Cryptocurrency taxation involves reporting digital asset transactions as capital gains or losses, subject to IRS rules, whereas like-kind exchanges allow deferral of taxes by swapping similar property, traditionally applicable to real estate. The IRS treats cryptocurrencies as property, eliminating the use of like-kind exchange benefits for crypto trades after 2018. Explore deeper insights into how these tax treatments impact your financial strategy.

Why it is important

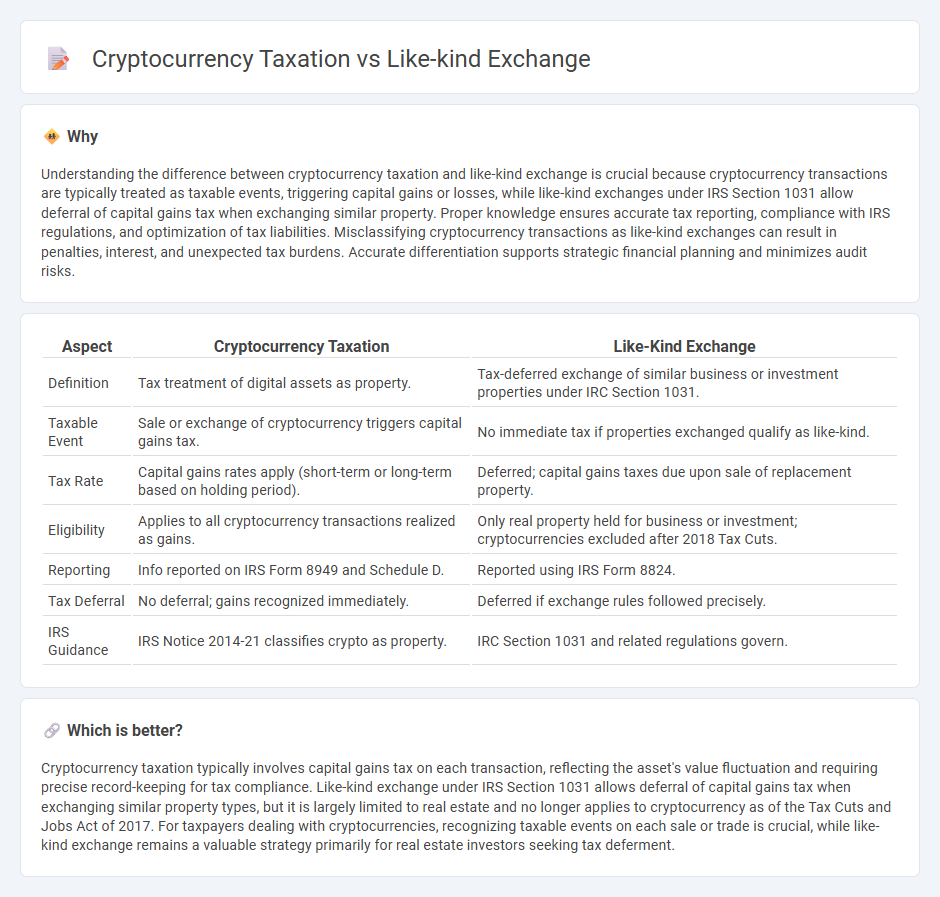

Understanding the difference between cryptocurrency taxation and like-kind exchange is crucial because cryptocurrency transactions are typically treated as taxable events, triggering capital gains or losses, while like-kind exchanges under IRS Section 1031 allow deferral of capital gains tax when exchanging similar property. Proper knowledge ensures accurate tax reporting, compliance with IRS regulations, and optimization of tax liabilities. Misclassifying cryptocurrency transactions as like-kind exchanges can result in penalties, interest, and unexpected tax burdens. Accurate differentiation supports strategic financial planning and minimizes audit risks.

