Digital asset valuation involves determining the fair market value of intangible assets such as cryptocurrencies and intellectual property using specialized models and market data. Contingent liability assessment focuses on evaluating potential financial obligations that depend on future events and uncertainties, requiring careful risk analysis and adherence to accounting standards. Explore more to understand the critical distinctions and methodologies in these accounting evaluations.

Why it is important

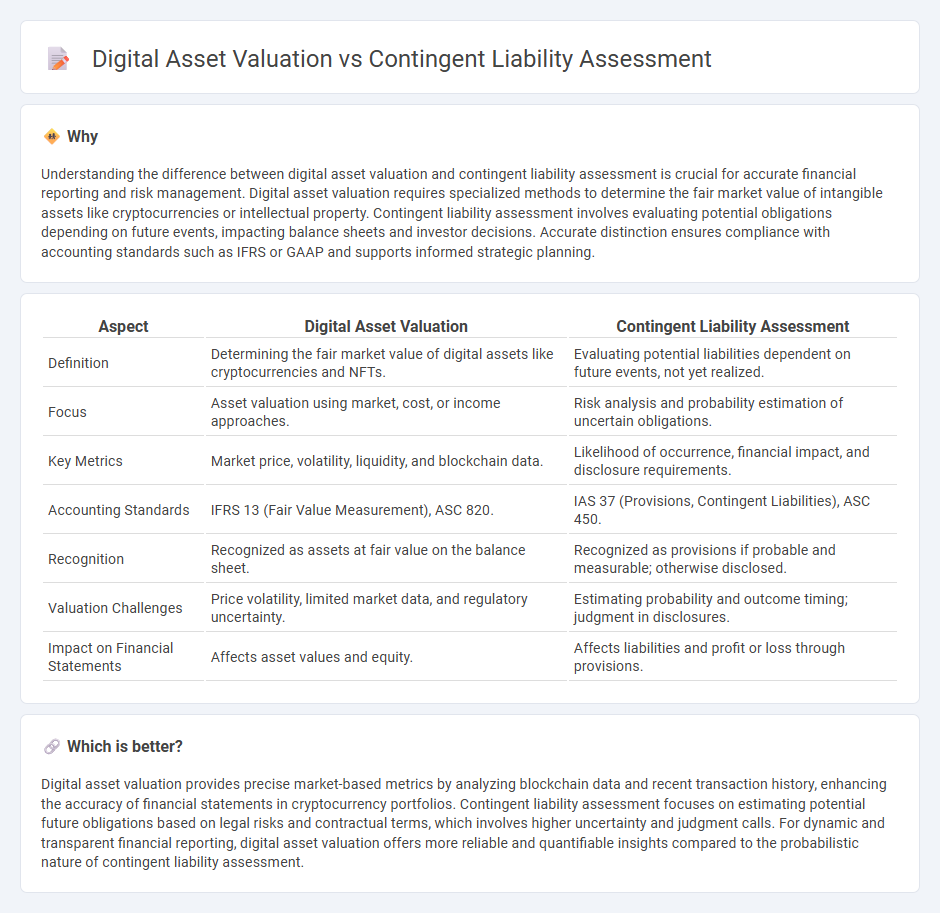

Understanding the difference between digital asset valuation and contingent liability assessment is crucial for accurate financial reporting and risk management. Digital asset valuation requires specialized methods to determine the fair market value of intangible assets like cryptocurrencies or intellectual property. Contingent liability assessment involves evaluating potential obligations depending on future events, impacting balance sheets and investor decisions. Accurate distinction ensures compliance with accounting standards such as IFRS or GAAP and supports informed strategic planning.

Comparison Table

| Aspect | Digital Asset Valuation | Contingent Liability Assessment |

|---|---|---|

| Definition | Determining the fair market value of digital assets like cryptocurrencies and NFTs. | Evaluating potential liabilities dependent on future events, not yet realized. |

| Focus | Asset valuation using market, cost, or income approaches. | Risk analysis and probability estimation of uncertain obligations. |

| Key Metrics | Market price, volatility, liquidity, and blockchain data. | Likelihood of occurrence, financial impact, and disclosure requirements. |

| Accounting Standards | IFRS 13 (Fair Value Measurement), ASC 820. | IAS 37 (Provisions, Contingent Liabilities), ASC 450. |

| Recognition | Recognized as assets at fair value on the balance sheet. | Recognized as provisions if probable and measurable; otherwise disclosed. |

| Valuation Challenges | Price volatility, limited market data, and regulatory uncertainty. | Estimating probability and outcome timing; judgment in disclosures. |

| Impact on Financial Statements | Affects asset values and equity. | Affects liabilities and profit or loss through provisions. |

Which is better?

Digital asset valuation provides precise market-based metrics by analyzing blockchain data and recent transaction history, enhancing the accuracy of financial statements in cryptocurrency portfolios. Contingent liability assessment focuses on estimating potential future obligations based on legal risks and contractual terms, which involves higher uncertainty and judgment calls. For dynamic and transparent financial reporting, digital asset valuation offers more reliable and quantifiable insights compared to the probabilistic nature of contingent liability assessment.

Connection

Digital asset valuation and contingent liability assessment intersect through their reliance on accurate financial analysis and risk measurement to ensure precise reporting. Both processes require evaluating future uncertainties and market fluctuations that impact asset values and potential obligations. Integrating these assessments enhances transparency and compliance within accounting frameworks, improving financial decision-making.

Key Terms

**Contingent liability assessment:**

Contingent liability assessment involves identifying potential obligations arising from uncertain events that may impact a company's financial statements, often requiring probability evaluation and accurate estimation of potential losses. This process is critical for risk management and regulatory compliance, ensuring transparent disclosure under accounting standards like IFRS and GAAP. Explore deeper insights into contingent liability assessment methodologies and their impact on corporate financial health.

Probable obligation

Contingent liability assessment centers on identifying and measuring probable obligations arising from past events, which may result in future outflows of resources depending on the likelihood of occurrence. Digital asset valuation involves estimating the fair market value of assets like cryptocurrencies or NFTs, where probable obligations could influence the asset's risk profile and valuation accuracy. Explore detailed comparisons of contingent liabilities and digital asset valuations to understand how probable obligations impact financial reporting and asset management.

Disclosure requirements

Contingent liability assessment requires precise estimation of potential obligations based on past events and future uncertainties, emphasizing clear disclosure of risks and financial impacts in financial statements. Digital asset valuation involves determining the fair value of intangible assets like cryptocurrencies, necessitating transparent reporting of valuation methodologies, market conditions, and volatility factors to ensure stakeholder understanding. Explore detailed frameworks and compliance guidelines to master disclosure requirements in both domains.

Source and External Links

Chapter 13 - Contingent Liabilities - This chapter outlines the Department of Veterans Affairs' financial policies regarding recognition, accounting, and reporting of contingent liabilities.

Contingent Liability - Contingent liabilities are categorized into high, medium, and low probability based on their likelihood of occurrence, with high probability liabilities being recorded as expenses and liabilities.

Contingent Liabilities - Contingent liabilities are classified under GAAP as probable, possible, or remote, with probable liabilities requiring recognition in financial statements.

dowidth.com

dowidth.com