Tax equity financing leverages tax credits and incentives to attract investments in projects like renewable energy, providing investors with financial returns through tax benefits. Grant funding offers non-repayable financial support from governments or organizations, aimed at promoting specific initiatives without the need for equity sharing or repayment. Explore more to understand which funding option aligns best with your financial strategy.

Why it is important

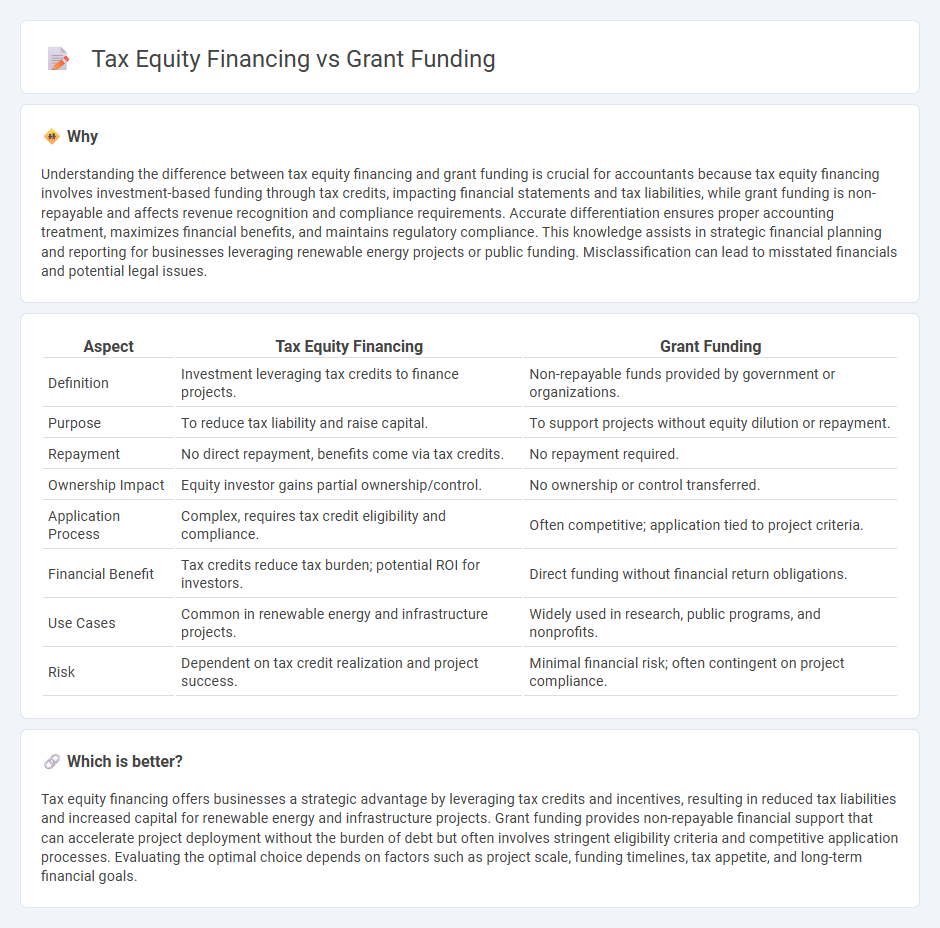

Understanding the difference between tax equity financing and grant funding is crucial for accountants because tax equity financing involves investment-based funding through tax credits, impacting financial statements and tax liabilities, while grant funding is non-repayable and affects revenue recognition and compliance requirements. Accurate differentiation ensures proper accounting treatment, maximizes financial benefits, and maintains regulatory compliance. This knowledge assists in strategic financial planning and reporting for businesses leveraging renewable energy projects or public funding. Misclassification can lead to misstated financials and potential legal issues.

Comparison Table

| Aspect | Tax Equity Financing | Grant Funding |

|---|---|---|

| Definition | Investment leveraging tax credits to finance projects. | Non-repayable funds provided by government or organizations. |

| Purpose | To reduce tax liability and raise capital. | To support projects without equity dilution or repayment. |

| Repayment | No direct repayment, benefits come via tax credits. | No repayment required. |

| Ownership Impact | Equity investor gains partial ownership/control. | No ownership or control transferred. |

| Application Process | Complex, requires tax credit eligibility and compliance. | Often competitive; application tied to project criteria. |

| Financial Benefit | Tax credits reduce tax burden; potential ROI for investors. | Direct funding without financial return obligations. |

| Use Cases | Common in renewable energy and infrastructure projects. | Widely used in research, public programs, and nonprofits. |

| Risk | Dependent on tax credit realization and project success. | Minimal financial risk; often contingent on project compliance. |

Which is better?

Tax equity financing offers businesses a strategic advantage by leveraging tax credits and incentives, resulting in reduced tax liabilities and increased capital for renewable energy and infrastructure projects. Grant funding provides non-repayable financial support that can accelerate project deployment without the burden of debt but often involves stringent eligibility criteria and competitive application processes. Evaluating the optimal choice depends on factors such as project scale, funding timelines, tax appetite, and long-term financial goals.

Connection

Tax equity financing and grant funding both serve as critical financial strategies in accounting to support project development and operational costs. Tax equity financing involves investors providing capital in exchange for tax benefits such as production tax credits or investment tax credits, commonly used in renewable energy projects. Grant funding offers non-repayable financial assistance from government agencies or institutions, complementing tax equity by reducing upfront capital requirements and enhancing overall project feasibility.

Key Terms

Non-repayable funds (Grant Funding)

Grant funding offers non-repayable funds provided by government agencies or organizations to support renewable energy projects, reducing upfront capital costs without increasing debt obligations. Unlike tax equity financing, grants do not require repayment or equity ownership, making them a highly attractive option for developers seeking risk-free capital. Explore how grant funding can optimize your project's financial structure and accelerate development timelines.

Tax credits (Tax Equity Financing)

Tax equity financing leverages tax credits such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC) to attract investors who can offset their tax liabilities, providing crucial capital for renewable energy projects. This method differs from grant funding by offering a direct tax benefit rather than a lump sum, aligning investor returns with project performance and incentivizing long-term commitment. Explore how tax credits in tax equity financing can maximize project value and drive sustainable investment growth.

Investor returns (Tax Equity Financing)

Tax equity financing offers investors substantial returns through tax credits such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), which reduce their tax liability and enhance overall profitability. Unlike grant funding, which provides non-repayable capital with no direct financial returns, tax equity structures align investor incentives with project performance, generating steady cash flows and tax benefits over the project's lifespan. Explore detailed comparisons to understand how tax equity financing can maximize your investment returns.

Source and External Links

Grants | U.S. Small Business Administration - SBA provides grants primarily to nonprofits, Resource Partners, and educational organizations to support entrepreneurship, scientific research, manufacturing, and exporting, but not for starting or expanding a business.

Grants - The Administration for Children and Families - ACF offers federal grants and cooperative agreements to support the economic and social well-being of children, families, and communities, with resources to help applicants in registration, application, and grant management.

Home Page | Grants & Funding - The NIH provides funding programs for research careers, detailed grant policies, and compliance requirements guiding the use and administration of NIH grants.

dowidth.com

dowidth.com