Continuous assurance uses automated, real-time data analysis to monitor financial transactions and controls, enhancing transparency and reducing risks throughout the fiscal period. External audits provide an independent, comprehensive evaluation of financial statements at a specific point in time, ensuring compliance with accounting standards and regulatory requirements. Explore the key differences and benefits of continuous assurance and external audits to optimize your organization's financial oversight.

Why it is important

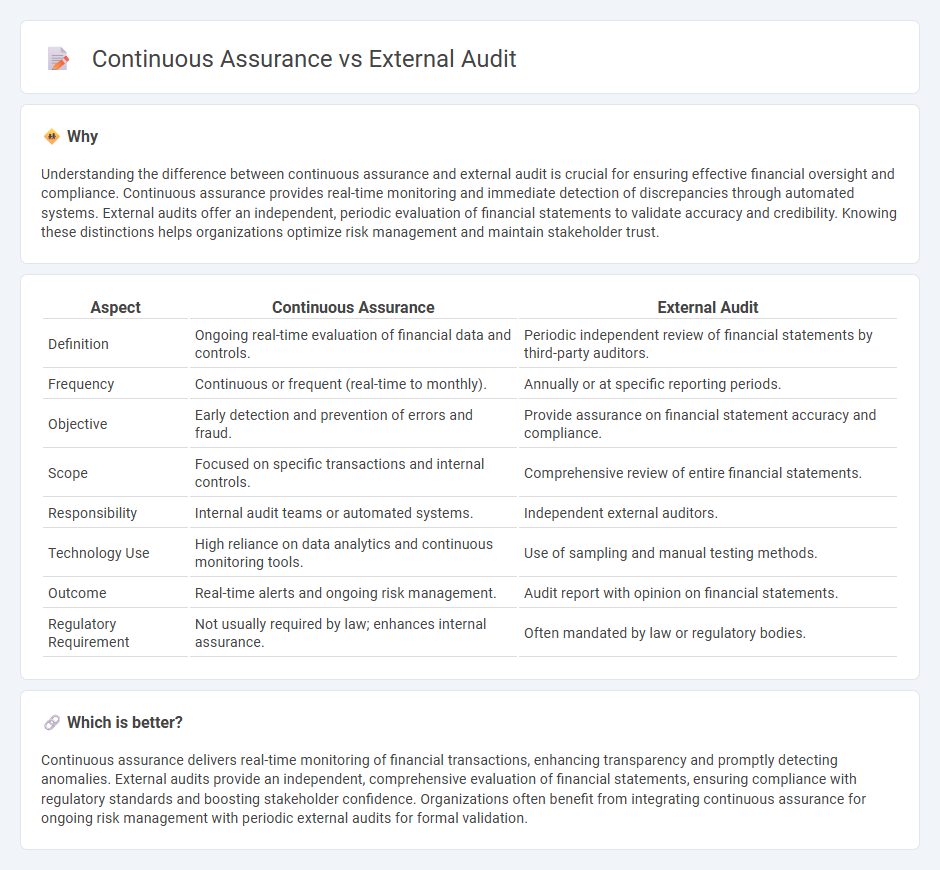

Understanding the difference between continuous assurance and external audit is crucial for ensuring effective financial oversight and compliance. Continuous assurance provides real-time monitoring and immediate detection of discrepancies through automated systems. External audits offer an independent, periodic evaluation of financial statements to validate accuracy and credibility. Knowing these distinctions helps organizations optimize risk management and maintain stakeholder trust.

Comparison Table

| Aspect | Continuous Assurance | External Audit |

|---|---|---|

| Definition | Ongoing real-time evaluation of financial data and controls. | Periodic independent review of financial statements by third-party auditors. |

| Frequency | Continuous or frequent (real-time to monthly). | Annually or at specific reporting periods. |

| Objective | Early detection and prevention of errors and fraud. | Provide assurance on financial statement accuracy and compliance. |

| Scope | Focused on specific transactions and internal controls. | Comprehensive review of entire financial statements. |

| Responsibility | Internal audit teams or automated systems. | Independent external auditors. |

| Technology Use | High reliance on data analytics and continuous monitoring tools. | Use of sampling and manual testing methods. |

| Outcome | Real-time alerts and ongoing risk management. | Audit report with opinion on financial statements. |

| Regulatory Requirement | Not usually required by law; enhances internal assurance. | Often mandated by law or regulatory bodies. |

Which is better?

Continuous assurance delivers real-time monitoring of financial transactions, enhancing transparency and promptly detecting anomalies. External audits provide an independent, comprehensive evaluation of financial statements, ensuring compliance with regulatory standards and boosting stakeholder confidence. Organizations often benefit from integrating continuous assurance for ongoing risk management with periodic external audits for formal validation.

Connection

Continuous assurance provides real-time monitoring and validation of financial data, enhancing the accuracy and reliability of information used by external auditors. External audits rely on continuous assurance reports to identify risks and verify compliance efficiently, reducing the likelihood of errors or fraud. Integration of continuous assurance with external audit processes leads to improved transparency and stronger corporate governance.

Key Terms

Independence

External audit emphasizes strict independence to provide unbiased financial statement verification by third-party auditors, ensuring stakeholder trust and compliance with regulatory standards. Continuous assurance integrates ongoing data monitoring and real-time controls, balancing independence with operational involvement to enhance timely risk detection and reporting accuracy. Explore how maintaining auditor independence affects the quality and reliability of assurance processes in both approaches.

Real-time monitoring

External audit traditionally offers periodic, retrospective assessments of financial statements, focusing on historical accuracy and compliance. Continuous assurance employs real-time monitoring techniques leveraging automated data analytics and AI to provide ongoing validation and risk detection throughout the fiscal year. Discover how real-time monitoring transforms assurance processes by enhancing transparency and immediacy in financial oversight.

Reporting frequency

External audits are typically conducted annually or semi-annually, providing a periodic assessment of financial statements to ensure compliance with regulatory standards. Continuous assurance, on the other hand, utilizes real-time data monitoring and automated controls to deliver ongoing verification of transactions and processes throughout the fiscal year. Explore the benefits of continuous assurance for enhancing reporting accuracy and timeliness.

Source and External Links

Understanding the Purpose and Benefits of External Audits - An external audit provides confidence to stakeholders by validating the accuracy of financial statements and evaluating internal controls, thereby enhancing decision-making and risk management.

External Audit vs. Internal Audit: What's the Difference? - External audits focus on verifying the accuracy of financial statements for stakeholders, such as shareholders and regulatory bodies, ensuring compliance and detecting fraud.

External Auditor - An external auditor conducts independent audits of an organization's financial statements according to specific laws or rules, providing unbiased reports to stakeholders like investors and government agencies.

dowidth.com

dowidth.com