Cryptotax compliance involves accurately reporting cryptocurrency transactions and paying the appropriate taxes to adhere to regulatory standards. Tax evasion, in contrast, is the illegal act of deliberately avoiding tax liabilities through underreporting or concealing income. Explore the distinctions and legal implications between cryptotax responsibilities and tax evasion practices to ensure full compliance.

Why it is important

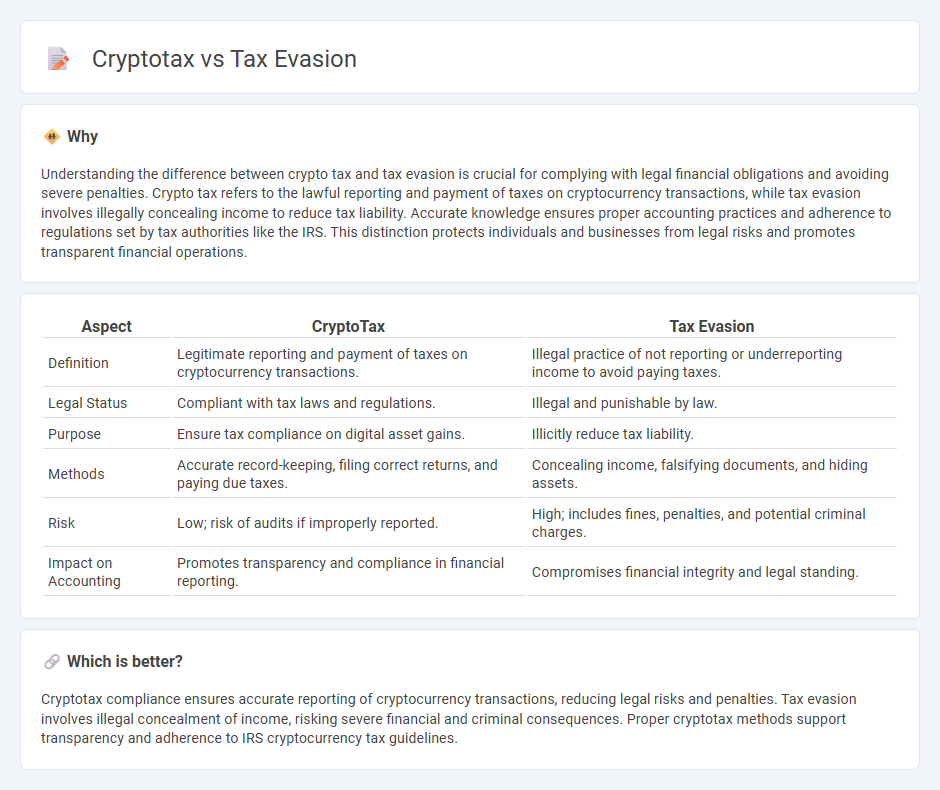

Understanding the difference between crypto tax and tax evasion is crucial for complying with legal financial obligations and avoiding severe penalties. Crypto tax refers to the lawful reporting and payment of taxes on cryptocurrency transactions, while tax evasion involves illegally concealing income to reduce tax liability. Accurate knowledge ensures proper accounting practices and adherence to regulations set by tax authorities like the IRS. This distinction protects individuals and businesses from legal risks and promotes transparent financial operations.

Comparison Table

| Aspect | CryptoTax | Tax Evasion |

|---|---|---|

| Definition | Legitimate reporting and payment of taxes on cryptocurrency transactions. | Illegal practice of not reporting or underreporting income to avoid paying taxes. |

| Legal Status | Compliant with tax laws and regulations. | Illegal and punishable by law. |

| Purpose | Ensure tax compliance on digital asset gains. | Illicitly reduce tax liability. |

| Methods | Accurate record-keeping, filing correct returns, and paying due taxes. | Concealing income, falsifying documents, and hiding assets. |

| Risk | Low; risk of audits if improperly reported. | High; includes fines, penalties, and potential criminal charges. |

| Impact on Accounting | Promotes transparency and compliance in financial reporting. | Compromises financial integrity and legal standing. |

Which is better?

Cryptotax compliance ensures accurate reporting of cryptocurrency transactions, reducing legal risks and penalties. Tax evasion involves illegal concealment of income, risking severe financial and criminal consequences. Proper cryptotax methods support transparency and adherence to IRS cryptocurrency tax guidelines.

Connection

Cryptotax regulations play a crucial role in identifying and preventing tax evasion related to cryptocurrency transactions, ensuring compliance with tax laws. Tax authorities use blockchain analysis tools to trace digital asset movements, reducing the risk of unreported income and fraudulent tax filings. Proper cryptotax reporting enhances transparency and helps mitigate illegal tax avoidance schemes in the evolving digital economy.

Key Terms

Non-compliance

Tax evasion involves illegal practices to avoid tax liabilities by underreporting income or inflating deductions, whereas crypto tax non-compliance often stems from misunderstanding complex regulations surrounding digital assets like Bitcoin and Ethereum. The decentralized and pseudonymous nature of cryptocurrencies complicates tracking and reporting, increasing risks of inadvertent errors or intentional evasion. Explore the latest compliance strategies and regulatory developments to stay informed about crypto tax obligations.

Blockchain tracing

Tax evasion involves illegal practices to avoid paying taxes, whereas crypto tax compliance leverages blockchain tracing to ensure transparent and accurate reporting of cryptocurrency transactions. Blockchain's immutable ledger allows tax authorities to track and verify digital asset movements, reducing the risk of hidden or unreported income. Explore how advanced blockchain analysis tools enhance tax enforcement and compliance in the evolving crypto landscape.

Reporting regulations

Tax evasion involves illegally hiding income or assets to avoid taxes, while cryptotax compliance requires strict adherence to reporting regulations mandated by tax authorities globally. Cryptocurrency transactions must be reported with transparency, including gains, losses, and transfers, according to frameworks like the IRS guidelines or FATF recommendations. Explore further to understand the evolving landscape of crypto tax reporting and how to stay compliant.

Source and External Links

Tax Evasion - Corruptionary A-Z - Transparency.org - Tax evasion is the illegal non-payment or under-payment of taxes by deliberately making false declarations or no declarations to tax authorities, distinguished from legal tax avoidance by its illegality and intent to deceive.

Tax evasion - Wikipedia - Tax evasion is a federal crime in the U.S. involving illegal attempts to evade tax payment or assessment, often through underreporting income or using opaque corporate structures like shell companies to conceal assets, with serious penalties including fines and imprisonment.

Who Goes to Prison for Tax Evasion? | H&R Block - While tax evasion can lead to criminal prosecution and imprisonment, the IRS prosecutes a small number of cases typically involving willful, large-scale underreporting of income or hiding assets, with audits often revealing the fraud through identified patterns.

dowidth.com

dowidth.com