Real-time expense recognition records costs immediately as they occur, providing up-to-date financial insights and enhancing accuracy in financial reporting. In contrast, amortization spreads an expense over a specific period to match the asset's useful life, aligning costs with revenues generated. Discover more about how these accounting methods impact your financial strategy and compliance.

Why it is important

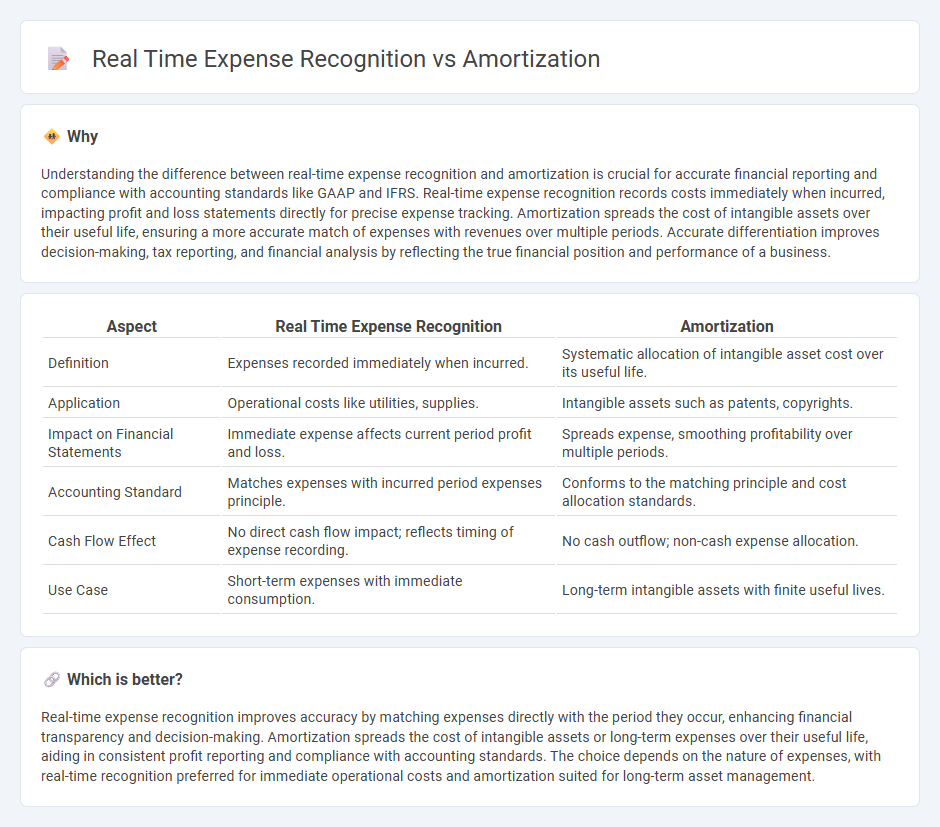

Understanding the difference between real-time expense recognition and amortization is crucial for accurate financial reporting and compliance with accounting standards like GAAP and IFRS. Real-time expense recognition records costs immediately when incurred, impacting profit and loss statements directly for precise expense tracking. Amortization spreads the cost of intangible assets over their useful life, ensuring a more accurate match of expenses with revenues over multiple periods. Accurate differentiation improves decision-making, tax reporting, and financial analysis by reflecting the true financial position and performance of a business.

Comparison Table

| Aspect | Real Time Expense Recognition | Amortization |

|---|---|---|

| Definition | Expenses recorded immediately when incurred. | Systematic allocation of intangible asset cost over its useful life. |

| Application | Operational costs like utilities, supplies. | Intangible assets such as patents, copyrights. |

| Impact on Financial Statements | Immediate expense affects current period profit and loss. | Spreads expense, smoothing profitability over multiple periods. |

| Accounting Standard | Matches expenses with incurred period expenses principle. | Conforms to the matching principle and cost allocation standards. |

| Cash Flow Effect | No direct cash flow impact; reflects timing of expense recording. | No cash outflow; non-cash expense allocation. |

| Use Case | Short-term expenses with immediate consumption. | Long-term intangible assets with finite useful lives. |

Which is better?

Real-time expense recognition improves accuracy by matching expenses directly with the period they occur, enhancing financial transparency and decision-making. Amortization spreads the cost of intangible assets or long-term expenses over their useful life, aiding in consistent profit reporting and compliance with accounting standards. The choice depends on the nature of expenses, with real-time recognition preferred for immediate operational costs and amortization suited for long-term asset management.

Connection

Real-time expense recognition enhances financial accuracy by immediately recording costs as they occur, ensuring current expense tracking. Amortization systematically allocates the cost of intangible assets over their useful life, aligning expenses with revenue generation periods. Together, these processes optimize financial reporting by accurately matching time-specific expenses with corresponding revenues for improved fiscal transparency.

Key Terms

Depreciation

Depreciation represents the systematic allocation of an asset's cost over its useful life, reflecting amortization's scheduled expense recognition approach. In contrast, real-time expense recognition records depreciation immediately based on actual asset usage or changes, offering more precise financial reporting. Discover how differentiating these methods impacts asset valuation and tax strategies.

Accrual Basis

Amortization systematically allocates intangible asset costs over their useful life, aligning expenses with revenue generation under the accrual basis of accounting. Real-time expense recognition records costs immediately when incurred, which may cause fluctuations in financial statements without matching expenses to related revenues. Explore deeper insights into accrual accounting principles and their impact on financial reporting.

Capitalization

Amortization spreads the cost of an intangible asset over its useful life, capitalizing the expense to reflect long-term value rather than immediate expenditure. Real-time expense recognition records costs as they are incurred, impacting short-term profitability without deferring the expense to future periods. Explore how capitalization strategies influence financial reporting and asset valuation in greater detail.

Source and External Links

Amortization in accounting 101 - Thomson Reuters tax - Amortization in accounting is the gradual write-down of the cost of an intangible asset over its expected useful life, typically calculated by dividing the asset's initial cost by its useful years to allocate expense annually.

What is amortization and why is it important? - Banco Santander - Amortization means the reduction in value of an asset over time or the gradual repayment of a loan principal, distinct from interest, by spreading payments over the agreement period.

amortization | Wex | US Law | LII / Legal Information Institute - Amortization refers to both the process of spreading loan payments over time so the debt is paid off fully and the accounting practice of systematically expensing the cost of intangible assets to match revenues generated.

dowidth.com

dowidth.com