Continuous close streamlines financial reporting by integrating real-time transactions and ongoing adjustments throughout the accounting period, reducing the month-end workload. Automated close leverages technology to execute repetitive tasks, such as reconciliations and journal entries, enhancing accuracy and efficiency in closing processes. Explore the differences between continuous and automated close to optimize your accounting cycle.

Why it is important

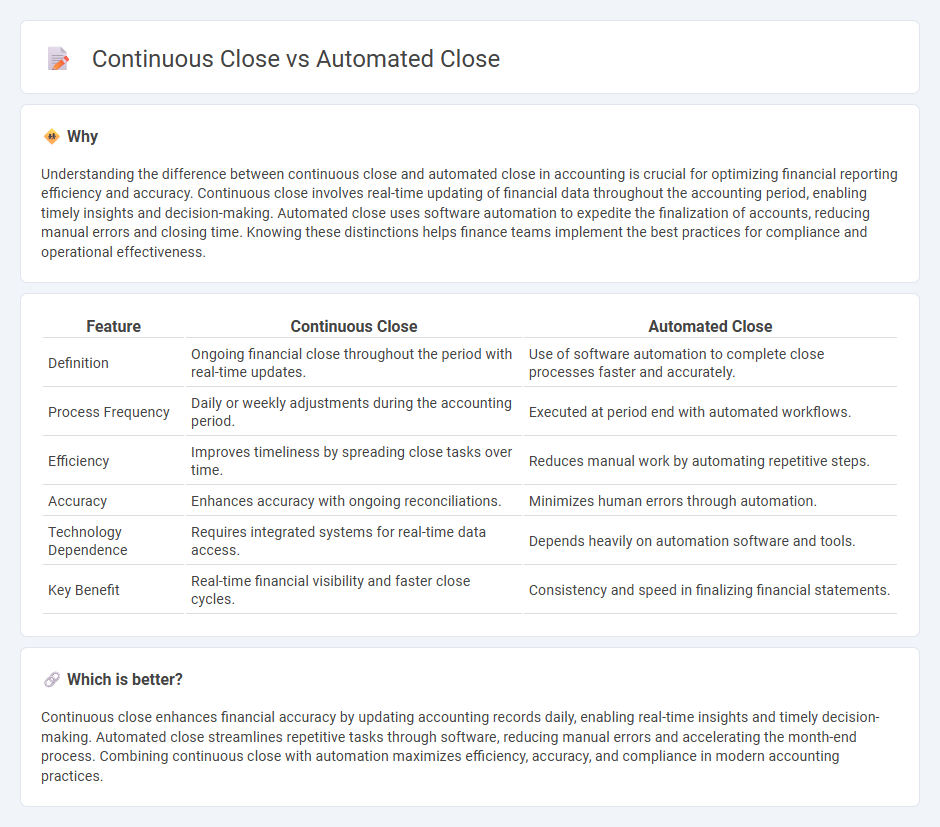

Understanding the difference between continuous close and automated close in accounting is crucial for optimizing financial reporting efficiency and accuracy. Continuous close involves real-time updating of financial data throughout the accounting period, enabling timely insights and decision-making. Automated close uses software automation to expedite the finalization of accounts, reducing manual errors and closing time. Knowing these distinctions helps finance teams implement the best practices for compliance and operational effectiveness.

Comparison Table

| Feature | Continuous Close | Automated Close |

|---|---|---|

| Definition | Ongoing financial close throughout the period with real-time updates. | Use of software automation to complete close processes faster and accurately. |

| Process Frequency | Daily or weekly adjustments during the accounting period. | Executed at period end with automated workflows. |

| Efficiency | Improves timeliness by spreading close tasks over time. | Reduces manual work by automating repetitive steps. |

| Accuracy | Enhances accuracy with ongoing reconciliations. | Minimizes human errors through automation. |

| Technology Dependence | Requires integrated systems for real-time data access. | Depends heavily on automation software and tools. |

| Key Benefit | Real-time financial visibility and faster close cycles. | Consistency and speed in finalizing financial statements. |

Which is better?

Continuous close enhances financial accuracy by updating accounting records daily, enabling real-time insights and timely decision-making. Automated close streamlines repetitive tasks through software, reducing manual errors and accelerating the month-end process. Combining continuous close with automation maximizes efficiency, accuracy, and compliance in modern accounting practices.

Connection

Continuous close and automated close both enhance the accounting close process by reducing manual effort and increasing accuracy. Continuous close involves real-time data processing throughout the accounting period, while automated close leverages software tools to streamline repetitive tasks like reconciliations and journal entries. Integrating automated close systems within a continuous close framework accelerates financial reporting and improves compliance with regulatory standards.

Key Terms

Real-time data processing

Automated close streamlines financial period closing by leveraging rule-based workflows to process data faster and reduce manual intervention, enhancing efficiency and accuracy. Continuous close maintains an ongoing review of financial transactions with real-time data processing, enabling instant visibility into financial standings and rapid identification of discrepancies. Explore more about optimizing your finance operations through real-time automated and continuous close techniques.

Workflow automation

Automated close streamlines the financial closing process by executing predefined tasks through workflow automation platforms, reducing manual effort and errors while improving accuracy and speed. Continuous close integrates real-time transaction processing and automated validation, enabling finance teams to maintain up-to-date financial data and accelerate the close cycle. Explore how workflow automation can transform your closing process for greater efficiency and compliance.

Period-end reconciliation

Automated close significantly reduces errors and accelerates period-end reconciliation by leveraging real-time data integration and workflow automation, compared to continuous close, which emphasizes ongoing transaction validation and continuous data entry. Period-end reconciliation in automated close systems ensures faster financial close cycles with improved accuracy by linking all ledger adjustments directly to source data. Explore how automated close solutions can transform your financial processes and streamline period reconciliation tasks.

Source and External Links

Autonomous Finance and Accounting | Automated Close Process - Autonomous financial close automates key accounting tasks like transaction entries, reconciliations, data consolidation, and reporting throughout the month, shifting the role of accountants from data entry to reviewing and accelerating the entire close process.

Accelerate the Automated Close - Oracle - Oracle's automated close uses cloud technology, machine learning, and intelligent process automation to speed up account reconciliation, consolidation, and reporting, enabling faster management reporting and real-time data flow.

15 Financial Close Software Tools to Evaluate in 2025 | Numeric - Financial close software automates reconciliations, task management, journal entries, and compliance checks by integrating with financial systems to streamline the month-end close with increased accuracy and efficiency.

dowidth.com

dowidth.com