Payroll automation streamlines salary calculations, tax deductions, and compliance reporting by utilizing advanced accounting software, significantly reducing human errors common in paper-based payroll systems. Paper-based payroll relies on manual entry and physical record-keeping, increasing the risk of inaccuracies, processing delays, and data security issues. Explore the benefits and challenges of both methods to optimize your company's payroll management.

Why it is important

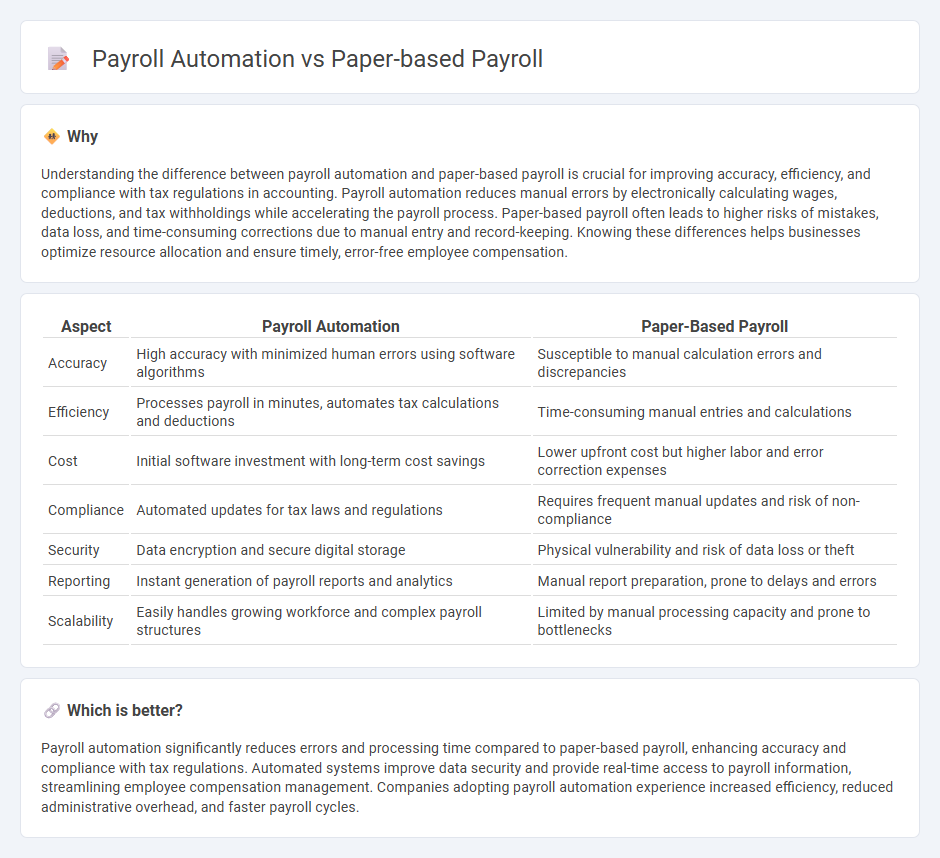

Understanding the difference between payroll automation and paper-based payroll is crucial for improving accuracy, efficiency, and compliance with tax regulations in accounting. Payroll automation reduces manual errors by electronically calculating wages, deductions, and tax withholdings while accelerating the payroll process. Paper-based payroll often leads to higher risks of mistakes, data loss, and time-consuming corrections due to manual entry and record-keeping. Knowing these differences helps businesses optimize resource allocation and ensure timely, error-free employee compensation.

Comparison Table

| Aspect | Payroll Automation | Paper-Based Payroll |

|---|---|---|

| Accuracy | High accuracy with minimized human errors using software algorithms | Susceptible to manual calculation errors and discrepancies |

| Efficiency | Processes payroll in minutes, automates tax calculations and deductions | Time-consuming manual entries and calculations |

| Cost | Initial software investment with long-term cost savings | Lower upfront cost but higher labor and error correction expenses |

| Compliance | Automated updates for tax laws and regulations | Requires frequent manual updates and risk of non-compliance |

| Security | Data encryption and secure digital storage | Physical vulnerability and risk of data loss or theft |

| Reporting | Instant generation of payroll reports and analytics | Manual report preparation, prone to delays and errors |

| Scalability | Easily handles growing workforce and complex payroll structures | Limited by manual processing capacity and prone to bottlenecks |

Which is better?

Payroll automation significantly reduces errors and processing time compared to paper-based payroll, enhancing accuracy and compliance with tax regulations. Automated systems improve data security and provide real-time access to payroll information, streamlining employee compensation management. Companies adopting payroll automation experience increased efficiency, reduced administrative overhead, and faster payroll cycles.

Connection

Payroll automation enhances accounting efficiency by replacing paper-based payroll systems, reducing manual errors and processing time. This shift improves data accuracy and compliance with tax regulations through digital record-keeping and real-time calculations. Integrating automated payroll into accounting software streamlines financial reporting and payroll tax filings, optimizing overall payroll management.

Key Terms

Manual Recordkeeping

Manual recordkeeping in paper-based payroll systems often leads to increased errors, data loss, and time-consuming processes compared to automated payroll solutions that ensure accuracy and efficiency through digital data entry and storage. Paper records require physical handling and secure storage, raising the risk of misplacement or damage, while payroll automation centralizes information with real-time access and built-in compliance checks. Explore how transitioning from manual to automated payroll recordkeeping can transform workplace productivity and financial management.

Data Entry Errors

Paper-based payroll systems are prone to high rates of data entry errors due to manual input, which can lead to inaccuracies in employee compensation and tax calculations. Payroll automation significantly reduces these errors by using integrated software that validates and processes data in real-time, enhancing accuracy and compliance. Explore how transitioning to automated payroll can improve operational efficiency and minimize costly mistakes.

Payroll Software

Paper-based payroll involves manual data entry, physical document storage, and higher risks of errors or non-compliance with tax regulations, leading to increased processing time and costs. Payroll automation, especially through dedicated payroll software, streamlines calculations, tax filings, and employee record management with enhanced accuracy, security, and real-time reporting capabilities. Explore how advanced payroll software can transform your business operations with efficiency and compliance benefits.

Source and External Links

Paper vs. Digital Tools: which is the best solution for the Payroll - This article discusses the simplicity and compliance benefits of using physical documentation for payroll management.

Paper to Digital: The Evolution of Payroll - This piece explores the transition from paper-based payroll systems to more efficient digital platforms.

What is paperless payroll? - This article highlights the benefits of moving away from paper-based systems, including cost savings and improved efficiency.

dowidth.com

dowidth.com