Predictive close in accounting uses historical financial data and analytics to forecast closing timelines, improving accuracy and planning efficiency. Continuous close integrates real-time data processing and automation to maintain up-to-date financial records throughout the accounting period. Explore the advantages and applications of predictive close versus continuous close to optimize your financial closing process.

Why it is important

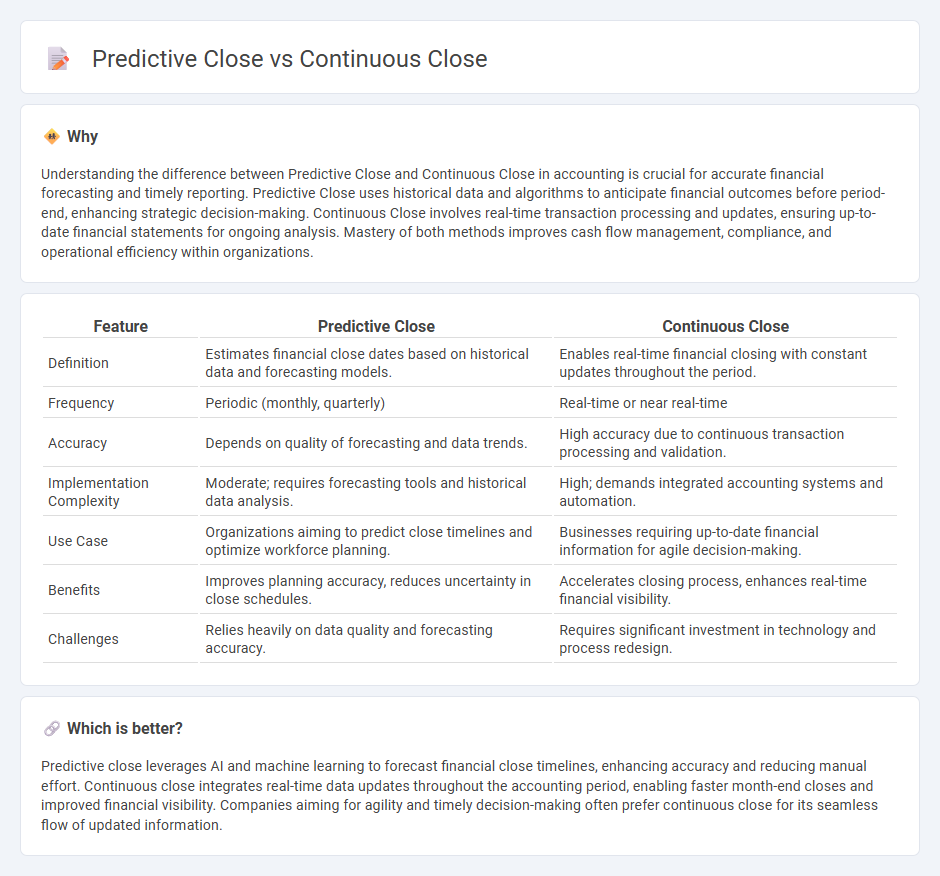

Understanding the difference between Predictive Close and Continuous Close in accounting is crucial for accurate financial forecasting and timely reporting. Predictive Close uses historical data and algorithms to anticipate financial outcomes before period-end, enhancing strategic decision-making. Continuous Close involves real-time transaction processing and updates, ensuring up-to-date financial statements for ongoing analysis. Mastery of both methods improves cash flow management, compliance, and operational efficiency within organizations.

Comparison Table

| Feature | Predictive Close | Continuous Close |

|---|---|---|

| Definition | Estimates financial close dates based on historical data and forecasting models. | Enables real-time financial closing with constant updates throughout the period. |

| Frequency | Periodic (monthly, quarterly) | Real-time or near real-time |

| Accuracy | Depends on quality of forecasting and data trends. | High accuracy due to continuous transaction processing and validation. |

| Implementation Complexity | Moderate; requires forecasting tools and historical data analysis. | High; demands integrated accounting systems and automation. |

| Use Case | Organizations aiming to predict close timelines and optimize workforce planning. | Businesses requiring up-to-date financial information for agile decision-making. |

| Benefits | Improves planning accuracy, reduces uncertainty in close schedules. | Accelerates closing process, enhances real-time financial visibility. |

| Challenges | Relies heavily on data quality and forecasting accuracy. | Requires significant investment in technology and process redesign. |

Which is better?

Predictive close leverages AI and machine learning to forecast financial close timelines, enhancing accuracy and reducing manual effort. Continuous close integrates real-time data updates throughout the accounting period, enabling faster month-end closes and improved financial visibility. Companies aiming for agility and timely decision-making often prefer continuous close for its seamless flow of updated information.

Connection

Predictive close and continuous close are connected through their goal of enhancing financial reporting accuracy and timeliness in accounting processes. Predictive close utilizes advanced analytics and artificial intelligence to forecast closing outcomes, while continuous close integrates real-time data updates throughout the accounting period to reduce closing cycle times. Both methods optimize financial close efficiency, improve compliance, and support strategic decision-making in corporate finance.

Key Terms

Real-time data

Continuous close leverages real-time data streams to update financial records instantly throughout the accounting period, enhancing accuracy and decision-making speed. Predictive close uses historical and current data analytics to forecast closing outcomes, facilitating proactive issue resolution before period end. Explore how integrating real-time data can transform your closing process efficiency and accuracy.

Automation

Continuous close leverages real-time data integration and automation tools to streamline financial reporting, reducing cycle times and improving accuracy. Predictive close incorporates advanced analytics and machine learning algorithms to forecast closing outcomes and identify potential discrepancies before finalization. Explore how combining automation with predictive insights can transform your financial close process.

Forecasting

Continuous close enhances forecasting accuracy by providing real-time financial data updates, allowing businesses to adjust projections promptly. Predictive close utilizes AI and machine learning models to analyze historical data, enabling more precise future financial forecasts. Explore the differences and benefits of each method to optimize your financial forecasting strategies.

Source and External Links

Continuous close: Is it time for your business to move to real ... - Sage - Continuous close, also called continuous accounting or rolling close, is the practice of using automation and integrated systems so accounting entries are made immediately, keeping company books up to date at any time rather than waiting for month-end closes.

Why You Should Consider a Continuous Financial Close - A continuous financial close performs accounting activities such as reconciliations and journal entries throughout the period, providing real-time, accurate financial data that enhances transparency, speeds up processes, and supports timely decision-making.

Continuous Close and Why It Matters | Enterprise Accounting Software - Continuous close is like a rolling close that keeps financial books nearly ready to close at any moment, distributing the workload throughout the month and enabling executives access to accurate, real-time financial data and faster month-end closes.

dowidth.com

dowidth.com