Real-time auditing leverages advanced software and continuous data monitoring to provide immediate insights into financial transactions, enhancing accuracy and reducing risks compared to traditional auditing methods. Traditional auditing relies on periodic examinations of financial records, often involving manual processes and retrospective analysis. Explore how these auditing approaches impact financial transparency and decision-making.

Why it is important

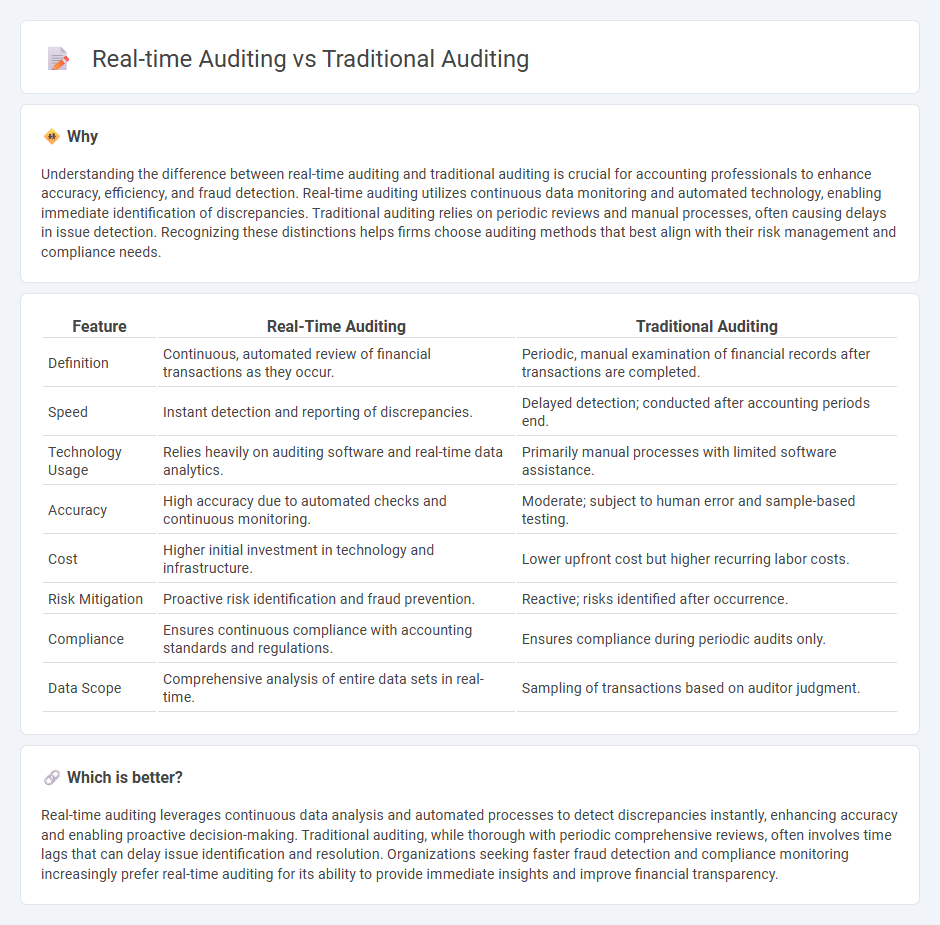

Understanding the difference between real-time auditing and traditional auditing is crucial for accounting professionals to enhance accuracy, efficiency, and fraud detection. Real-time auditing utilizes continuous data monitoring and automated technology, enabling immediate identification of discrepancies. Traditional auditing relies on periodic reviews and manual processes, often causing delays in issue detection. Recognizing these distinctions helps firms choose auditing methods that best align with their risk management and compliance needs.

Comparison Table

| Feature | Real-Time Auditing | Traditional Auditing |

|---|---|---|

| Definition | Continuous, automated review of financial transactions as they occur. | Periodic, manual examination of financial records after transactions are completed. |

| Speed | Instant detection and reporting of discrepancies. | Delayed detection; conducted after accounting periods end. |

| Technology Usage | Relies heavily on auditing software and real-time data analytics. | Primarily manual processes with limited software assistance. |

| Accuracy | High accuracy due to automated checks and continuous monitoring. | Moderate; subject to human error and sample-based testing. |

| Cost | Higher initial investment in technology and infrastructure. | Lower upfront cost but higher recurring labor costs. |

| Risk Mitigation | Proactive risk identification and fraud prevention. | Reactive; risks identified after occurrence. |

| Compliance | Ensures continuous compliance with accounting standards and regulations. | Ensures compliance during periodic audits only. |

| Data Scope | Comprehensive analysis of entire data sets in real-time. | Sampling of transactions based on auditor judgment. |

Which is better?

Real-time auditing leverages continuous data analysis and automated processes to detect discrepancies instantly, enhancing accuracy and enabling proactive decision-making. Traditional auditing, while thorough with periodic comprehensive reviews, often involves time lags that can delay issue identification and resolution. Organizations seeking faster fraud detection and compliance monitoring increasingly prefer real-time auditing for its ability to provide immediate insights and improve financial transparency.

Connection

Real-time auditing leverages continuous data analysis and automated controls to enhance the accuracy and timeliness of financial reporting, complementing the periodic nature of traditional auditing by providing ongoing risk assessment and fraud detection. Traditional auditing relies on historical data review and sampling techniques to verify financial statements, while real-time auditing integrates with enterprise resource planning (ERP) systems to facilitate immediate anomaly detection and compliance monitoring. Together, these methods create a comprehensive audit framework that balances thorough verification with proactive financial oversight.

Key Terms

Sampling

Traditional auditing relies heavily on sampling methods to verify financial data, which can lead to delayed detection of errors or fraud due to its retrospective nature. Real-time auditing leverages advanced data analytics and continuous monitoring techniques, enabling auditors to assess entire data sets instantly and catch anomalies as they occur. Explore the advantages of real-time auditing over traditional sampling to enhance financial accuracy and compliance.

Continuous monitoring

Traditional auditing relies on periodic assessments that often result in delayed identification of compliance issues and financial discrepancies. Real-time auditing enhances continuous monitoring by leveraging automated data analysis, enabling immediate detection of anomalies and operational risks. Explore in-depth how continuous monitoring transforms auditing effectiveness and risk management strategies.

Audit trails

Traditional auditing relies on periodic reviews of audit trails, often resulting in delayed detection of discrepancies or fraud. Real-time auditing continuously monitors audit trails, enabling instant identification of anomalies and enhancing compliance with regulatory standards. Discover how implementing real-time auditing can revolutionize your organization's oversight and risk management.

Source and External Links

Six Biggest Challenges of Traditional Audit Techniques - Traditional auditing relies on manual, time-consuming processes that are prone to human error and often use sample-based testing, which can miss critical issues and limit the audit's effectiveness.

The Traditional Audit Vs. the Fraud Audit - Traditional audits focus on assessing internal controls and financial statements for general compliance, while fraud audits are specifically designed to uncover intentional misstatements or deception.

Why Traditional Auditing Falls Short--and How AI is Changing the Game - Traditional auditing methods depend on analyzing small samples of data, potentially overlooking hidden risks, whereas modern AI-enabled audits can examine 100% of transactions for more comprehensive risk detection.

dowidth.com

dowidth.com