Cryptofinance reconciliation involves verifying cryptocurrency transactions, digital wallets, and blockchain records to ensure accuracy in financial reports. Vendor reconciliation focuses on matching company purchase records with vendor invoices and payment confirmations to maintain accounts payable accuracy. Explore further to understand how these reconciliation processes impact financial integrity and reporting.

Why it is important

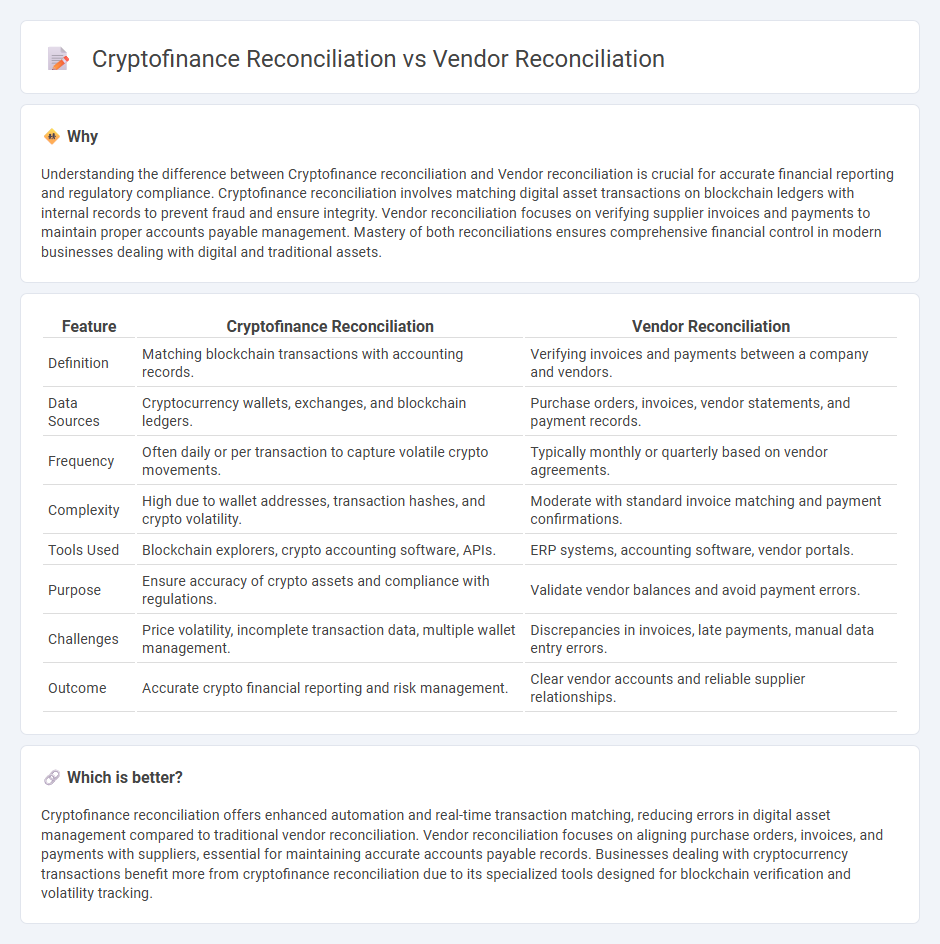

Understanding the difference between Cryptofinance reconciliation and Vendor reconciliation is crucial for accurate financial reporting and regulatory compliance. Cryptofinance reconciliation involves matching digital asset transactions on blockchain ledgers with internal records to prevent fraud and ensure integrity. Vendor reconciliation focuses on verifying supplier invoices and payments to maintain proper accounts payable management. Mastery of both reconciliations ensures comprehensive financial control in modern businesses dealing with digital and traditional assets.

Comparison Table

| Feature | Cryptofinance Reconciliation | Vendor Reconciliation |

|---|---|---|

| Definition | Matching blockchain transactions with accounting records. | Verifying invoices and payments between a company and vendors. |

| Data Sources | Cryptocurrency wallets, exchanges, and blockchain ledgers. | Purchase orders, invoices, vendor statements, and payment records. |

| Frequency | Often daily or per transaction to capture volatile crypto movements. | Typically monthly or quarterly based on vendor agreements. |

| Complexity | High due to wallet addresses, transaction hashes, and crypto volatility. | Moderate with standard invoice matching and payment confirmations. |

| Tools Used | Blockchain explorers, crypto accounting software, APIs. | ERP systems, accounting software, vendor portals. |

| Purpose | Ensure accuracy of crypto assets and compliance with regulations. | Validate vendor balances and avoid payment errors. |

| Challenges | Price volatility, incomplete transaction data, multiple wallet management. | Discrepancies in invoices, late payments, manual data entry errors. |

| Outcome | Accurate crypto financial reporting and risk management. | Clear vendor accounts and reliable supplier relationships. |

Which is better?

Cryptofinance reconciliation offers enhanced automation and real-time transaction matching, reducing errors in digital asset management compared to traditional vendor reconciliation. Vendor reconciliation focuses on aligning purchase orders, invoices, and payments with suppliers, essential for maintaining accurate accounts payable records. Businesses dealing with cryptocurrency transactions benefit more from cryptofinance reconciliation due to its specialized tools designed for blockchain verification and volatility tracking.

Connection

Cryptofinance reconciliation involves verifying cryptocurrency transactions against blockchain records to ensure accuracy and prevent discrepancies in digital asset management. Vendor reconciliation focuses on matching vendor invoices with payment records to maintain accurate accounts payable and avoid financial errors. Both processes rely on meticulous transaction verification to uphold financial integrity and streamline accounting workflows.

Key Terms

Accounts Payable

Vendor reconciliation in Accounts Payable involves matching vendor invoices with payment records to ensure accuracy and resolve discrepancies. Cryptofinance reconciliation extends this process by integrating blockchain transaction data to verify payments, enhance transparency, and mitigate risks associated with digital asset transfers. Explore more to understand how cryptofinance technologies innovate accounts payable reconciliation for modern businesses.

Blockchain Ledger

Vendor reconciliation involves matching vendor invoices with payments to ensure accurate accounting records, while Cryptofinance reconciliation specifically addresses discrepancies within blockchain ledger transactions, focusing on decentralized, immutable records. Blockchain ledger reconciliation uses cryptographic hashing and consensus mechanisms to verify transaction integrity, enhancing transparency and reducing fraud risks compared to traditional vendor reconciliation systems. Explore in-depth methodologies and tools to streamline your blockchain ledger reconciliation processes.

Transaction Matching

Vendor reconciliation primarily focuses on matching purchase orders, invoices, and payment records to ensure supplier transactions align with company accounts, utilizing structured financial data and defined payment terms. Cryptofinance reconciliation, however, centers on transaction matching between blockchain entries and internal ledgers, addressing complexities such as multiple cryptographic asset types, transaction hashes, and fluctuating crypto values. Explore detailed methodologies and tools to optimize transaction matching in both domains for enhanced accuracy and financial transparency.

Source and External Links

Vendor Reconciliation: Processes and Best Practices - This blog post outlines the key steps and benefits of vendor reconciliation, including matching invoices, checking balances, and resolving discrepancies.

Vendor Reconciliation Process in Accounts Payable - This article explains the necessity of matching invoices with vendor statements to correct discrepancies and ensure accurate payments.

Vendor Reconciliation | Glossary - This glossary entry defines vendor reconciliation as matching internal records with vendor statements to ensure accuracy and identifies its importance in maintaining financial health.

dowidth.com

dowidth.com