Forensic analytics focuses on detecting and investigating financial fraud by analyzing data patterns and anomalies, using techniques such as data mining and predictive modeling. Tax accounting involves preparing and filing accurate tax returns in compliance with regulations while maximizing tax efficiency through detailed knowledge of tax codes. Explore the distinct roles and methodologies of forensic analytics and tax accounting to better understand their impact on financial integrity.

Why it is important

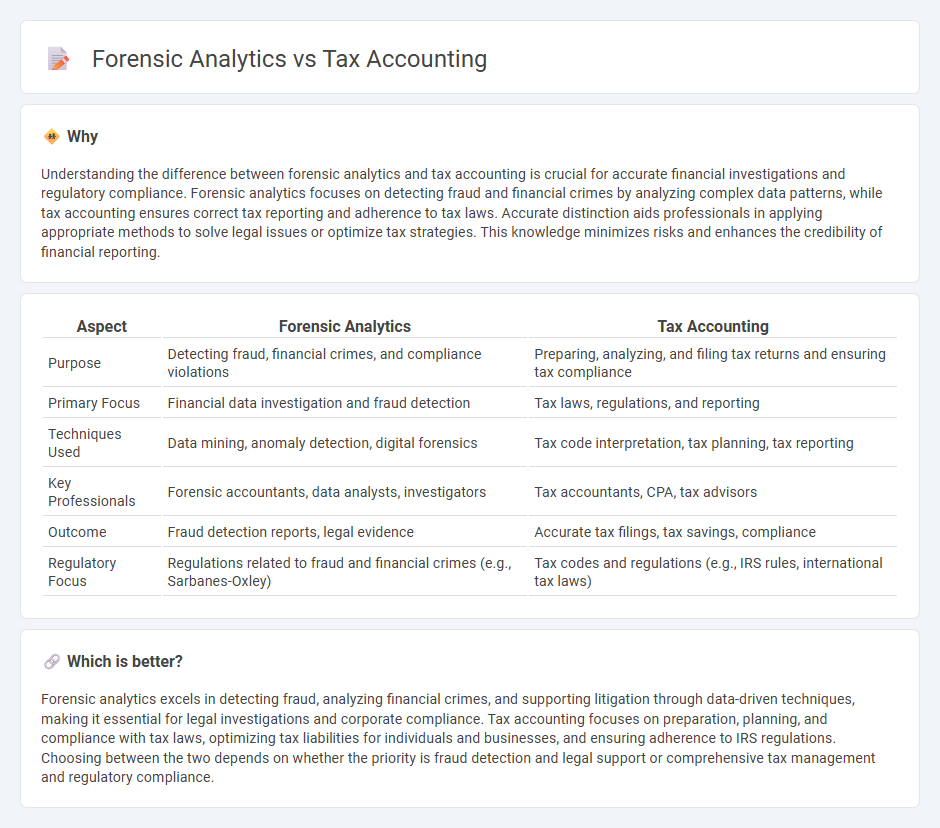

Understanding the difference between forensic analytics and tax accounting is crucial for accurate financial investigations and regulatory compliance. Forensic analytics focuses on detecting fraud and financial crimes by analyzing complex data patterns, while tax accounting ensures correct tax reporting and adherence to tax laws. Accurate distinction aids professionals in applying appropriate methods to solve legal issues or optimize tax strategies. This knowledge minimizes risks and enhances the credibility of financial reporting.

Comparison Table

| Aspect | Forensic Analytics | Tax Accounting |

|---|---|---|

| Purpose | Detecting fraud, financial crimes, and compliance violations | Preparing, analyzing, and filing tax returns and ensuring tax compliance |

| Primary Focus | Financial data investigation and fraud detection | Tax laws, regulations, and reporting |

| Techniques Used | Data mining, anomaly detection, digital forensics | Tax code interpretation, tax planning, tax reporting |

| Key Professionals | Forensic accountants, data analysts, investigators | Tax accountants, CPA, tax advisors |

| Outcome | Fraud detection reports, legal evidence | Accurate tax filings, tax savings, compliance |

| Regulatory Focus | Regulations related to fraud and financial crimes (e.g., Sarbanes-Oxley) | Tax codes and regulations (e.g., IRS rules, international tax laws) |

Which is better?

Forensic analytics excels in detecting fraud, analyzing financial crimes, and supporting litigation through data-driven techniques, making it essential for legal investigations and corporate compliance. Tax accounting focuses on preparation, planning, and compliance with tax laws, optimizing tax liabilities for individuals and businesses, and ensuring adherence to IRS regulations. Choosing between the two depends on whether the priority is fraud detection and legal support or comprehensive tax management and regulatory compliance.

Connection

Forensic analytics enhances tax accounting by meticulously examining financial records to detect discrepancies, fraud, and tax evasion, ensuring compliance with tax regulations. This integration supports accurate tax reporting and strengthens audit processes by uncovering hidden patterns and irregularities within complex data sets. Utilizing data mining and predictive analytics, forensic techniques provide deeper insights into tax liabilities and risk assessments for both individuals and corporations.

Key Terms

**Tax accounting:**

Tax accounting involves accurately preparing financial records to comply with tax laws and regulations, focusing on deductions, credits, and reporting requirements to minimize tax liabilities. It requires in-depth knowledge of the Internal Revenue Code and detailed documentation to withstand audits and ensure legal compliance. Explore more about tax accounting strategies and compliance techniques here.

Tax Compliance

Tax accounting ensures accurate reporting and adherence to tax laws by managing financial records and preparing tax returns, which is crucial for tax compliance. Forensic analytics involves examining financial data to detect fraud, errors, and irregularities that could lead to non-compliance or legal issues with tax authorities. Explore more about how integrating forensic analytics enhances tax compliance strategies for businesses.

Deferred Tax Assets/Liabilities

Deferred Tax Assets and Liabilities require precise recognition and measurement under tax accounting principles to ensure accurate financial reporting and compliance with IFRS or GAAP standards. Forensic analytics enhances this process by identifying discrepancies, potential tax fraud, and assessment errors in deferred tax balances through data-driven investigation techniques. Explore more to understand how integrating forensic analytics can improve the reliability of deferred tax asset and liability evaluations.

Source and External Links

Tax Accounting | Definition, Types & Examples - Tax accounting is a specialized field focused on minimizing tax liability and ensuring compliance with tax laws for individuals and organizations by preparing accurate returns and identifying tax-saving opportunities.

Tax Accountant Careers - Tax accountants prepare filings, manage payments, analyze financial data for tax efficiency, and advise clients on tax planning while staying updated with ever-changing tax regulations.

What Is a Tax Accountant? - Tax accountants specialize in tax filing, planning, and compliance, helping clients minimize tax liability, avoid penalties, and navigate the complexities of tax laws for both individuals and businesses.

dowidth.com

dowidth.com