Digital asset taxation involves the valuation and reporting of cryptocurrencies, NFTs, and other blockchain-based assets, focusing on capital gains and transactional records. Intellectual property taxation centers on the income generated from patents, copyrights, and trademarks, with emphasis on royalties, licensing fees, and amortization. Explore the differences in regulatory frameworks and tax implications to optimize your accounting strategies.

Why it is important

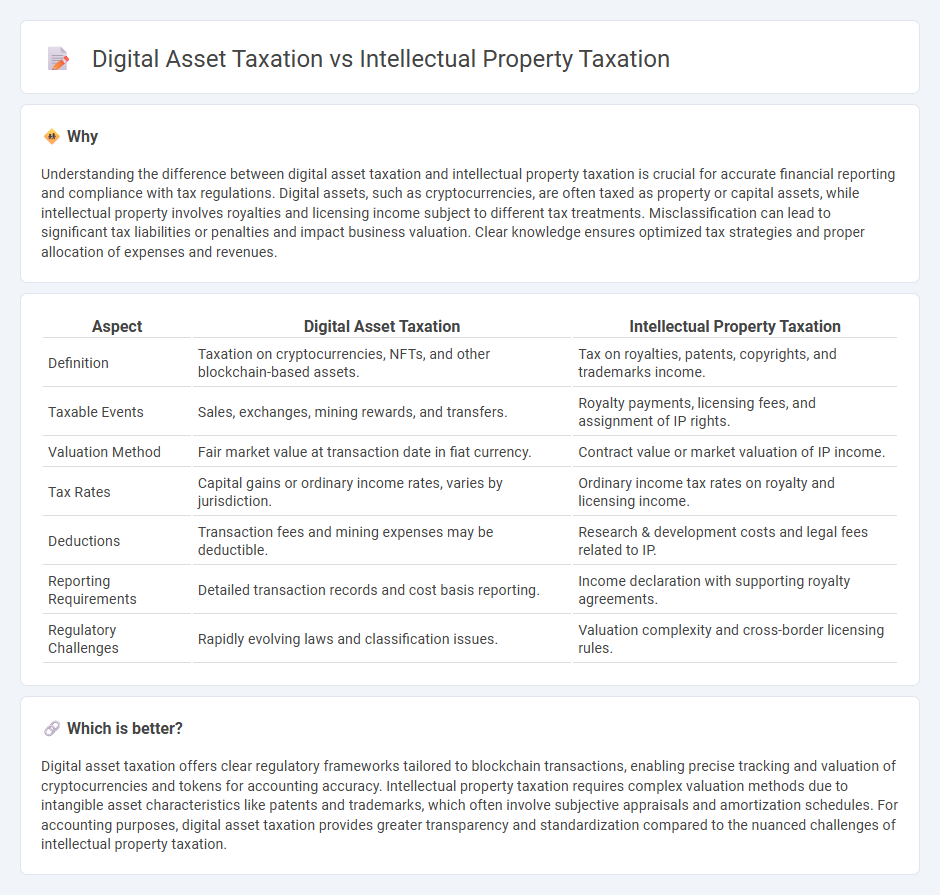

Understanding the difference between digital asset taxation and intellectual property taxation is crucial for accurate financial reporting and compliance with tax regulations. Digital assets, such as cryptocurrencies, are often taxed as property or capital assets, while intellectual property involves royalties and licensing income subject to different tax treatments. Misclassification can lead to significant tax liabilities or penalties and impact business valuation. Clear knowledge ensures optimized tax strategies and proper allocation of expenses and revenues.

Comparison Table

| Aspect | Digital Asset Taxation | Intellectual Property Taxation |

|---|---|---|

| Definition | Taxation on cryptocurrencies, NFTs, and other blockchain-based assets. | Tax on royalties, patents, copyrights, and trademarks income. |

| Taxable Events | Sales, exchanges, mining rewards, and transfers. | Royalty payments, licensing fees, and assignment of IP rights. |

| Valuation Method | Fair market value at transaction date in fiat currency. | Contract value or market valuation of IP income. |

| Tax Rates | Capital gains or ordinary income rates, varies by jurisdiction. | Ordinary income tax rates on royalty and licensing income. |

| Deductions | Transaction fees and mining expenses may be deductible. | Research & development costs and legal fees related to IP. |

| Reporting Requirements | Detailed transaction records and cost basis reporting. | Income declaration with supporting royalty agreements. |

| Regulatory Challenges | Rapidly evolving laws and classification issues. | Valuation complexity and cross-border licensing rules. |

Which is better?

Digital asset taxation offers clear regulatory frameworks tailored to blockchain transactions, enabling precise tracking and valuation of cryptocurrencies and tokens for accounting accuracy. Intellectual property taxation requires complex valuation methods due to intangible asset characteristics like patents and trademarks, which often involve subjective appraisals and amortization schedules. For accounting purposes, digital asset taxation provides greater transparency and standardization compared to the nuanced challenges of intellectual property taxation.

Connection

Digital asset taxation and intellectual property taxation intersect through the valuation and transfer of intangible assets, as both involve assessing the worth and tax implications of non-physical property rights. Tax authorities require detailed records of digital assets like cryptocurrencies and intellectual properties such as patents or copyrights to determine capital gains, royalty incomes, or licensing fees accurately. Understanding these connections ensures compliance with tax regulations and optimizes tax planning strategies related to the ownership and monetization of intangible assets.

Key Terms

Amortization

Intellectual property taxation often involves amortization of intangible assets such as patents, copyrights, and trademarks over their useful life, allowing businesses to deduct the asset's cost progressively. Digital asset taxation, particularly for cryptocurrencies and NFTs, generally lacks standardized amortization rules, resulting in immediate recognition of gains or losses upon transaction. Explore detailed comparisons of amortization practices in intellectual property and digital asset taxation to optimize your tax strategy.

Capital Gains

Capital gains taxation on intellectual property often involves complex valuation methods due to the intangible nature of patents, trademarks, or copyrights, impacting the taxable event upon sale or transfer. Digital asset taxation, particularly for cryptocurrencies and NFTs, requires tracking acquisition costs and fair market value at transaction times, with capital gains recognized on sales or exchanges. Explore detailed guidelines and strategies for navigating these evolving tax landscapes to optimize compliance and financial outcomes.

Fair Market Value

Intellectual property taxation and digital asset taxation both hinge on accurately determining Fair Market Value (FMV), a critical factor for tax compliance and reporting. Intellectual property FMV depends on factors such as licensing income, market comparables, and cost of development, while digital asset FMV is often influenced by market supply-demand dynamics, trading platforms, and volatility. Explore detailed methodologies and regulatory considerations to optimize taxation strategies for each asset type.

Source and External Links

Tax Implications of Intellectual Property Creation and Licensing - Intellectual property like patents, trademarks, and copyrights is considered a capital asset, with creation costs often capitalized and amortized or depreciated, and with losses recognized if the IP becomes impaired or obsolete.

An Introduction to the Tax Treatment of Intellectual Property - Under the Tax Cuts and Jobs Act, IP creation costs are not immediately deductible but instead capitalized into the asset's tax basis, affecting later deductions for depreciation or amortization and determining tax on sale.

The Taxation of IP in a Nutshell - Patents are commonly depreciated at 25% per year on a declining balance, with possible recapture of deductions upon sale, while copyrights may be held as capital or inventory depending on use, impacting tax treatment of income and gains.

dowidth.com

dowidth.com