Digital twin accounting leverages real-time digital replicas of financial processes to enhance accuracy and predictive analysis, optimizing resource management and operational efficiency. Sustainability accounting focuses on measuring environmental, social, and governance (ESG) impacts, integrating non-financial metrics to support responsible business practices and long-term value creation. Explore how these accounting innovations transform financial reporting and strategic decision-making.

Why it is important

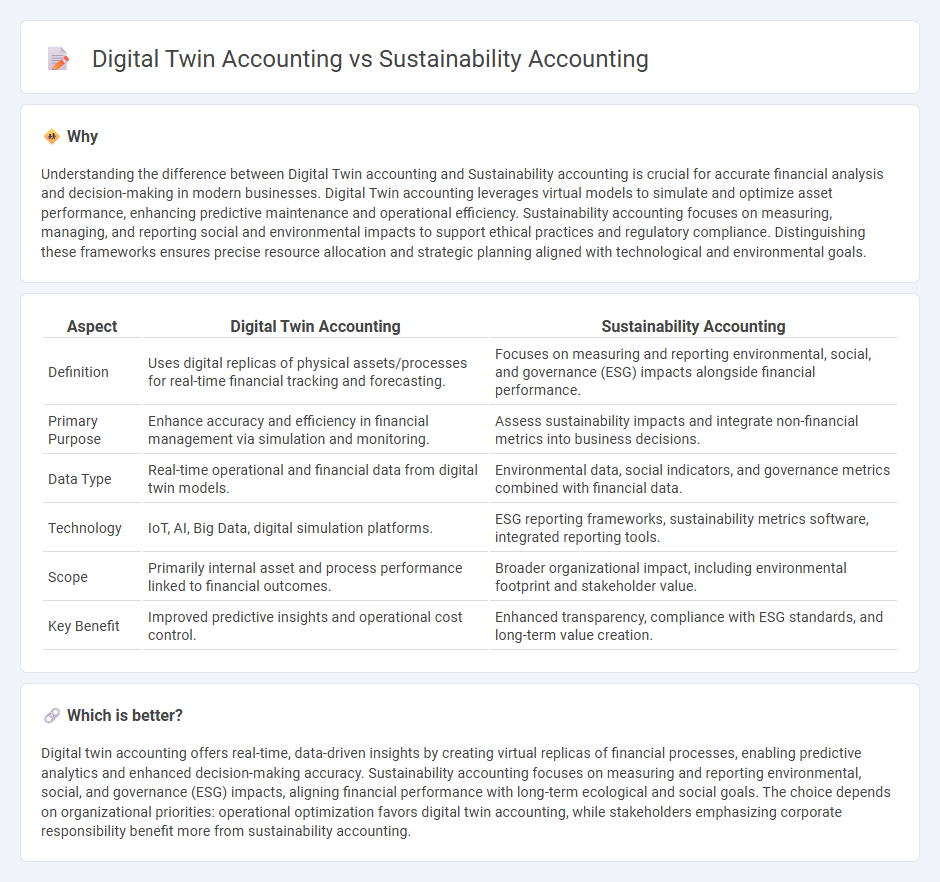

Understanding the difference between Digital Twin accounting and Sustainability accounting is crucial for accurate financial analysis and decision-making in modern businesses. Digital Twin accounting leverages virtual models to simulate and optimize asset performance, enhancing predictive maintenance and operational efficiency. Sustainability accounting focuses on measuring, managing, and reporting social and environmental impacts to support ethical practices and regulatory compliance. Distinguishing these frameworks ensures precise resource allocation and strategic planning aligned with technological and environmental goals.

Comparison Table

| Aspect | Digital Twin Accounting | Sustainability Accounting |

|---|---|---|

| Definition | Uses digital replicas of physical assets/processes for real-time financial tracking and forecasting. | Focuses on measuring and reporting environmental, social, and governance (ESG) impacts alongside financial performance. |

| Primary Purpose | Enhance accuracy and efficiency in financial management via simulation and monitoring. | Assess sustainability impacts and integrate non-financial metrics into business decisions. |

| Data Type | Real-time operational and financial data from digital twin models. | Environmental data, social indicators, and governance metrics combined with financial data. |

| Technology | IoT, AI, Big Data, digital simulation platforms. | ESG reporting frameworks, sustainability metrics software, integrated reporting tools. |

| Scope | Primarily internal asset and process performance linked to financial outcomes. | Broader organizational impact, including environmental footprint and stakeholder value. |

| Key Benefit | Improved predictive insights and operational cost control. | Enhanced transparency, compliance with ESG standards, and long-term value creation. |

Which is better?

Digital twin accounting offers real-time, data-driven insights by creating virtual replicas of financial processes, enabling predictive analytics and enhanced decision-making accuracy. Sustainability accounting focuses on measuring and reporting environmental, social, and governance (ESG) impacts, aligning financial performance with long-term ecological and social goals. The choice depends on organizational priorities: operational optimization favors digital twin accounting, while stakeholders emphasizing corporate responsibility benefit more from sustainability accounting.

Connection

Digital twin accounting leverages virtual models of financial processes to enhance real-time data accuracy and predictive analytics, which supports sustainability accounting by enabling precise measurement of environmental impacts and resource usage. Sustainability accounting focuses on tracking and reporting non-financial metrics such as carbon emissions, waste reduction, and energy consumption that are integrated into digital twins for comprehensive financial and ecological insights. The synergy between these frameworks enhances transparency, facilitates regulatory compliance, and drives informed decision-making toward sustainable business practices.

Key Terms

**Sustainability accounting:**

Sustainability accounting systematically measures and reports an organization's environmental, social, and governance (ESG) impacts, providing transparent data to stakeholders for informed decision-making. It integrates financial performance with sustainability metrics such as carbon emissions, energy efficiency, and resource consumption, enabling companies to track progress toward sustainability goals. Explore how sustainability accounting drives responsible business practices and regulatory compliance for more insights.

Environmental, Social, and Governance (ESG)

Sustainability accounting emphasizes tracking and reporting on Environmental, Social, and Governance (ESG) metrics to measure a company's impact and compliance with sustainable practices. Digital twin accounting integrates ESG data with real-time digital replicas of physical assets, enabling dynamic simulation and predictive analytics for improved decision-making. Discover how combining these approaches enhances transparency and drives more effective ESG strategies.

Triple Bottom Line

Sustainability accounting emphasizes measuring environmental, social, and economic impacts aligned with the Triple Bottom Line framework to drive responsible business practices. Digital twin accounting leverages real-time data simulation and virtual models to enhance precision in tracking these sustainability metrics across operations. Explore how integrating these approaches can optimize your organization's sustainability performance.

Source and External Links

Sustainability accounting - Sustainability accounting, also known as social accounting or non-financial reporting, focuses on disclosing a firm's social, environmental, and economic impacts to external stakeholders and is linked to the triple bottom line of People, Planet, Profit with guidelines like the Global Reporting Initiative ensuring consistency.

Sustainability accounting: Using accounting to better society - Sustainability accounting, or ESG accounting, involves measuring and reporting companies' environmental, social, and governance impacts, helping organizations set and reach sustainability goals and ensuring accountability to investors and the public.

Sustainable Accounting: Measuring Environmental and Social Impact - Sustainable accounting quantifies and reports an organization's environmental, social, and economic impacts using standards like those from the Sustainability Accounting Standards Board (SASB) and complements traditional financial reporting for better sustainability management.

dowidth.com

dowidth.com