Embedded finance reporting integrates financial services directly into non-financial platforms, enabling real-time transaction data and enhanced operational insights. ESG reporting focuses on environmental, social, and governance metrics, driving transparency and accountability in sustainability efforts. Explore how these reporting frameworks transform accounting practices and strategic decision-making.

Why it is important

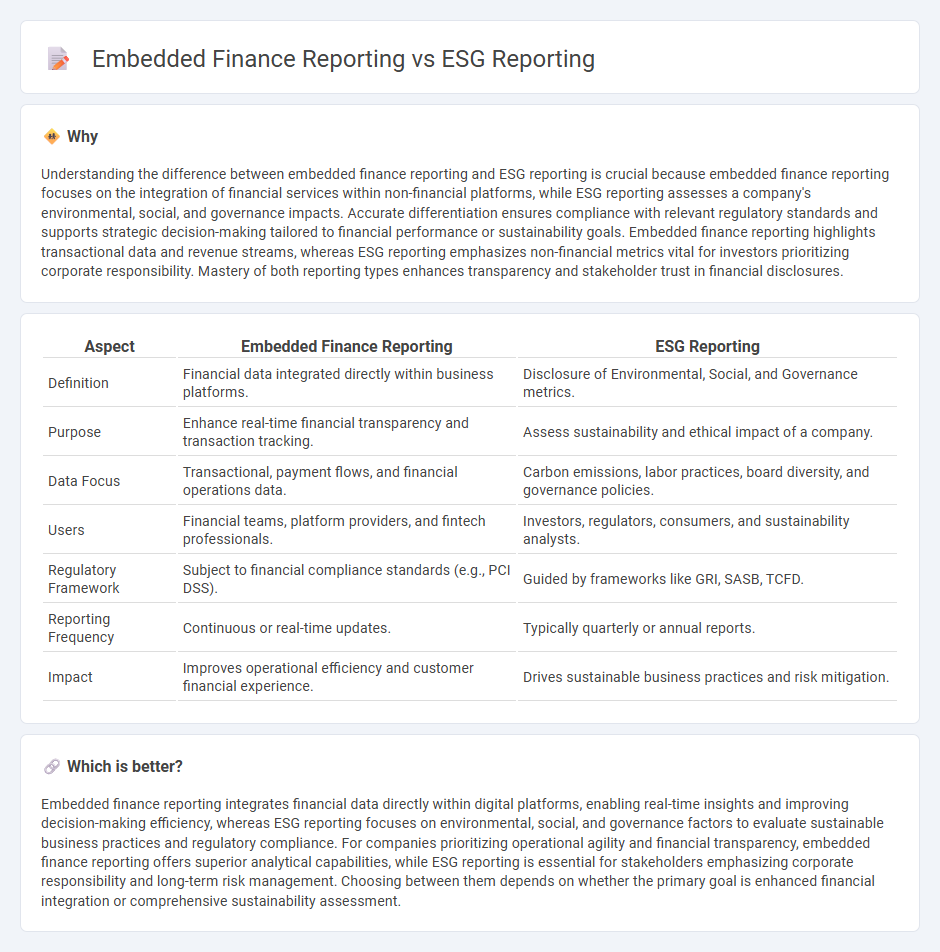

Understanding the difference between embedded finance reporting and ESG reporting is crucial because embedded finance reporting focuses on the integration of financial services within non-financial platforms, while ESG reporting assesses a company's environmental, social, and governance impacts. Accurate differentiation ensures compliance with relevant regulatory standards and supports strategic decision-making tailored to financial performance or sustainability goals. Embedded finance reporting highlights transactional data and revenue streams, whereas ESG reporting emphasizes non-financial metrics vital for investors prioritizing corporate responsibility. Mastery of both reporting types enhances transparency and stakeholder trust in financial disclosures.

