ESG assurance focuses on validating environmental, social, and governance disclosures to enhance transparency and stakeholder trust, while compliance audits concentrate on adherence to laws, regulations, and internal policies. Both processes are essential for corporate accountability but differ in scope, with ESG assurance increasingly driving sustainable business practices and risk management. Explore how integrating ESG assurance can transform traditional compliance audits and elevate organizational performance.

Why it is important

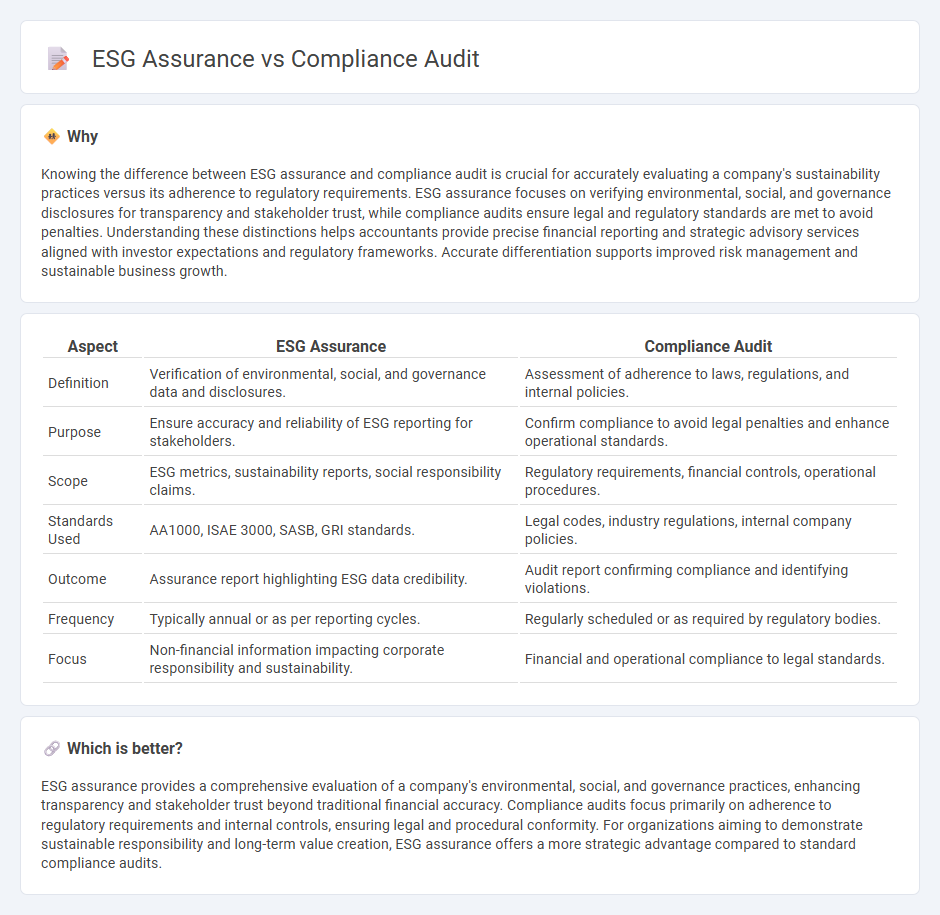

Knowing the difference between ESG assurance and compliance audit is crucial for accurately evaluating a company's sustainability practices versus its adherence to regulatory requirements. ESG assurance focuses on verifying environmental, social, and governance disclosures for transparency and stakeholder trust, while compliance audits ensure legal and regulatory standards are met to avoid penalties. Understanding these distinctions helps accountants provide precise financial reporting and strategic advisory services aligned with investor expectations and regulatory frameworks. Accurate differentiation supports improved risk management and sustainable business growth.

Comparison Table

| Aspect | ESG Assurance | Compliance Audit |

|---|---|---|

| Definition | Verification of environmental, social, and governance data and disclosures. | Assessment of adherence to laws, regulations, and internal policies. |

| Purpose | Ensure accuracy and reliability of ESG reporting for stakeholders. | Confirm compliance to avoid legal penalties and enhance operational standards. |

| Scope | ESG metrics, sustainability reports, social responsibility claims. | Regulatory requirements, financial controls, operational procedures. |

| Standards Used | AA1000, ISAE 3000, SASB, GRI standards. | Legal codes, industry regulations, internal company policies. |

| Outcome | Assurance report highlighting ESG data credibility. | Audit report confirming compliance and identifying violations. |

| Frequency | Typically annual or as per reporting cycles. | Regularly scheduled or as required by regulatory bodies. |

| Focus | Non-financial information impacting corporate responsibility and sustainability. | Financial and operational compliance to legal standards. |

Which is better?

ESG assurance provides a comprehensive evaluation of a company's environmental, social, and governance practices, enhancing transparency and stakeholder trust beyond traditional financial accuracy. Compliance audits focus primarily on adherence to regulatory requirements and internal controls, ensuring legal and procedural conformity. For organizations aiming to demonstrate sustainable responsibility and long-term value creation, ESG assurance offers a more strategic advantage compared to standard compliance audits.

Connection

ESG assurance and compliance audits are connected through their shared goal of verifying organizational adherence to regulatory standards and ethical practices. ESG assurance specifically evaluates environmental, social, and governance factors to ensure transparent and sustainable business operations, while compliance audits focus on conformity with legal and financial regulations. Together, they enhance accountability and risk management by providing stakeholders with reliable verification of a company's overall compliance and sustainability performance.

Key Terms

Compliance audit:

Compliance audits evaluate an organization's adherence to regulatory requirements, internal policies, and industry standards to ensure legal and operational conformity. ESG assurance, by contrast, verifies environmental, social, and governance disclosures for accuracy, transparency, and alignment with sustainability goals. Explore more to understand how compliance audits safeguard risk management and legal accountability in corporate governance.

Regulatory requirements

Compliance audits primarily evaluate adherence to established regulatory requirements, ensuring organizations meet legal standards and avoid penalties. ESG assurance emphasizes verifying environmental, social, and governance data to build stakeholder trust and support sustainable business practices. Explore how aligning these processes enhances both regulatory compliance and ESG transparency.

Internal controls

Compliance audits primarily assess the effectiveness of internal controls in adhering to regulatory requirements and organizational policies, ensuring risk mitigation and accurate financial reporting. ESG assurance evaluates the reliability and accuracy of environmental, social, and governance disclosures, emphasizing the robustness of internal controls related to sustainability data collection and reporting. Explore how integrating these audits can strengthen overall governance and data integrity in your organization.

Source and External Links

Compliance Audit: A Comprehensive Guide - This guide outlines the process of conducting a compliance audit, including planning, execution, and follow-up steps to ensure organizational adherence to regulations.

Compliance Audit: Definition, Types, and What to Expect - This article defines compliance audits as formal evaluations of an organization's adherence to regulatory frameworks and provides insights into the audit process.

Compliance Audit Definition - A compliance audit is a comprehensive review of an organization's adherence to regulatory guidelines, assessing the strength of compliance preparations and risk management procedures.

dowidth.com

dowidth.com