to detect discrepancies instantly, enhancing financial accuracy and compliance. Integrated auditing combines financial, operational, and information system audits into a cohesive framework to provide comprehensive risk assessment and organizational insight. Explore the advantages and applications of these auditing approaches to optimize accounting practices.

Why it is important

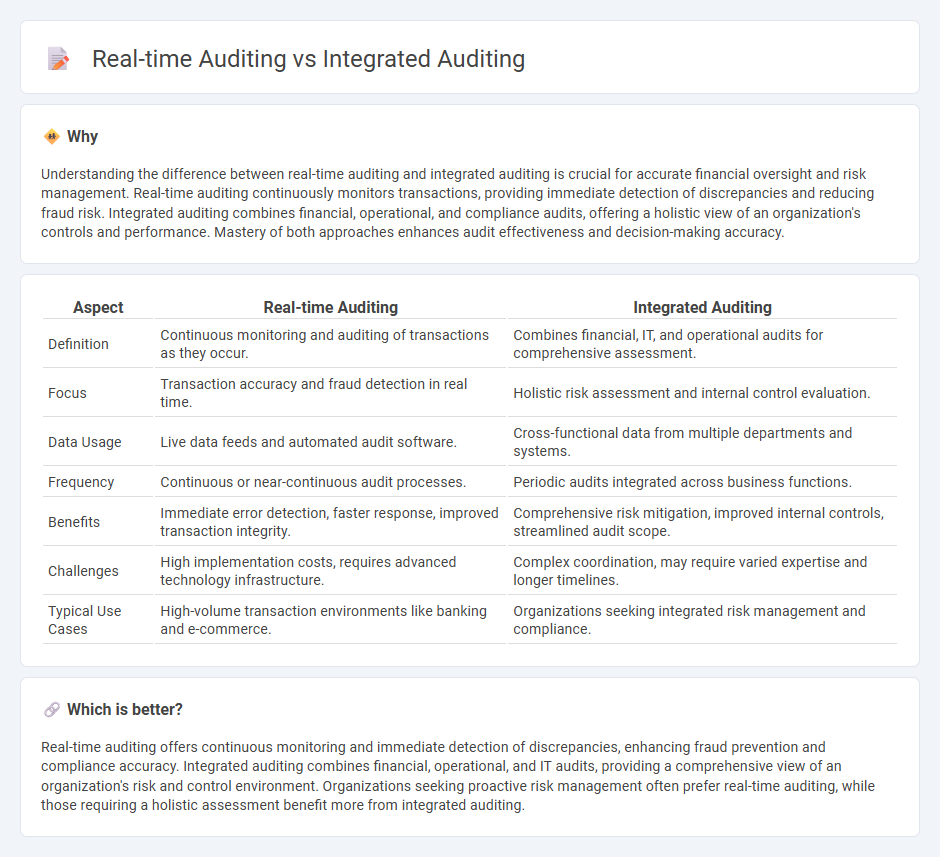

Understanding the difference between real-time auditing and integrated auditing is crucial for accurate financial oversight and risk management. Real-time auditing continuously monitors transactions, providing immediate detection of discrepancies and reducing fraud risk. Integrated auditing combines financial, operational, and compliance audits, offering a holistic view of an organization's controls and performance. Mastery of both approaches enhances audit effectiveness and decision-making accuracy.

Comparison Table

| Aspect | Real-time Auditing | Integrated Auditing |

|---|---|---|

| Definition | Continuous monitoring and auditing of transactions as they occur. | Combines financial, IT, and operational audits for comprehensive assessment. |

| Focus | Transaction accuracy and fraud detection in real time. | Holistic risk assessment and internal control evaluation. |

| Data Usage | Live data feeds and automated audit software. | Cross-functional data from multiple departments and systems. |

| Frequency | Continuous or near-continuous audit processes. | Periodic audits integrated across business functions. |

| Benefits | Immediate error detection, faster response, improved transaction integrity. | Comprehensive risk mitigation, improved internal controls, streamlined audit scope. |

| Challenges | High implementation costs, requires advanced technology infrastructure. | Complex coordination, may require varied expertise and longer timelines. |

| Typical Use Cases | High-volume transaction environments like banking and e-commerce. | Organizations seeking integrated risk management and compliance. |

Which is better?

Real-time auditing offers continuous monitoring and immediate detection of discrepancies, enhancing fraud prevention and compliance accuracy. Integrated auditing combines financial, operational, and IT audits, providing a comprehensive view of an organization's risk and control environment. Organizations seeking proactive risk management often prefer real-time auditing, while those requiring a holistic assessment benefit more from integrated auditing.

Connection

Real-time auditing and integrated auditing are connected through their focus on continuous monitoring and comprehensive evaluation of financial data, enhancing accuracy and compliance. Real-time auditing leverages automated systems to provide immediate insights, while integrated auditing combines financial and operational audits for a holistic risk assessment. This connection enables more proactive detection of anomalies and streamlines reporting processes within accounting practices.

Key Terms

Controls Testing

Integrated auditing combines financial and operational controls testing within a single audit framework, enhancing efficiency and risk assessment by addressing multiple compliance aspects simultaneously. Real-time auditing focuses on continuous monitoring and immediate controls testing, enabling instant detection and correction of discrepancies to improve accuracy and reduce fraud risk. Explore the detailed benefits and applications of both auditing methods to strengthen your control testing strategy.

Continuous Monitoring

Integrated auditing combines financial, operational, and compliance audits to provide a comprehensive evaluation of an organization's processes, improving efficiency by eliminating redundancies. Real-time auditing leverages continuous monitoring tools and data analytics to detect discrepancies and risks instantly, enabling proactive issue resolution and enhanced control environments. Explore how continuous monitoring transforms audit effectiveness and risk management strategies.

Risk Assessment

Integrated auditing combines financial, operational, and IT audits to provide a comprehensive risk assessment framework, enhancing organizational control and compliance. Real-time auditing employs continuous monitoring and data analytics to identify and address risks instantly, supporting proactive decision-making and minimizing potential losses. Explore the nuances and benefits of each approach to optimize your risk management strategy.

Source and External Links

What is an Integrated Audit? - Risk Management & Audit Services - An integrated audit evaluates the relationships among information technology, financial, and operational controls to ensure an effective and efficient internal control environment, covering risks, data accuracy, security, and business continuity.

What is an Integrated Audit | F&A Glossary - BlackLine - An integrated audit combines the examination of financial statements with an evaluation of internal financial controls to identify material weaknesses that could affect financial reporting accuracy.

What's an Integrated Audit and How to Do One - HighRadius - By merging financial, operational, and compliance audits into a single review, integrated audits provide a holistic view of organizational risks, streamline processes, and help ensure compliance across multiple areas.

dowidth.com

dowidth.com