Smart contracts accounting leverages blockchain technology to automate and record financial transactions with high transparency and immutability, enhancing efficiency in audit trails. Forensic accounting focuses on investigating financial discrepancies and fraud through meticulous examination of records and data analysis. Discover how these specialized accounting fields transform financial management and fraud detection.

Why it is important

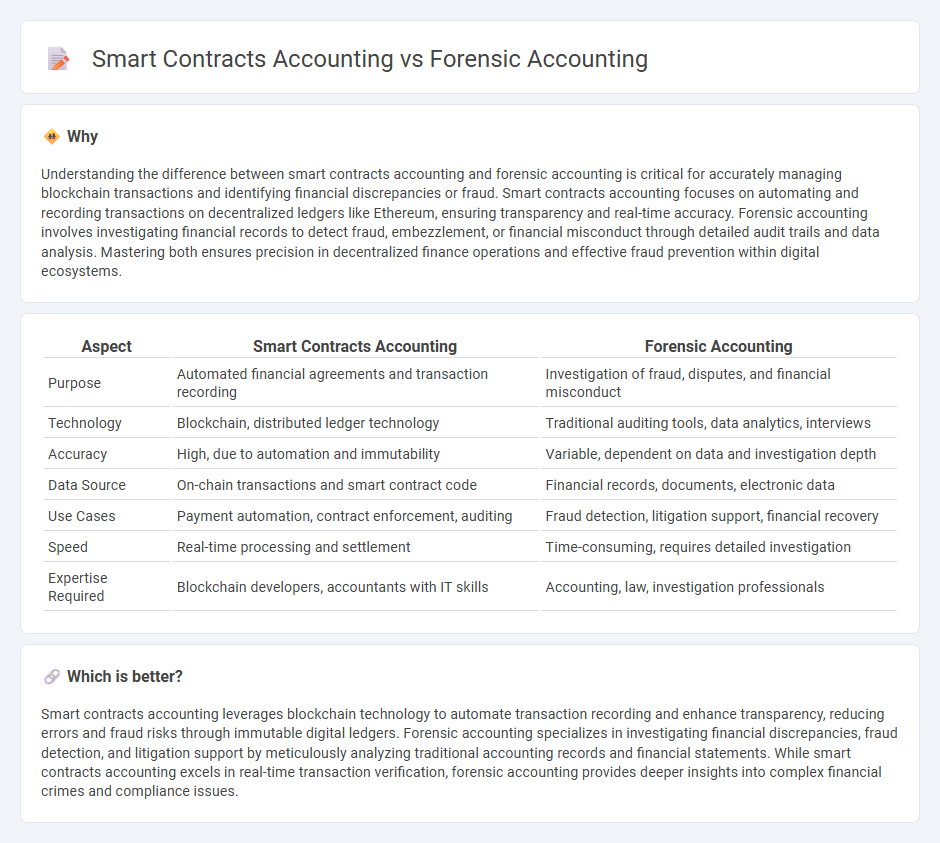

Understanding the difference between smart contracts accounting and forensic accounting is critical for accurately managing blockchain transactions and identifying financial discrepancies or fraud. Smart contracts accounting focuses on automating and recording transactions on decentralized ledgers like Ethereum, ensuring transparency and real-time accuracy. Forensic accounting involves investigating financial records to detect fraud, embezzlement, or financial misconduct through detailed audit trails and data analysis. Mastering both ensures precision in decentralized finance operations and effective fraud prevention within digital ecosystems.

Comparison Table

| Aspect | Smart Contracts Accounting | Forensic Accounting |

|---|---|---|

| Purpose | Automated financial agreements and transaction recording | Investigation of fraud, disputes, and financial misconduct |

| Technology | Blockchain, distributed ledger technology | Traditional auditing tools, data analytics, interviews |

| Accuracy | High, due to automation and immutability | Variable, dependent on data and investigation depth |

| Data Source | On-chain transactions and smart contract code | Financial records, documents, electronic data |

| Use Cases | Payment automation, contract enforcement, auditing | Fraud detection, litigation support, financial recovery |

| Speed | Real-time processing and settlement | Time-consuming, requires detailed investigation |

| Expertise Required | Blockchain developers, accountants with IT skills | Accounting, law, investigation professionals |

Which is better?

Smart contracts accounting leverages blockchain technology to automate transaction recording and enhance transparency, reducing errors and fraud risks through immutable digital ledgers. Forensic accounting specializes in investigating financial discrepancies, fraud detection, and litigation support by meticulously analyzing traditional accounting records and financial statements. While smart contracts accounting excels in real-time transaction verification, forensic accounting provides deeper insights into complex financial crimes and compliance issues.

Connection

Smart contracts accounting integrates blockchain technology to automate and verify financial transactions, enhancing accuracy and transparency. Forensic accounting leverages this immutability and traceability to detect fraud and financial discrepancies within smart contract records. The synergy between these fields strengthens financial auditing by providing tamper-proof evidence and detailed transactional histories.

Key Terms

Forensic accounting:

Forensic accounting involves the use of accounting, auditing, and investigative skills to examine financial statements and transactions for fraud, embezzlement, or other white-collar crimes, often supporting legal proceedings with evidentiary reports. This specialized field requires a deep understanding of financial data analysis, legal frameworks, and compliance standards to detect discrepancies and ensure accurate accountability. Explore the complexities of forensic accounting to understand how it safeguards financial integrity in various sectors.

Fraud detection

Forensic accounting specializes in investigating financial discrepancies and detecting fraud through meticulous analysis of accounting records, bank statements, and transaction histories. Smart contracts accounting leverages blockchain technology to automate transactions and enforce contract terms, providing transparent, tamper-proof records that enhance real-time fraud detection and reduce human error. Explore the evolving landscape of fraud detection by discovering how these two approaches complement each other in strengthening financial integrity.

Litigation support

Forensic accounting involves detailed financial analysis and investigation to uncover fraud or financial discrepancies, often providing critical evidence in litigation support. Smart contracts accounting automates transaction verification and enforces contractual terms on blockchain, enhancing transparency and reducing disputes in legal cases. Explore the evolving roles of these accounting methods in litigation support to understand their impact on financial dispute resolution.

Source and External Links

Forensic Accounting Career Overview - Forensic accountants use accounting skills to investigate financial crimes like fraud and embezzlement, often serving as expert witnesses in legal proceedings.

What Is Forensic Accounting? - This field involves applying accounting skills to investigate financial crimes, determine their extent, and assist in legal matters.

Forensic Accounting - This specialty in accounting investigates financial crimes by analyzing financial transactions and providing expert testimony in legal cases.

dowidth.com

dowidth.com