Fractional CFO services provide strategic financial leadership and high-level decision-making support, while CPA services focus on accurate tax preparation, compliance, and audit responsibilities. Fractional CFOs drive business growth through financial planning and analysis, whereas CPAs ensure adherence to accounting standards and regulatory requirements. Explore the differences to determine which financial expertise best suits your business needs.

Why it is important

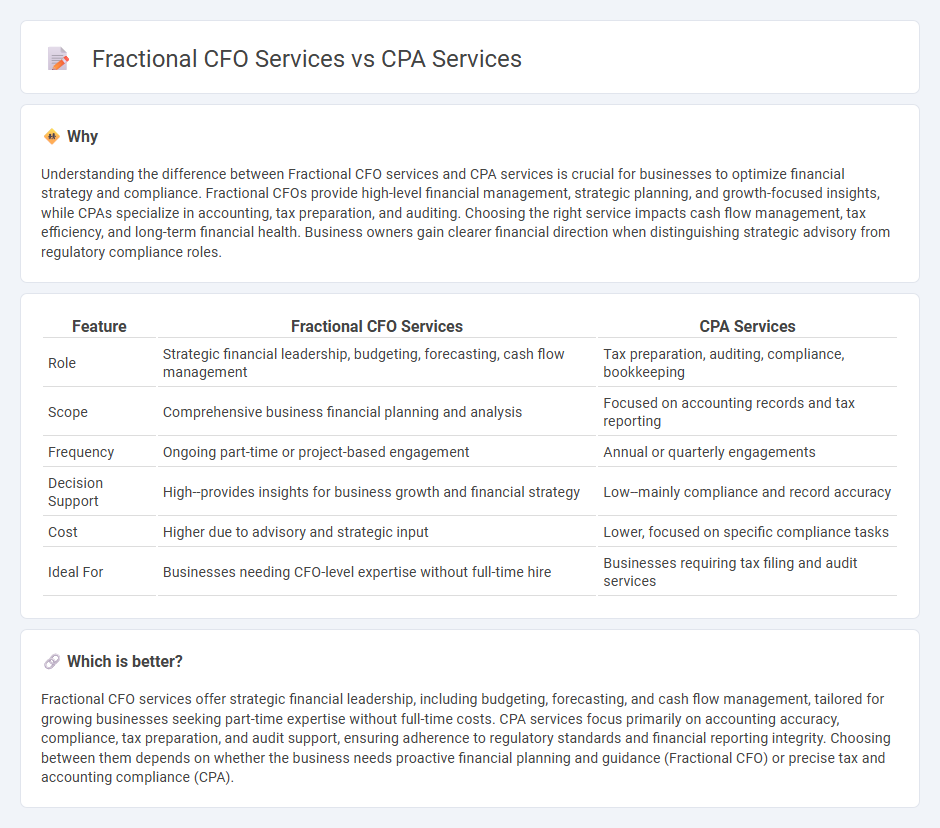

Understanding the difference between Fractional CFO services and CPA services is crucial for businesses to optimize financial strategy and compliance. Fractional CFOs provide high-level financial management, strategic planning, and growth-focused insights, while CPAs specialize in accounting, tax preparation, and auditing. Choosing the right service impacts cash flow management, tax efficiency, and long-term financial health. Business owners gain clearer financial direction when distinguishing strategic advisory from regulatory compliance roles.

Comparison Table

| Feature | Fractional CFO Services | CPA Services |

|---|---|---|

| Role | Strategic financial leadership, budgeting, forecasting, cash flow management | Tax preparation, auditing, compliance, bookkeeping |

| Scope | Comprehensive business financial planning and analysis | Focused on accounting records and tax reporting |

| Frequency | Ongoing part-time or project-based engagement | Annual or quarterly engagements |

| Decision Support | High--provides insights for business growth and financial strategy | Low--mainly compliance and record accuracy |

| Cost | Higher due to advisory and strategic input | Lower, focused on specific compliance tasks |

| Ideal For | Businesses needing CFO-level expertise without full-time hire | Businesses requiring tax filing and audit services |

Which is better?

Fractional CFO services offer strategic financial leadership, including budgeting, forecasting, and cash flow management, tailored for growing businesses seeking part-time expertise without full-time costs. CPA services focus primarily on accounting accuracy, compliance, tax preparation, and audit support, ensuring adherence to regulatory standards and financial reporting integrity. Choosing between them depends on whether the business needs proactive financial planning and guidance (Fractional CFO) or precise tax and accounting compliance (CPA).

Connection

Fractional CFO services and CPA services are connected through their shared focus on financial strategy and compliance, where Fractional CFOs provide high-level financial planning and decision support, while CPAs ensure accurate accounting and tax reporting. Both services collaborate to optimize cash flow management, budgeting, forecasting, and regulatory adherence, enhancing business financial health. Combining Fractional CFO insights with CPA expertise allows businesses to achieve comprehensive financial oversight and strategic growth.

Key Terms

Audit

CPA services primarily focus on ensuring accurate financial reporting and compliance through thorough audits aligned with Generally Accepted Accounting Principles (GAAP). Fractional CFO services take a strategic approach by using audit insights to drive financial planning, risk management, and long-term business growth. Explore how integrating both services can enhance your company's financial health and operational efficiency.

Financial Strategy

CPA services primarily handle tax compliance, auditing, and financial reporting, ensuring accurate and timely financial documentation. Fractional CFO services emphasize financial strategy, including cash flow management, budgeting, forecasting, and long-term financial planning to drive business growth. Explore how integrating both services can optimize your company's financial health and strategic decision-making.

Outsourced Leadership

CPA services primarily handle financial record-keeping, tax preparation, and compliance, ensuring accuracy and regulatory adherence. Fractional CFO services provide outsourced leadership by offering strategic financial planning, cash flow management, and business growth guidance on a part-time basis. Explore how outsourcing financial leadership can transform your business's financial health and decision-making.

Source and External Links

Virtual CPA Services for Small Business | Online CPA - Provides tailored CPA services for small and mid-sized businesses, offering financial guidance, tax strategy, and compliance services.

Should I Hire a CPA or Tax Accountant Near Me? - Discusses the roles of CPAs in various accounting areas and factors influencing their service costs.

CPA Services, P.C. - Offers a comprehensive range of tax, accounting, payroll, and business services with a personalized approach.

dowidth.com

dowidth.com