On-demand accruals in accounting provide real-time recognition of revenues and expenses as they occur, enhancing financial accuracy and timely decision-making. Periodic entries, by contrast, update accounts at predefined intervals, which may delay the reflection of financial status. Explore further to understand how choosing between these methods impacts cash flow management and financial reporting.

Why it is important

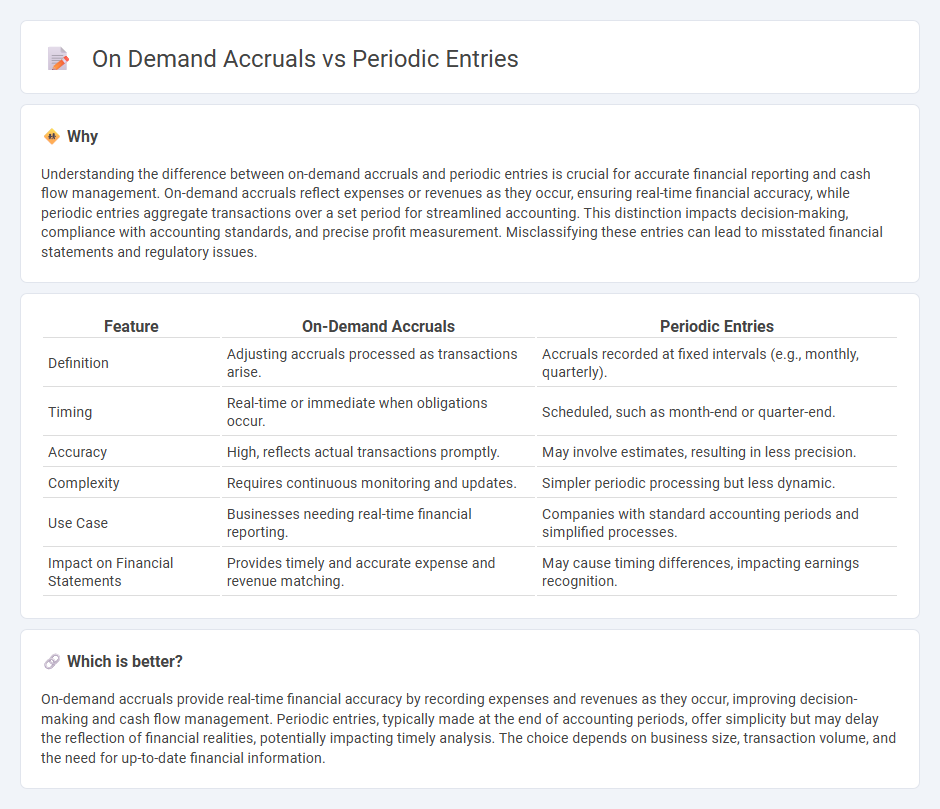

Understanding the difference between on-demand accruals and periodic entries is crucial for accurate financial reporting and cash flow management. On-demand accruals reflect expenses or revenues as they occur, ensuring real-time financial accuracy, while periodic entries aggregate transactions over a set period for streamlined accounting. This distinction impacts decision-making, compliance with accounting standards, and precise profit measurement. Misclassifying these entries can lead to misstated financial statements and regulatory issues.

Comparison Table

| Feature | On-Demand Accruals | Periodic Entries |

|---|---|---|

| Definition | Adjusting accruals processed as transactions arise. | Accruals recorded at fixed intervals (e.g., monthly, quarterly). |

| Timing | Real-time or immediate when obligations occur. | Scheduled, such as month-end or quarter-end. |

| Accuracy | High, reflects actual transactions promptly. | May involve estimates, resulting in less precision. |

| Complexity | Requires continuous monitoring and updates. | Simpler periodic processing but less dynamic. |

| Use Case | Businesses needing real-time financial reporting. | Companies with standard accounting periods and simplified processes. |

| Impact on Financial Statements | Provides timely and accurate expense and revenue matching. | May cause timing differences, impacting earnings recognition. |

Which is better?

On-demand accruals provide real-time financial accuracy by recording expenses and revenues as they occur, improving decision-making and cash flow management. Periodic entries, typically made at the end of accounting periods, offer simplicity but may delay the reflection of financial realities, potentially impacting timely analysis. The choice depends on business size, transaction volume, and the need for up-to-date financial information.

Connection

On-demand accruals and periodic entries are connected through their role in accurately matching revenues and expenses to the correct accounting periods. On-demand accruals ensure expenses or revenues are recorded when incurred, even if cash transactions occur later, while periodic entries consolidate these adjustments at regular intervals for financial reporting. This connection helps maintain precise financial statements by aligning income and expenses according to accounting principles.

Key Terms

Journal Entries

Periodic entries record transactions at set intervals, simplifying bookkeeping but risking outdated financial data. On-demand accruals capture expenses and revenues as they occur, ensuring real-time accuracy and compliance with GAAP. Explore deeper insights into journal entries and their impact on financial reporting.

Accrual Basis

Periodic entries record expenses or revenues at regular intervals, aligning with the accrual basis principle of matching income and expenses within the same accounting period. On-demand accruals recognize transactions as they occur, providing real-time accuracy for financial statements under the accrual basis. Explore more about how these methods impact financial reporting and accuracy.

Timing (Period-End vs. Real-Time)

Periodic entries record accruals at the end of an accounting period, ensuring financial statements reflect expenses and revenues incurred during that timeframe. On demand accruals update financial records in real-time as transactions occur, providing immediate accuracy but requiring more continuous monitoring and system integration. Explore how these timing differences impact financial reporting accuracy and operational efficiency.

Source and External Links

Periodic inventory system - explanation, journal entries, example - The periodic inventory system records all purchases in a purchases account and updates inventory only at period-end with journal entries for purchases, sales, returns, and ending inventory adjustments.

Periodic inventory system definition - AccountingTools - Under the periodic inventory system, purchases are recorded in a purchases account and the ending inventory balance is updated only after a physical count, transferring the purchases balance to inventory at period-end.

Periodic Inventory System: Is It the Right Choice? - NetSuite - The periodic inventory system involves physical counts at intervals, with stock valuation methods such as periodic LIFO, where cost of goods sold is calculated after counting ending inventory without tracking each sale.

dowidth.com

dowidth.com