Embedded finance reporting integrates financial data within operational platforms, enabling real-time insights and streamlined workflows tailored for business decision-making. Tax reporting focuses on compliance and accuracy in filing tax returns, adhering to regulatory standards and deadlines set by tax authorities. Discover how both reporting methods enhance financial transparency and efficiency in their unique ways.

Why it is important

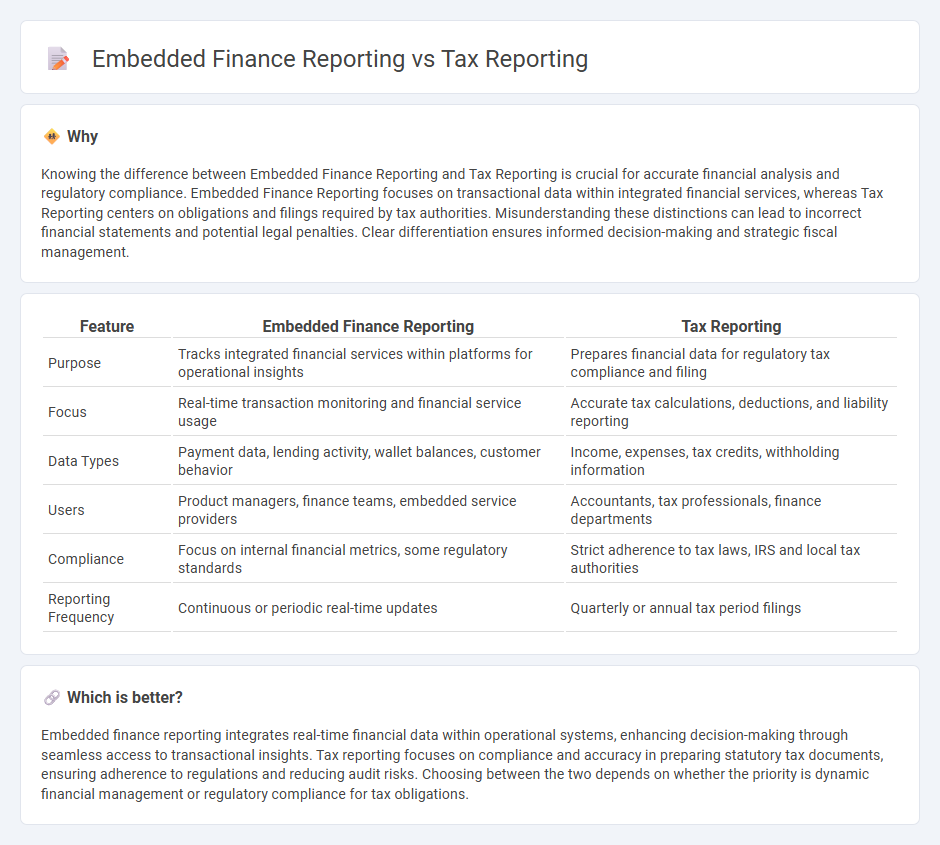

Knowing the difference between Embedded Finance Reporting and Tax Reporting is crucial for accurate financial analysis and regulatory compliance. Embedded Finance Reporting focuses on transactional data within integrated financial services, whereas Tax Reporting centers on obligations and filings required by tax authorities. Misunderstanding these distinctions can lead to incorrect financial statements and potential legal penalties. Clear differentiation ensures informed decision-making and strategic fiscal management.

Comparison Table

| Feature | Embedded Finance Reporting | Tax Reporting |

|---|---|---|

| Purpose | Tracks integrated financial services within platforms for operational insights | Prepares financial data for regulatory tax compliance and filing |

| Focus | Real-time transaction monitoring and financial service usage | Accurate tax calculations, deductions, and liability reporting |

| Data Types | Payment data, lending activity, wallet balances, customer behavior | Income, expenses, tax credits, withholding information |

| Users | Product managers, finance teams, embedded service providers | Accountants, tax professionals, finance departments |

| Compliance | Focus on internal financial metrics, some regulatory standards | Strict adherence to tax laws, IRS and local tax authorities |

| Reporting Frequency | Continuous or periodic real-time updates | Quarterly or annual tax period filings |

Which is better?

Embedded finance reporting integrates real-time financial data within operational systems, enhancing decision-making through seamless access to transactional insights. Tax reporting focuses on compliance and accuracy in preparing statutory tax documents, ensuring adherence to regulations and reducing audit risks. Choosing between the two depends on whether the priority is dynamic financial management or regulatory compliance for tax obligations.

Connection

Embedded finance reporting integrates financial services directly into business platforms, enabling real-time transaction tracking and automated data capture, which enhances the accuracy of tax reporting. Accurate tax reporting relies on comprehensive financial records generated through embedded finance systems, reducing errors and ensuring compliance with regulatory requirements. This seamless connection streamlines accounting processes by consolidating financial and tax data, facilitating efficient audits and reporting deadlines.

Key Terms

**Tax reporting:**

Tax reporting involves the systematic collection and submission of financial data related to income, expenses, and tax liabilities to regulatory authorities, ensuring compliance with local, national, and international tax laws. Accurate tax reporting requires integration with accounting systems to automate calculations, manage deductions, and generate audit-ready documents, minimizing errors and penalties. Discover how optimized tax reporting solutions can streamline your financial compliance and reduce operational risks.

Taxable Income

Tax reporting centers on accurately calculating and documenting taxable income to comply with government regulations and optimize tax liabilities. Embedded finance reporting integrates financial services within non-financial platforms, requiring tailored approaches to recognize revenue and expenses related to taxable income from embedded transactions. Explore the differences in detail to understand how each impacts financial strategy and compliance.

Deductions

Tax reporting emphasizes accurate deduction documentation to ensure compliance with IRS regulations, maximizing eligible expense claims that reduce taxable income. Embedded finance reporting integrates deduction tracking directly into financial platforms, enabling real-time visibility and streamlined reconciliation of transaction-related deductions. Explore how combining these approaches enhances financial accuracy and efficiency.

Source and External Links

Administering Tax Reporting - Oracle Help Center - Tax Reporting is a comprehensive global tax provision solution for multinational companies, covering tax automation, provision calculation, reporting, and analysis according to GAAP or IFRS standards.

Tax information reporting - Wikipedia - In the U.S., tax information reporting requires organizations to report wage and non-wage payments, with federal and state filings, deadlines, and penalties to enforce compliance.

File federal taxes | USAGov - This resource helps individuals and noncitizens determine filing obligations, how to file federal tax returns, verify receipt, and obtain identification numbers for tax filing.

dowidth.com

dowidth.com