Comparison Table

| Aspect | Cryptocurrency Taxation | Like-Kind Exchange |

|---|---|---|

| Definition | Tax treatment of digital assets as property. | Tax-deferred exchange of similar business or investment properties under IRC Section 1031. |

| Taxable Event | Sale or exchange of cryptocurrency triggers capital gains tax. | No immediate tax if properties exchanged qualify as like-kind. |

| Tax Rate | Capital gains rates apply (short-term or long-term based on holding period). | Deferred; capital gains taxes due upon sale of replacement property. |

| Eligibility | Applies to all cryptocurrency transactions realized as gains. | Only real property held for business or investment; cryptocurrencies excluded after 2018 Tax Cuts. |

| Reporting | Info reported on IRS Form 8949 and Schedule D. | Reported using IRS Form 8824. |

| Tax Deferral | No deferral; gains recognized immediately. | Deferred if exchange rules followed precisely. |

| IRS Guidance | IRS Notice 2014-21 classifies crypto as property. | IRC Section 1031 and related regulations govern. |

Which is better?

Cryptocurrency taxation typically involves capital gains tax on each transaction, reflecting the asset's value fluctuation and requiring precise record-keeping for tax compliance. Like-kind exchange under IRS Section 1031 allows deferral of capital gains tax when exchanging similar property types, but it is largely limited to real estate and no longer applies to cryptocurrency as of the Tax Cuts and Jobs Act of 2017. For taxpayers dealing with cryptocurrencies, recognizing taxable events on each sale or trade is crucial, while like-kind exchange remains a valuable strategy primarily for real estate investors seeking tax deferment.

Connection

Cryptocurrency taxation intersects with like-kind exchange rules by determining whether digital asset trades qualify for tax deferral under IRS Code Section 1031. Since 2018, the IRS clarified that like-kind exchanges are limited to real property, excluding cryptocurrencies, which are treated as capital assets subject to capital gains tax upon sale or exchange. This distinction influences tax planning strategies for cryptocurrency investors who must report gains and losses instead of deferring taxes through like-kind exchange mechanisms.

Key Terms

Section 1031 Exchange

The Section 1031 exchange allows deferral of capital gains taxes on like-kind property exchanges, but it explicitly excludes cryptocurrency from qualifying assets under current IRS rules. Unlike real estate or tangible personal property, digital currencies are treated as property subject to capital gains tax upon each sale or exchange. Explore the latest IRS guidelines to understand how cryptocurrency taxation differs from traditional 1031 exchanges.

Capital Gains

Like-kind exchange rules under IRS Section 1031 allow deferral of capital gains taxes when exchanging similar property, but these rules currently exclude cryptocurrency transactions. Cryptocurrency sales are treated as property sales, triggering capital gains tax based on the difference between the purchase price and the sale price. Explore detailed IRS guidelines to understand the specific tax implications of cryptocurrency trading.

Taxable Event

Like-kind exchanges under IRS Section 1031 allow deferral of capital gains tax when exchanging similar types of real property, excluding cryptocurrency which the IRS treats as property but not eligible for 1031 treatment. Cryptocurrency transactions are taxable events upon sale, exchange, or use for goods and services, triggering capital gains or losses based on the asset's fair market value at the time of the transaction. Explore detailed IRS guidelines and case studies to understand how these tax rules impact your investment strategies.

Source and External Links

Like-kind exchange - A like-kind exchange under U.S. tax law, also called a 1031 exchange, allows disposal of an asset and acquisition of a replacement asset without current tax liability, typically used for real estate or certain business assets of like kind.

Navigating Like-Kind Exchange Rules Under Section 1031 - A 1031 exchange requires that exchanged properties be of like kind (same nature or character), held for business or investment, with strict timelines and use of a qualified intermediary to defer capital gains taxes.

Like-kind exchanges - Real estate tax tips - Like-kind real property is generally any real estate held for investment or business use, regardless of grade or quality, but real property in the U.S. is not like-kind to foreign real property; such exchanges are reported on IRS Form 8824.

dowidth.com

dowidth.com