Embedded lease accounting involves identifying lease components within larger contracts to accurately recognize lease liabilities and right-of-use assets under IFRS 16 and ASC 842 standards. Sublease accounting records the leasing of an asset previously leased, requiring separate recognition of sublease income and the net investment in the sublease. Explore detailed guidance and best practices to master both embedded lease and sublease accounting efficiently.

Why it is important

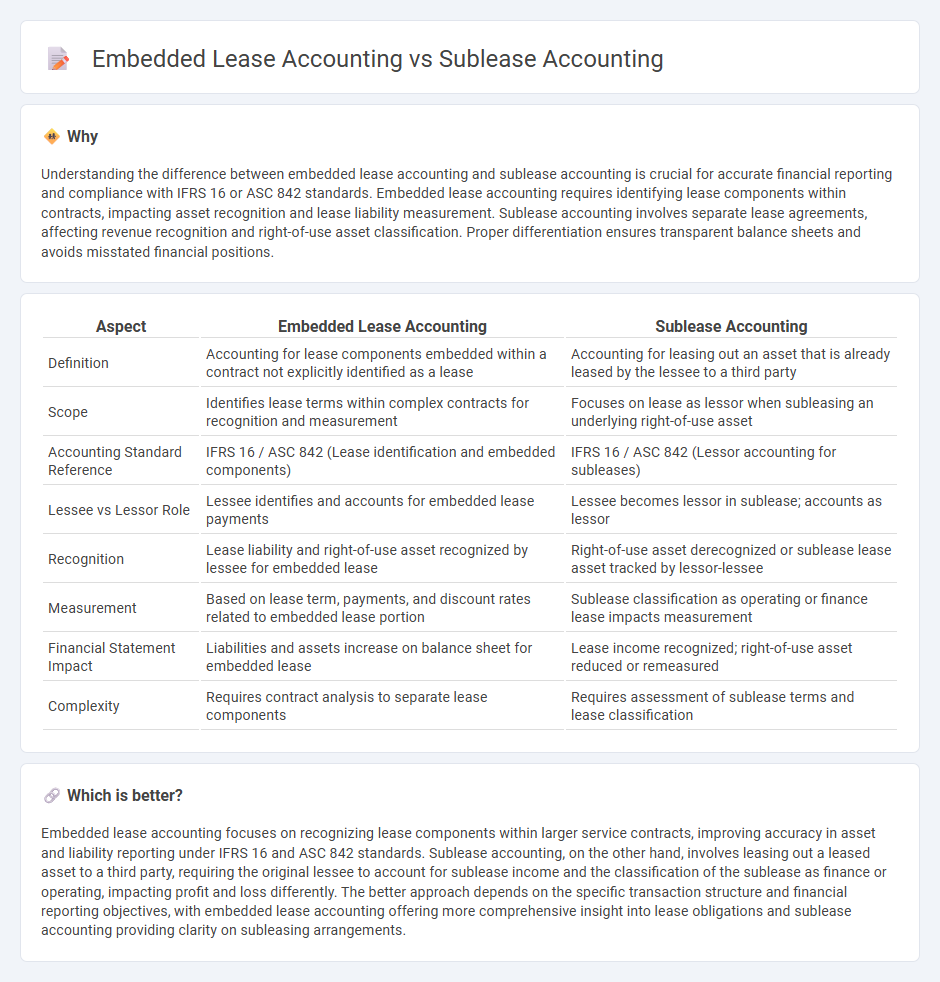

Understanding the difference between embedded lease accounting and sublease accounting is crucial for accurate financial reporting and compliance with IFRS 16 or ASC 842 standards. Embedded lease accounting requires identifying lease components within contracts, impacting asset recognition and lease liability measurement. Sublease accounting involves separate lease agreements, affecting revenue recognition and right-of-use asset classification. Proper differentiation ensures transparent balance sheets and avoids misstated financial positions.