Comparison Table

| Aspect | Embedded Finance Reporting | ESG Reporting |

|---|---|---|

| Definition | Financial data integrated directly within business platforms. | Disclosure of Environmental, Social, and Governance metrics. |

| Purpose | Enhance real-time financial transparency and transaction tracking. | Assess sustainability and ethical impact of a company. |

| Data Focus | Transactional, payment flows, and financial operations data. | Carbon emissions, labor practices, board diversity, and governance policies. |

| Users | Financial teams, platform providers, and fintech professionals. | Investors, regulators, consumers, and sustainability analysts. |

| Regulatory Framework | Subject to financial compliance standards (e.g., PCI DSS). | Guided by frameworks like GRI, SASB, TCFD. |

| Reporting Frequency | Continuous or real-time updates. | Typically quarterly or annual reports. |

| Impact | Improves operational efficiency and customer financial experience. | Drives sustainable business practices and risk mitigation. |

Which is better?

Embedded finance reporting integrates financial data directly within digital platforms, enabling real-time insights and improving decision-making efficiency, whereas ESG reporting focuses on environmental, social, and governance factors to evaluate sustainable business practices and regulatory compliance. For companies prioritizing operational agility and financial transparency, embedded finance reporting offers superior analytical capabilities, while ESG reporting is essential for stakeholders emphasizing corporate responsibility and long-term risk management. Choosing between them depends on whether the primary goal is enhanced financial integration or comprehensive sustainability assessment.

Connection

Embedded finance reporting integrates financial data directly within operational platforms, enabling real-time tracking of sustainability metrics crucial for ESG reporting. This seamless data flow enhances transparency and accuracy in disclosing environmental, social, and governance performance, aligning financial outcomes with ESG criteria. Advanced analytics in embedded finance support automated ESG compliance, improving decision-making and stakeholder trust.

Key Terms

**ESG Reporting:**

ESG reporting involves the disclosure of environmental, social, and governance metrics that measure a company's sustainability and ethical impact, aligning with global standards such as GRI, SASB, and TCFD. Companies use ESG data to enhance transparency, manage risks, and attract socially conscious investors by demonstrating compliance with regulatory frameworks and industry best practices. Discover how advanced ESG reporting tools can drive strategic decision-making and stakeholder trust.

Sustainability Metrics

ESG reporting centers on evaluating corporate environmental, social, and governance impacts using sustainability metrics such as carbon footprint, resource usage, and social responsibility indicators. Embedded finance reporting integrates financial services into non-financial platforms, emphasizing metrics like green investment ratios, sustainable loan portfolios, and impact financing outcomes aligned with sustainability goals. Explore detailed frameworks and best practices in these reporting methodologies to enhance transparency and drive corporate sustainability.

Non-financial Disclosure

ESG reporting centers on environmental, social, and governance metrics to disclose non-financial performance, enhancing transparency for stakeholders and investors. Embedded finance reporting integrates financial services into non-financial platforms, focusing on real-time transactional data and user behavior insights. Explore how these distinct reporting frameworks impact corporate accountability and market strategies.

Source and External Links

ESG reporting: Your comprehensive guide for 2025 - PlanA.Earth - ESG reporting is how organizations communicate their progress in environmental sustainability, social responsibility, and governance, focusing on accuracy, transparency, and strategic alignment with stakeholder expectations through goal setting, stakeholder engagement, data collection, and continuous evaluation.

10 Top ESG Reporting Frameworks Explained and Compared - ESG reporting reveals companies' sustainability progress and governance practices, helping attract investors and customers interested in responsible business, while also assisting regulatory compliance with standards increasingly mandated by governments, such as the EU's Corporate Sustainability Reporting Directive effective starting 2025.

What Is ESG Reporting? - IBM - ESG reporting discloses data on environmental stewardship, social impact, and governance quality to measure and benchmark a company's initiatives, providing stakeholders with insights essential for investment and risk assessment decisions.

dowidth.com

dowidth.com