Predictive close leverages real-time data analytics to forecast financial outcomes, enabling more accurate and timely decision-making compared to traditional quarterly close processes that aggregate past transaction data for reporting. This approach reduces closing cycles, enhances forecasting accuracy, and improves resource allocation. Explore how integrating predictive close can transform your accounting strategy and efficiency.

Why it is important

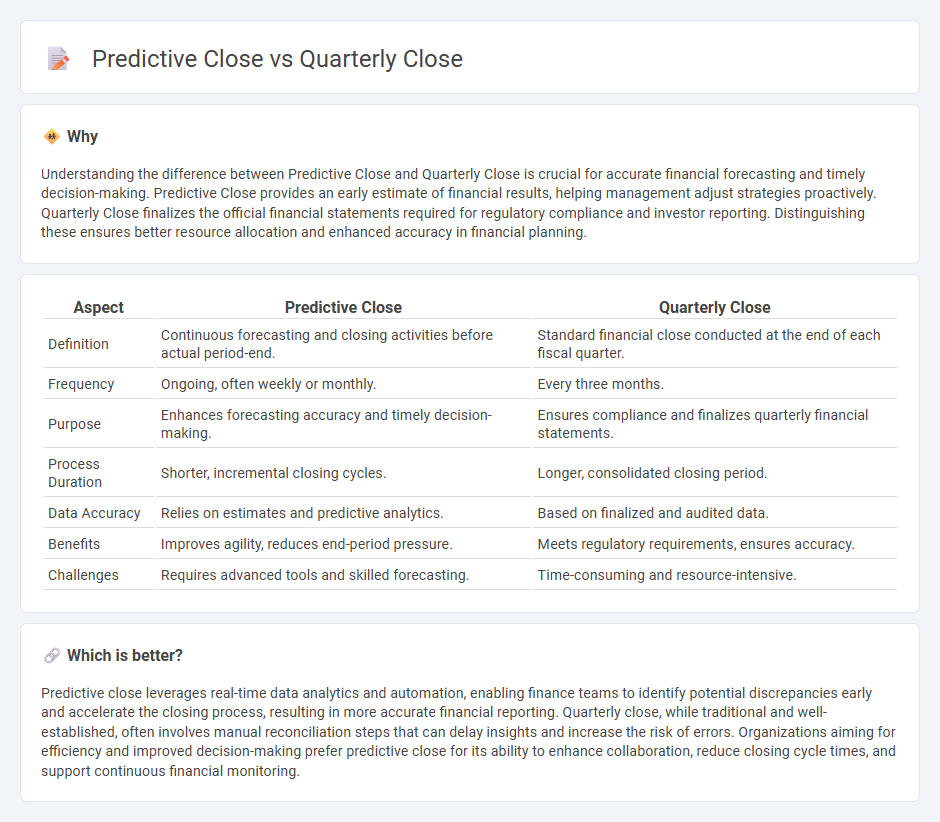

Understanding the difference between Predictive Close and Quarterly Close is crucial for accurate financial forecasting and timely decision-making. Predictive Close provides an early estimate of financial results, helping management adjust strategies proactively. Quarterly Close finalizes the official financial statements required for regulatory compliance and investor reporting. Distinguishing these ensures better resource allocation and enhanced accuracy in financial planning.

Comparison Table

| Aspect | Predictive Close | Quarterly Close |

|---|---|---|

| Definition | Continuous forecasting and closing activities before actual period-end. | Standard financial close conducted at the end of each fiscal quarter. |

| Frequency | Ongoing, often weekly or monthly. | Every three months. |

| Purpose | Enhances forecasting accuracy and timely decision-making. | Ensures compliance and finalizes quarterly financial statements. |

| Process Duration | Shorter, incremental closing cycles. | Longer, consolidated closing period. |

| Data Accuracy | Relies on estimates and predictive analytics. | Based on finalized and audited data. |

| Benefits | Improves agility, reduces end-period pressure. | Meets regulatory requirements, ensures accuracy. |

| Challenges | Requires advanced tools and skilled forecasting. | Time-consuming and resource-intensive. |

Which is better?

Predictive close leverages real-time data analytics and automation, enabling finance teams to identify potential discrepancies early and accelerate the closing process, resulting in more accurate financial reporting. Quarterly close, while traditional and well-established, often involves manual reconciliation steps that can delay insights and increase the risk of errors. Organizations aiming for efficiency and improved decision-making prefer predictive close for its ability to enhance collaboration, reduce closing cycle times, and support continuous financial monitoring.

Connection

Predictive close enhances the Quarterly close process by utilizing historical financial data and advanced analytics to forecast potential issues and streamline reconciliation tasks, reducing closing time and improving accuracy. Integrating predictive close techniques into Quarterly close workflows supports proactive decision-making and timely financial reporting within regulatory deadlines. Companies adopting predictive close report faster cycle times and increased confidence in quarterly earnings disclosures.

Key Terms

Financial Statements

Quarterly close involves the systematic process of finalizing financial statements at the end of a fiscal quarter to ensure accurate reporting of revenue, expenses, and net income. Predictive close leverages advanced analytics and machine learning models to forecast financial outcomes before the actual close, enhancing decision-making and risk management. Explore how integrating predictive close can revolutionize your financial statement accuracy and timeliness.

Accruals

Quarterly close processes rely heavily on accurate accruals to ensure financial statements reflect true expenses and revenues for the period, minimizing adjustments after the close. Predictive close leverages real-time data and advanced analytics to estimate accruals dynamically, significantly reducing the time and effort needed to finalize financials. Explore how integrating predictive close techniques can transform your accrual management and streamline financial reporting.

Forecasting

Quarterly close processes rely heavily on historical data to finalize financial results, often causing delays in identifying future trends. Predictive close leverages real-time analytics and AI to forecast outcomes, enabling proactive decision-making and improved accuracy in financial forecasting. Explore how predictive close transforms forecasting accuracy and accelerates financial insights.

Source and External Links

Quarter Close - The process of completing accounting activities, recording all transactions, reconciling accounts, and finalizing financial statements at the end of each fiscal quarter to provide an accurate summary for reporting and decision-making purposes.

How to Shorten Your Monthly or Quarterly Financial Close ... - Companies perform 'hard closes' quarterly (or more often) to reconcile balance sheets and lock the period, producing financial statements essential for audits, reporting, and internal decisions.

What is the Financial Close Process? | F&A Glossary - Financial close involves reviewing and recording all transactions, reconciling accounts, preparing adjusting entries, and finalizing financial statements as the last step before closing the books each fiscal period, including quarterly.

dowidth.com

dowidth.com