Comparison Table

| Aspect | Embedded Lease Accounting | Sublease Accounting |

|---|---|---|

| Definition | Accounting for lease components embedded within a contract not explicitly identified as a lease | Accounting for leasing out an asset that is already leased by the lessee to a third party |

| Scope | Identifies lease terms within complex contracts for recognition and measurement | Focuses on lease as lessor when subleasing an underlying right-of-use asset |

| Accounting Standard Reference | IFRS 16 / ASC 842 (Lease identification and embedded components) | IFRS 16 / ASC 842 (Lessor accounting for subleases) |

| Lessee vs Lessor Role | Lessee identifies and accounts for embedded lease payments | Lessee becomes lessor in sublease; accounts as lessor |

| Recognition | Lease liability and right-of-use asset recognized by lessee for embedded lease | Right-of-use asset derecognized or sublease lease asset tracked by lessor-lessee |

| Measurement | Based on lease term, payments, and discount rates related to embedded lease portion | Sublease classification as operating or finance lease impacts measurement |

| Financial Statement Impact | Liabilities and assets increase on balance sheet for embedded lease | Lease income recognized; right-of-use asset reduced or remeasured |

| Complexity | Requires contract analysis to separate lease components | Requires assessment of sublease terms and lease classification |

Which is better?

Embedded lease accounting focuses on recognizing lease components within larger service contracts, improving accuracy in asset and liability reporting under IFRS 16 and ASC 842 standards. Sublease accounting, on the other hand, involves leasing out a leased asset to a third party, requiring the original lessee to account for sublease income and the classification of the sublease as finance or operating, impacting profit and loss differently. The better approach depends on the specific transaction structure and financial reporting objectives, with embedded lease accounting offering more comprehensive insight into lease obligations and sublease accounting providing clarity on subleasing arrangements.

Connection

Embedded lease accounting involves identifying lease components within a contract that may not explicitly state lease terms, requiring analysis of asset use and payment allocations. Sublease accounting connects by managing transactions where the original lessee becomes a lessor, recognizing lease liabilities and right-of-use assets under IFRS 16 or ASC 842 standards. Both accounting processes ensure accurate financial reporting through lease identification, classification, and measurement in accordance with lease accounting frameworks.

Key Terms

Lease Classification

Sublease accounting requires classifying the primary lease as either a finance or operating lease, which determines how the sublease is recorded on the financial statements. Embedded lease accounting focuses on identifying lease components within contracts not explicitly labeled as leases, ensuring accurate lease classification based on right-of-use assets and lease liabilities. Explore detailed guidance on lease classification for both subleases and embedded leases to enhance your accounting practices.

Right-of-Use Asset

In sublease accounting, the right-of-use asset is derecognized from the head lessee's balance sheet and a lease receivable is recorded, reflecting the sublease income. Embedded lease accounting requires identification of the right-of-use asset within a contract that includes both lease and non-lease components, necessitating separation and allocation of payments. Explore detailed accounting treatments to better understand the distinctions in recognizing and measuring right-of-use assets.

Lease Liability

Lease liability in sublease accounting involves recognizing the right-of-use asset and corresponding lease liability for the head lease, while the sublease is accounted for separately as a lease receivable or expense depending on its classification. Embedded lease accounting requires identifying lease components within a contract and separately recognizing lease liabilities and right-of-use assets related to those embedded leases. Discover more about how these accounting frameworks impact financial reporting and lease management.

Source and External Links

Sublease Accounting for ASC 842 Explained with Example - FinQuery - Under ASC 842, a sublease occurs when an original lessee leases the asset to a third party but remains obligated under the head lease, requiring the sublessor to separately account for the original lease liability and the sublease income.

Sublease Accounting Under ASC 842 | Visual Lease - ASC 842 mandates separate accounting for the original lease obligation and sublease income by the sublessor, enhancing financial transparency compared to prior standards where sublease income offset lease expenses directly.

How to Account for a Sublease Under ASC 842 - Subleasing under ASC 842 requires the original lessee to act in two roles--lessee and intermediate lessor--and to account for the head lease and sublease as separate contracts without netting balances.

dowidth.com

dowidth.com