Workflow automation streamlines repetitive accounting tasks such as invoice processing and expense approvals, increasing efficiency and reducing errors. Integrated financial management systems unify accounting, budgeting, and reporting functions, providing real-time visibility and data consistency across departments. Explore how these technologies can transform your accounting processes and improve financial decision-making.

Why it is important

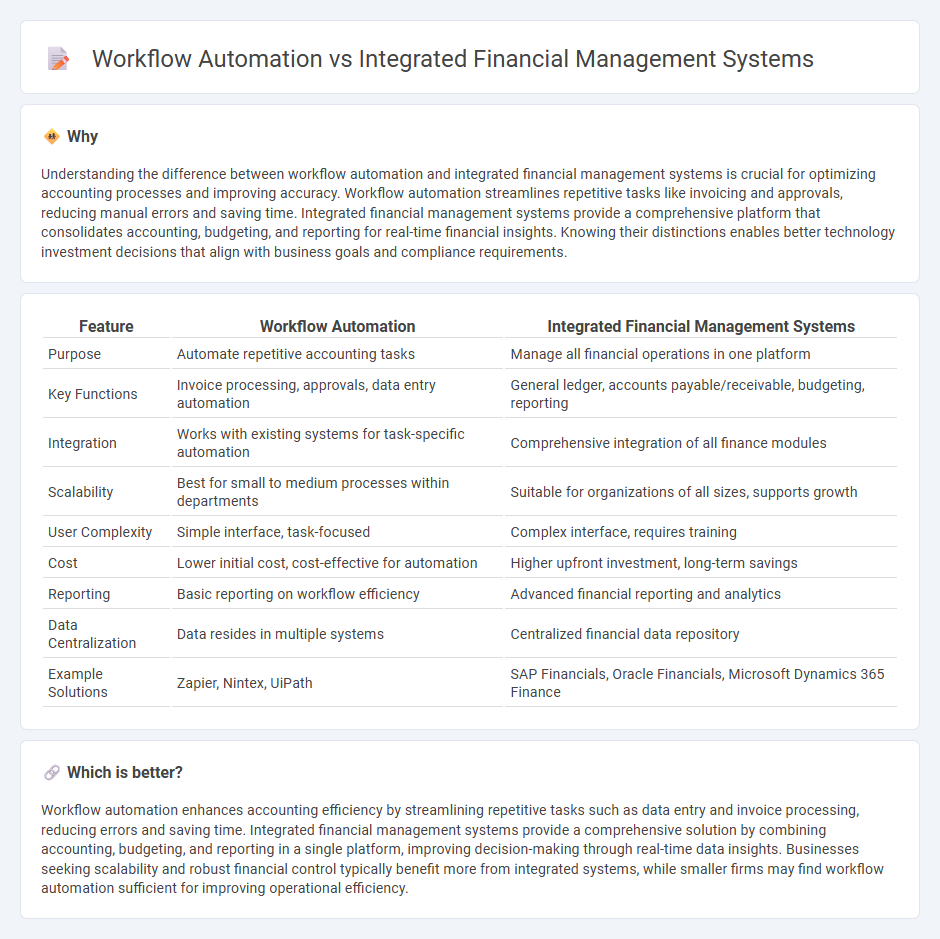

Understanding the difference between workflow automation and integrated financial management systems is crucial for optimizing accounting processes and improving accuracy. Workflow automation streamlines repetitive tasks like invoicing and approvals, reducing manual errors and saving time. Integrated financial management systems provide a comprehensive platform that consolidates accounting, budgeting, and reporting for real-time financial insights. Knowing their distinctions enables better technology investment decisions that align with business goals and compliance requirements.

Comparison Table

| Feature | Workflow Automation | Integrated Financial Management Systems |

|---|---|---|

| Purpose | Automate repetitive accounting tasks | Manage all financial operations in one platform |

| Key Functions | Invoice processing, approvals, data entry automation | General ledger, accounts payable/receivable, budgeting, reporting |

| Integration | Works with existing systems for task-specific automation | Comprehensive integration of all finance modules |

| Scalability | Best for small to medium processes within departments | Suitable for organizations of all sizes, supports growth |

| User Complexity | Simple interface, task-focused | Complex interface, requires training |

| Cost | Lower initial cost, cost-effective for automation | Higher upfront investment, long-term savings |

| Reporting | Basic reporting on workflow efficiency | Advanced financial reporting and analytics |

| Data Centralization | Data resides in multiple systems | Centralized financial data repository |

| Example Solutions | Zapier, Nintex, UiPath | SAP Financials, Oracle Financials, Microsoft Dynamics 365 Finance |

Which is better?

Workflow automation enhances accounting efficiency by streamlining repetitive tasks such as data entry and invoice processing, reducing errors and saving time. Integrated financial management systems provide a comprehensive solution by combining accounting, budgeting, and reporting in a single platform, improving decision-making through real-time data insights. Businesses seeking scalability and robust financial control typically benefit more from integrated systems, while smaller firms may find workflow automation sufficient for improving operational efficiency.

Connection

Workflow automation streamlines repetitive accounting tasks such as data entry, invoice processing, and reconciliations, reducing errors and increasing efficiency. Integrated financial management systems centralize financial data, enabling seamless data flow across modules like budgeting, payroll, and reporting. The connection between both lies in how workflow automation enhances the capabilities of integrated systems by ensuring real-time, accurate processing and improved financial visibility.

Key Terms

General Ledger

Integrated financial management systems consolidate General Ledger functions with budgeting, accounts payable, and reporting modules, ensuring real-time data accuracy and compliance. Workflow automation enhances these systems by streamlining approval processes, error reduction, and transaction validation within the General Ledger, boosting overall efficiency. Explore how combining both can optimize your financial operations and accuracy.

Process Mapping

Integrated financial management systems streamline accounting, budgeting, and reporting through centralized data, enhancing accuracy and reducing manual errors. Workflow automation focuses on process mapping to visualize, optimize, and automate repetitive tasks, improving operational efficiency and consistency. Explore how combining these technologies can transform your organization's financial processes and drive greater productivity.

Compliance

Integrated financial management systems centralize financial data and automate compliance reporting, ensuring adherence to accounting standards and regulatory requirements with real-time audit trails. Workflow automation streamlines compliance tasks by automating approval processes, notifications, and document management, reducing human error and enhancing accountability. Explore how both solutions can optimize compliance efforts for your organization.

Source and External Links

Integrated Financial Management Information Systems - These systems support public sector budgetary, financial, and accounting operations to enhance public financial management.

Integrated Financial Management System (IFMS) - This IT-based system manages budgeting, accounting, and financial reporting for government entities, promoting transparency and accountability.

Integrated Financial Services for Businesses - These services combine financial offerings into a single platform, integrating technologies like APIs and cloud computing.

The Implementation of Integrated Financial Management Systems - This report discusses the implementation of IFMIS as a core component of financial reforms to enhance efficiency and data security.

dowidth.com

dowidth.com