Cryptocurrency taxation involves calculating capital gains and reporting income from digital asset transactions, while charitable donations of assets require accurate valuation and adherence to specific IRS guidelines for tax deductions. Both areas demand rigorous documentation and understanding of tax laws to optimize compliance and benefits. Explore how these tax considerations impact your financial strategy and charitable giving.

Why it is important

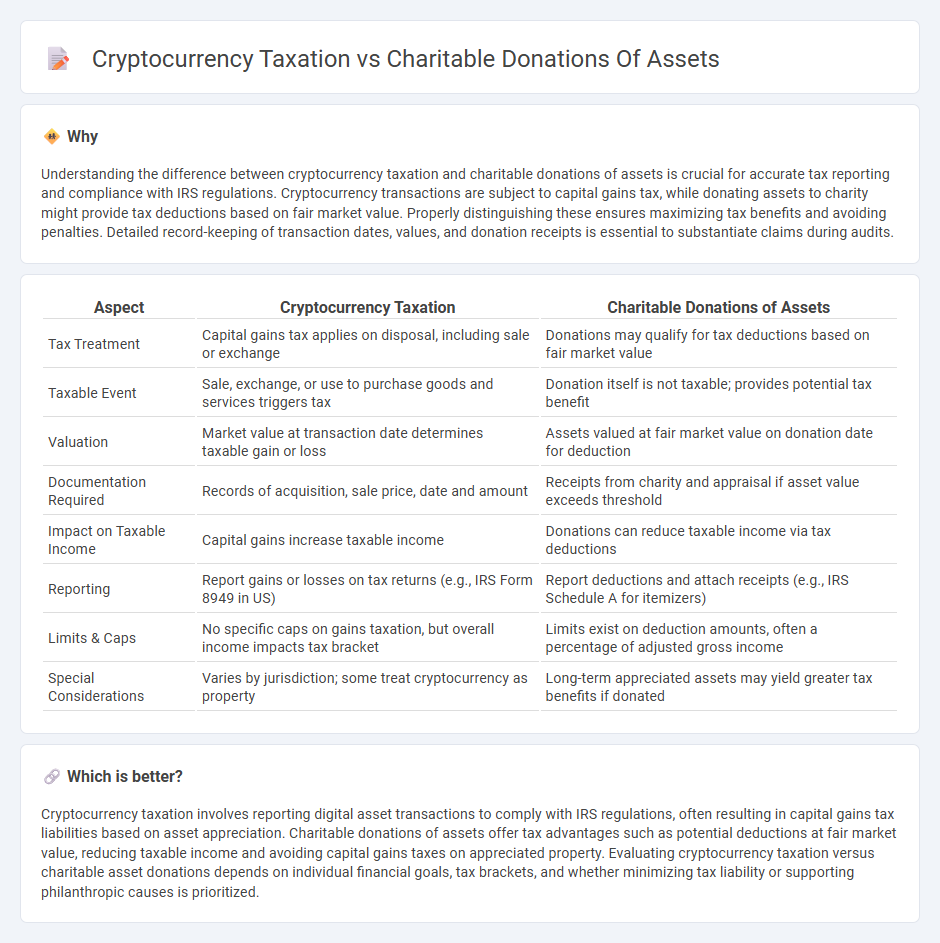

Understanding the difference between cryptocurrency taxation and charitable donations of assets is crucial for accurate tax reporting and compliance with IRS regulations. Cryptocurrency transactions are subject to capital gains tax, while donating assets to charity might provide tax deductions based on fair market value. Properly distinguishing these ensures maximizing tax benefits and avoiding penalties. Detailed record-keeping of transaction dates, values, and donation receipts is essential to substantiate claims during audits.

Comparison Table

| Aspect | Cryptocurrency Taxation | Charitable Donations of Assets |

|---|---|---|

| Tax Treatment | Capital gains tax applies on disposal, including sale or exchange | Donations may qualify for tax deductions based on fair market value |

| Taxable Event | Sale, exchange, or use to purchase goods and services triggers tax | Donation itself is not taxable; provides potential tax benefit |

| Valuation | Market value at transaction date determines taxable gain or loss | Assets valued at fair market value on donation date for deduction |

| Documentation Required | Records of acquisition, sale price, date and amount | Receipts from charity and appraisal if asset value exceeds threshold |

| Impact on Taxable Income | Capital gains increase taxable income | Donations can reduce taxable income via tax deductions |

| Reporting | Report gains or losses on tax returns (e.g., IRS Form 8949 in US) | Report deductions and attach receipts (e.g., IRS Schedule A for itemizers) |

| Limits & Caps | No specific caps on gains taxation, but overall income impacts tax bracket | Limits exist on deduction amounts, often a percentage of adjusted gross income |

| Special Considerations | Varies by jurisdiction; some treat cryptocurrency as property | Long-term appreciated assets may yield greater tax benefits if donated |

Which is better?

Cryptocurrency taxation involves reporting digital asset transactions to comply with IRS regulations, often resulting in capital gains tax liabilities based on asset appreciation. Charitable donations of assets offer tax advantages such as potential deductions at fair market value, reducing taxable income and avoiding capital gains taxes on appreciated property. Evaluating cryptocurrency taxation versus charitable asset donations depends on individual financial goals, tax brackets, and whether minimizing tax liability or supporting philanthropic causes is prioritized.

Connection

Cryptocurrency taxation intersects with charitable donations of assets through the IRS's recognition of digital currencies as property, which allows donors to claim fair market value deductions without triggering capital gains tax. Proper documentation of crypto donations ensures compliance with tax regulations, minimizing liability and maximizing charitable impact. Taxpayers must report these donations accurately to optimize tax benefits while adhering to evolving guidelines.

Key Terms

Fair Market Value

Charitable donations of assets and cryptocurrency taxation both hinge on Fair Market Value (FMV) to determine deductible amounts and taxable gains. For traditional assets, FMV is often established through appraisals or market quotations, while cryptocurrency FMV is typically calculated using the spot price at the time of the donation. Explore how FMV impacts tax benefits and reporting requirements on charitable crypto contributions to maximize your tax strategy.

Capital Gains Tax

Charitable donations of appreciated assets and cryptocurrency are both subject to Capital Gains Tax (CGT) implications, but the tax treatment differs significantly between the two. Donating appreciated stocks or real estate typically allows donors to avoid paying CGT on the increased value, while cryptocurrency donations may face complex valuation challenges and varying IRS guidelines on fair market value. Explore detailed tax strategies and the latest IRS rulings to maximize your charitable impact and minimize CGT liabilities.

Qualified Appraisal

Charitable donations of assets require a Qualified Appraisal to determine the fair market value for IRS reporting, especially when the donated property exceeds $5,000. Cryptocurrency donations, treated as property by the IRS, also demand precise valuation but often lack clear guidance on Qualified Appraisal requirements, creating complexity in tax reporting. Explore the nuances of Qualified Appraisal in asset and cryptocurrency donations to optimize tax benefits and compliance.

Source and External Links

Contribution Guide for Donor-Advised Funds - This guide outlines how donors can contribute various assets to a donor-advised fund, including non-cash assets like securities, to maximize tax benefits and charitable giving.

Charitable Donations: The Basics of Giving - Donating appreciated long-term assets, such as securities, can be a tax-efficient way to support charities by avoiding capital gains tax and increasing potential deductions.

Five tax-smart strategies to maximize your charitable giving - Donating appreciated securities directly to charities allows donors to avoid capital gains tax and receive a charitable income tax deduction equal to the fair market value of the securities.

dowidth.com

dowidth.com