Forensic analytics involves examining financial data to detect fraud, errors, and suspicious activities using advanced data analysis techniques, while auditing primarily focuses on evaluating financial statements for accuracy and compliance with accounting standards. Both practices play crucial roles in ensuring financial integrity and regulatory adherence in organizations. Discover more about how forensic analytics strengthens auditing processes and enhances financial oversight.

Why it is important

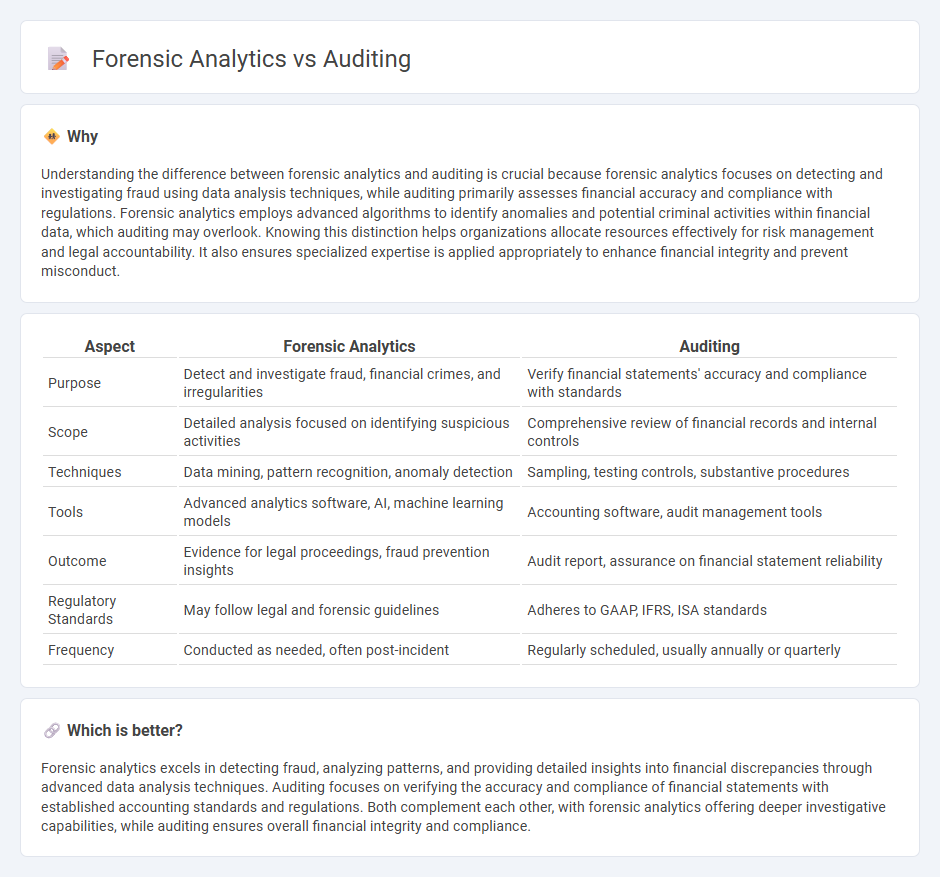

Understanding the difference between forensic analytics and auditing is crucial because forensic analytics focuses on detecting and investigating fraud using data analysis techniques, while auditing primarily assesses financial accuracy and compliance with regulations. Forensic analytics employs advanced algorithms to identify anomalies and potential criminal activities within financial data, which auditing may overlook. Knowing this distinction helps organizations allocate resources effectively for risk management and legal accountability. It also ensures specialized expertise is applied appropriately to enhance financial integrity and prevent misconduct.

Comparison Table

| Aspect | Forensic Analytics | Auditing |

|---|---|---|

| Purpose | Detect and investigate fraud, financial crimes, and irregularities | Verify financial statements' accuracy and compliance with standards |

| Scope | Detailed analysis focused on identifying suspicious activities | Comprehensive review of financial records and internal controls |

| Techniques | Data mining, pattern recognition, anomaly detection | Sampling, testing controls, substantive procedures |

| Tools | Advanced analytics software, AI, machine learning models | Accounting software, audit management tools |

| Outcome | Evidence for legal proceedings, fraud prevention insights | Audit report, assurance on financial statement reliability |

| Regulatory Standards | May follow legal and forensic guidelines | Adheres to GAAP, IFRS, ISA standards |

| Frequency | Conducted as needed, often post-incident | Regularly scheduled, usually annually or quarterly |

Which is better?

Forensic analytics excels in detecting fraud, analyzing patterns, and providing detailed insights into financial discrepancies through advanced data analysis techniques. Auditing focuses on verifying the accuracy and compliance of financial statements with established accounting standards and regulations. Both complement each other, with forensic analytics offering deeper investigative capabilities, while auditing ensures overall financial integrity and compliance.

Connection

Forensic analytics enhances auditing by using advanced data analysis techniques to identify anomalies, fraud, and financial discrepancies within accounting records. Auditors integrate forensic analytics tools to improve the accuracy and efficiency of risk assessment and fraud detection during financial statement examinations. This connection strengthens the reliability of audit outcomes and supports regulatory compliance in accounting practices.

Key Terms

Independence

Auditing emphasizes maintaining strict independence to ensure unbiased evaluation of financial statements, whereas forensic analytics often involves a more investigative approach that may require collaboration with legal authorities and stakeholders. Independence in auditing is governed by stringent regulatory standards like those from the AICPA and PCAOB, ensuring auditors remain free from conflicts of interest. Explore how these disciplines balance independence to uphold integrity and trust in financial oversight.

Materiality

Auditing emphasizes materiality to ensure financial statements are free from significant misstatements, targeting overall accuracy and compliance with accounting standards. Forensic analytics focuses on identifying material misrepresentations or fraud by analyzing detailed transactional data for anomalies and irregularities beyond standard auditing thresholds. Explore further to understand how these approaches differ in safeguarding financial integrity.

Evidence

Auditing systematically examines financial records to ensure accuracy and compliance, relying on sampling techniques to gather evidence. Forensic analytics dives deeper into transactional data using advanced algorithms to uncover fraud, anomalies, and hidden patterns as evidence. Explore more to understand how each approach uniquely supports financial integrity and legal investigations.

Source and External Links

What Is Auditing? Definition, Types & Importance - Deskera - Auditing is the systematic, independent review and verification of financial records to ensure accuracy, compliance with accounting standards, fraud detection, risk management, and enhancing stakeholder confidence.

Auditing: Definition, Types, and Importance - FreshBooks - Auditing is an objective examination of financial statements or records to confirm accuracy, compliance, and to build trust among stakeholders, with main types including internal, external, and IRS audits.

Auditing - Overview, Importance, Types, and Accounting Standards - Auditing refers to the independent evaluation of a company's financial statements to ensure fair representation and compliance with accounting standards such as IFRS or GAAP.

dowidth.com

dowidth.com