Fair value measurement reflects the current market price of an asset or liability, providing a dynamic assessment based on real-time data, while par value represents the nominal or face value assigned to financial instruments, often fixed at issuance. Understanding the distinction between fair value and par value is crucial for accurate financial reporting under accounting standards such as IFRS and GAAP. Explore detailed insights on how these valuation methods impact balance sheets and investor decisions.

Why it is important

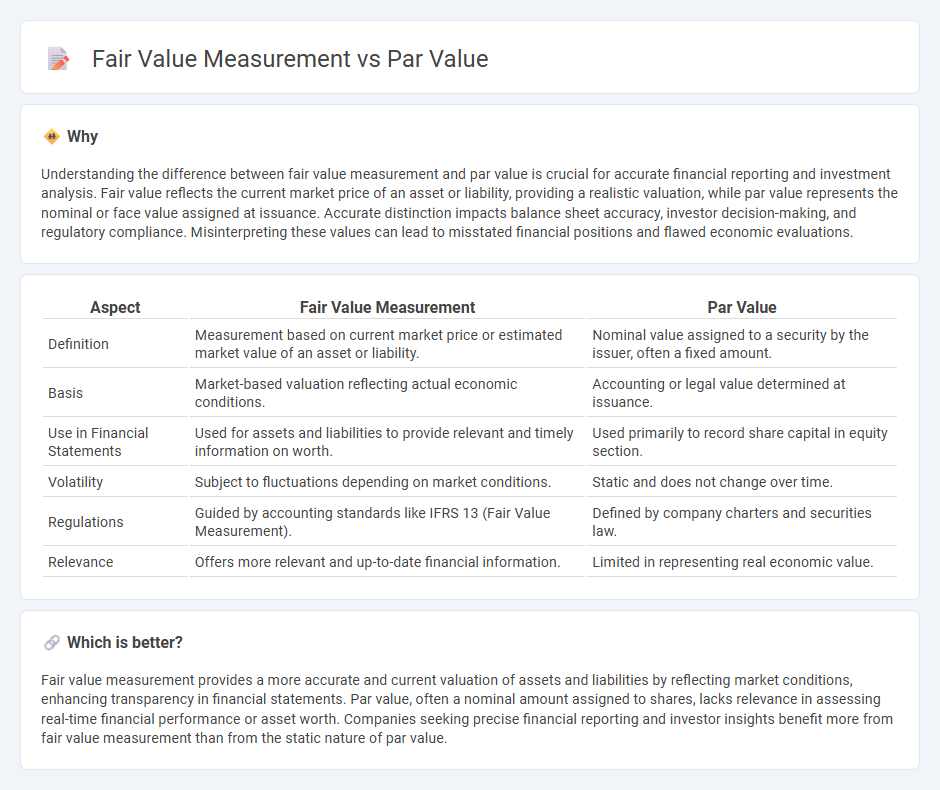

Understanding the difference between fair value measurement and par value is crucial for accurate financial reporting and investment analysis. Fair value reflects the current market price of an asset or liability, providing a realistic valuation, while par value represents the nominal or face value assigned at issuance. Accurate distinction impacts balance sheet accuracy, investor decision-making, and regulatory compliance. Misinterpreting these values can lead to misstated financial positions and flawed economic evaluations.

Comparison Table

| Aspect | Fair Value Measurement | Par Value |

|---|---|---|

| Definition | Measurement based on current market price or estimated market value of an asset or liability. | Nominal value assigned to a security by the issuer, often a fixed amount. |

| Basis | Market-based valuation reflecting actual economic conditions. | Accounting or legal value determined at issuance. |

| Use in Financial Statements | Used for assets and liabilities to provide relevant and timely information on worth. | Used primarily to record share capital in equity section. |

| Volatility | Subject to fluctuations depending on market conditions. | Static and does not change over time. |

| Regulations | Guided by accounting standards like IFRS 13 (Fair Value Measurement). | Defined by company charters and securities law. |

| Relevance | Offers more relevant and up-to-date financial information. | Limited in representing real economic value. |

Which is better?

Fair value measurement provides a more accurate and current valuation of assets and liabilities by reflecting market conditions, enhancing transparency in financial statements. Par value, often a nominal amount assigned to shares, lacks relevance in assessing real-time financial performance or asset worth. Companies seeking precise financial reporting and investor insights benefit more from fair value measurement than from the static nature of par value.

Connection

Fair value measurement and par value are connected through their roles in financial reporting and asset valuation, where par value represents the nominal value assigned to shares at issuance, while fair value reflects the current market price or estimated worth of an asset or liability. Par value often serves as a legal or accounting baseline, whereas fair value measurement aligns financial statements with market conditions, providing a more accurate representation of an entity's financial position. This connection ensures transparency in equity transactions and compliance with accounting standards such as IFRS 13 and ASC 820.

Key Terms

Nominal Value

Nominal value refers to the face or par value of a financial instrument, representing its original issuance value without adjustments for market fluctuations, while fair value reflects the current market price based on supply and demand dynamics. Par value is crucial for accounting and legal purposes, especially in equity and debt instruments, serving as the basis for dividend distributions and redemption calculations. Explore further to understand how nominal and fair value measurements impact financial reporting and investment decisions.

Market Value

Par value represents the nominal or face value of a financial instrument, often fixed and stated on the security itself, while fair value measurement reflects the current market value based on actual trading prices or market conditions. Market value takes into account supply and demand dynamics, liquidity, and investor sentiment, providing a more accurate and real-time assessment of an asset's worth. Explore further to understand how market value drives financial decision-making and reporting accuracy.

Measurement Basis

Par value represents the nominal or face value assigned to a financial instrument at issuance, reflecting a fixed amount without adjustment for market conditions. Fair value measurement assesses the current market price or an estimate based on market inputs, providing a dynamic valuation that reflects real-time economic factors. Explore deeper insights on how these measurement bases impact financial reporting and investment decisions.

Source and External Links

Par Value | Definition + Examples - Par value is the face value on issuance of securities like bonds or stocks, set on the security certificate, and remains constant unlike market value; for bonds, it is typically $1,000 and represents the principal to be repaid at maturity.

par value | Wex | US Law | LII / Legal Information Institute - Par value, also called nominal value, is the face value stated in the corporate charter and on stock or bond certificates, affecting maturity value and coupon payments, commonly $1,000 for bonds.

Par Value - Definition, Example, Importance - Par value is the static nominal or face value of a bond or stock established at issuance, used for calculating interest and minimum share price, and does not fluctuate with market value.

dowidth.com

dowidth.com