Invoice factoring platforms provide businesses immediate cash flow by selling outstanding invoices to third parties at a discount, improving working capital without creating debt. Merchant cash advances offer lump-sum funding based on future credit card sales, with repayments tied to daily transactions and higher overall costs. Explore the differences in costs, repayment terms, and suitability to determine the best funding option for your business growth needs.

Why it is important

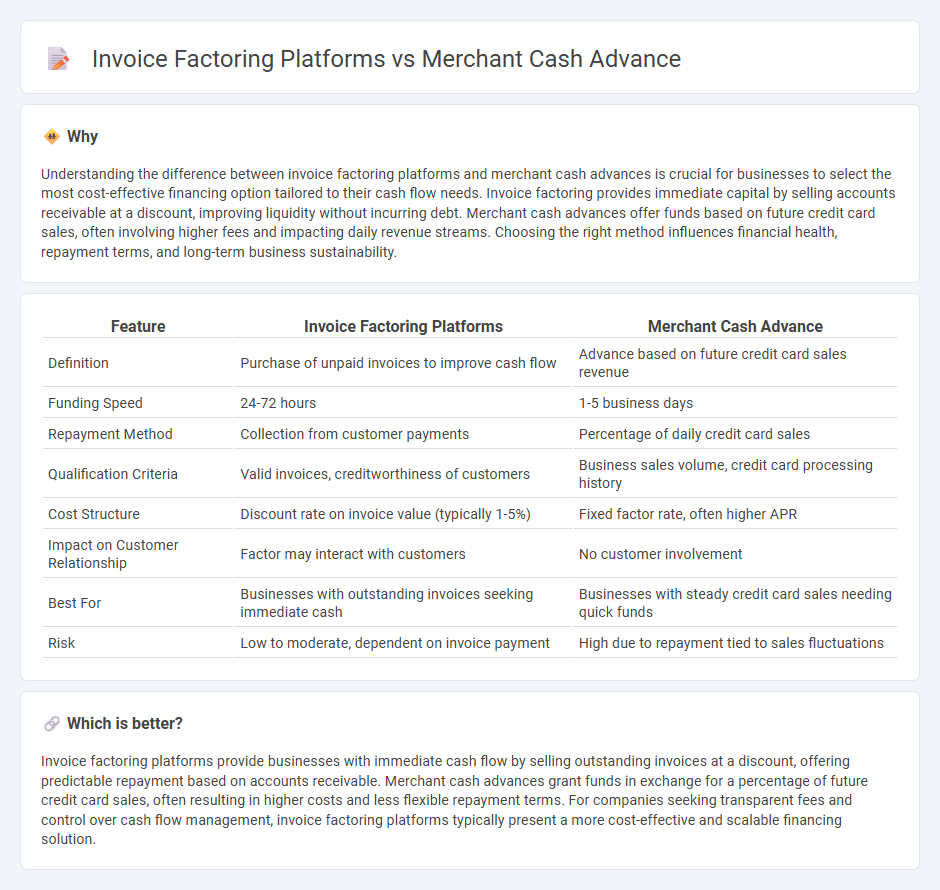

Understanding the difference between invoice factoring platforms and merchant cash advances is crucial for businesses to select the most cost-effective financing option tailored to their cash flow needs. Invoice factoring provides immediate capital by selling accounts receivable at a discount, improving liquidity without incurring debt. Merchant cash advances offer funds based on future credit card sales, often involving higher fees and impacting daily revenue streams. Choosing the right method influences financial health, repayment terms, and long-term business sustainability.

Comparison Table

| Feature | Invoice Factoring Platforms | Merchant Cash Advance |

|---|---|---|

| Definition | Purchase of unpaid invoices to improve cash flow | Advance based on future credit card sales revenue |

| Funding Speed | 24-72 hours | 1-5 business days |

| Repayment Method | Collection from customer payments | Percentage of daily credit card sales |

| Qualification Criteria | Valid invoices, creditworthiness of customers | Business sales volume, credit card processing history |

| Cost Structure | Discount rate on invoice value (typically 1-5%) | Fixed factor rate, often higher APR |

| Impact on Customer Relationship | Factor may interact with customers | No customer involvement |

| Best For | Businesses with outstanding invoices seeking immediate cash | Businesses with steady credit card sales needing quick funds |

| Risk | Low to moderate, dependent on invoice payment | High due to repayment tied to sales fluctuations |

Which is better?

Invoice factoring platforms provide businesses with immediate cash flow by selling outstanding invoices at a discount, offering predictable repayment based on accounts receivable. Merchant cash advances grant funds in exchange for a percentage of future credit card sales, often resulting in higher costs and less flexible repayment terms. For companies seeking transparent fees and control over cash flow management, invoice factoring platforms typically present a more cost-effective and scalable financing solution.

Connection

Invoice factoring platforms and merchant cash advance both provide alternative financing solutions for businesses seeking quick access to working capital. Invoice factoring platforms allow companies to sell their outstanding invoices at a discount for immediate cash, while merchant cash advance offers lump-sum funding repaid through a percentage of future sales. Both methods improve cash flow without incurring traditional debt, catering especially to small and medium-sized enterprises with fluctuating revenues.

Key Terms

Receivables

Merchant cash advance platforms provide businesses with upfront capital in exchange for a percentage of future sales receipts, leveraging daily card transactions as collateral. Invoice factoring platforms, on the other hand, offer immediate cash by purchasing outstanding invoices and managing the receivables collection process on behalf of the business. Explore detailed comparisons and benefits of each receivables financing option to determine the best solution for your cash flow needs.

Advance Rate

Merchant cash advance platforms typically offer advance rates ranging from 70% to 90% of future credit card sales, while invoice factoring platforms provide advance rates between 70% and 95% of invoice value. Advance rate efficiency depends on factors such as business creditworthiness, invoice age, and overall transaction volume, with invoice factoring often allowing for higher advance rates due to secured receivables. Explore more about how advance rates impact your funding options and cash flow management strategies.

Repayment Structure

Merchant cash advance platforms offer repayment through a percentage of daily credit card sales, aligning payments with business revenue fluctuations and providing flexibility during slow periods. Invoice factoring platforms involve selling outstanding invoices to a third party, which collects payments directly from customers, often leading to fixed repayment schedules based on invoice due dates. Explore how these repayment structures impact cash flow management and business growth by learning more about each financing option.

Source and External Links

Merchant Cash Advance - Apply Today | Rapid Finance - A merchant cash advance (MCA) provides businesses fast access to working capital by advancing a lump sum based on future credit card or receivables, repaid as a portion of future revenue with variable payments suited to business cash flow, ideal for businesses with high card sales or seasonal income.

Merchant cash advance - Wikipedia - An MCA is business funding paid back by taking a percentage of future revenue, typically credit card sales, with short payment terms and daily small payments instead of monthly installments, first established by AdvancMe in 2009 as an alternative to traditional loans.

Merchant Cash Advance (MCA) Guide for 2025 - Nav - Merchant cash advances offer a quick, flexible way for businesses to get funds upfront against future sales but tend to have higher costs than traditional loans, with repayments typically taken daily from credit card sales, suitable for businesses needing fast capital with less stringent approval processes.

dowidth.com

dowidth.com