Dynamic discounting offers variable early payment discounts based on the timing of the invoice settlement, optimizing cash flow for both buyers and suppliers. Static discounting provides a fixed discount rate regardless of the payment date, simplifying accounting processes but potentially leaving savings on the table. Discover how leveraging dynamic versus static discounting strategies can transform your accounts payable efficiency.

Why it is important

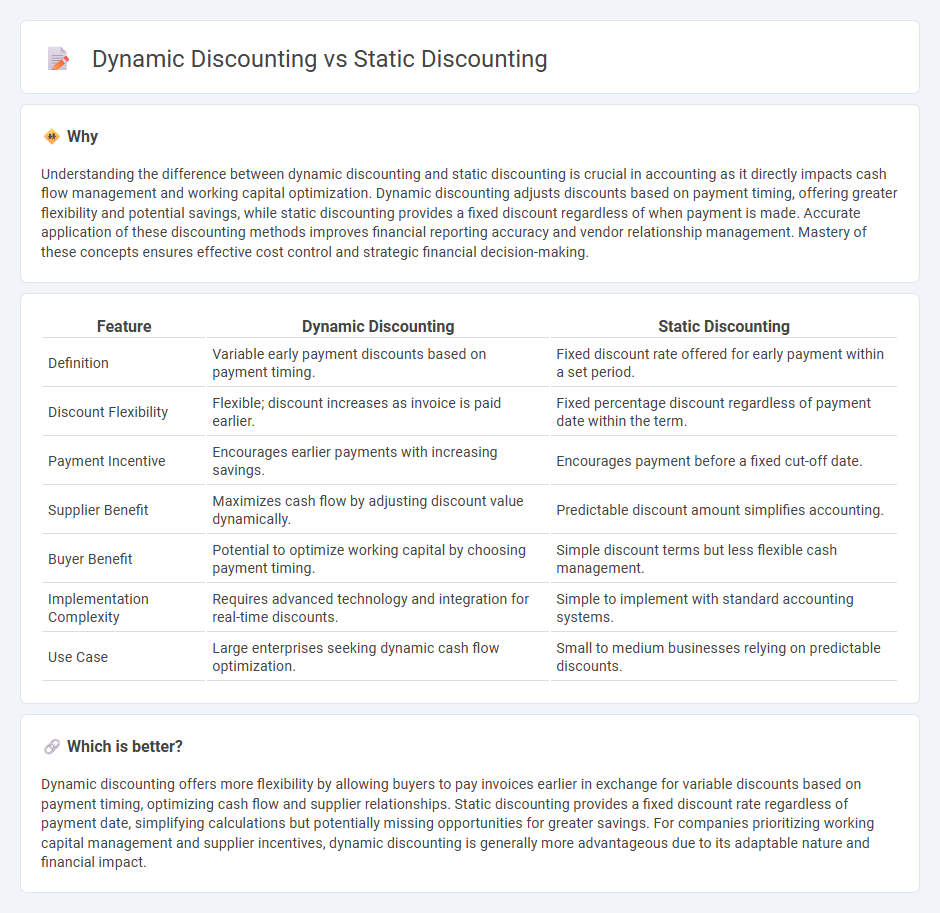

Understanding the difference between dynamic discounting and static discounting is crucial in accounting as it directly impacts cash flow management and working capital optimization. Dynamic discounting adjusts discounts based on payment timing, offering greater flexibility and potential savings, while static discounting provides a fixed discount regardless of when payment is made. Accurate application of these discounting methods improves financial reporting accuracy and vendor relationship management. Mastery of these concepts ensures effective cost control and strategic financial decision-making.

Comparison Table

| Feature | Dynamic Discounting | Static Discounting |

|---|---|---|

| Definition | Variable early payment discounts based on payment timing. | Fixed discount rate offered for early payment within a set period. |

| Discount Flexibility | Flexible; discount increases as invoice is paid earlier. | Fixed percentage discount regardless of payment date within the term. |

| Payment Incentive | Encourages earlier payments with increasing savings. | Encourages payment before a fixed cut-off date. |

| Supplier Benefit | Maximizes cash flow by adjusting discount value dynamically. | Predictable discount amount simplifies accounting. |

| Buyer Benefit | Potential to optimize working capital by choosing payment timing. | Simple discount terms but less flexible cash management. |

| Implementation Complexity | Requires advanced technology and integration for real-time discounts. | Simple to implement with standard accounting systems. |

| Use Case | Large enterprises seeking dynamic cash flow optimization. | Small to medium businesses relying on predictable discounts. |

Which is better?

Dynamic discounting offers more flexibility by allowing buyers to pay invoices earlier in exchange for variable discounts based on payment timing, optimizing cash flow and supplier relationships. Static discounting provides a fixed discount rate regardless of payment date, simplifying calculations but potentially missing opportunities for greater savings. For companies prioritizing working capital management and supplier incentives, dynamic discounting is generally more advantageous due to its adaptable nature and financial impact.

Connection

Dynamic discounting and static discounting both serve as early payment incentives in accounting, optimizing cash flow management by adjusting payment terms to benefit both buyers and suppliers. Dynamic discounting offers variable discounts that change based on the actual payment date, while static discounting provides a fixed discount rate regardless of when the payment occurs. Integrating these discounting methods enhances accounts payable strategies, improves supplier relationships, and maximizes working capital efficiency.

Key Terms

Net Present Value (NPV)

Static discounting applies a fixed discount rate to future cash flows, simplifying the calculation of Net Present Value (NPV) but potentially overlooking changes in market conditions. Dynamic discounting adjusts the discount rate over time based on factors such as risk, inflation, or interest rate fluctuations, offering a more accurate and reflective NPV estimation. Explore deeper insights into how dynamic discounting can enhance financial decision-making and investment analysis.

Cash Flow Timing

Static discounting uses a fixed discount rate to calculate the present value of future cash flows, assuming constant risk and market conditions over time. Dynamic discounting adjusts the discount rate based on real-time factors such as changes in market volatility, interest rates, and credit risk, providing a more accurate valuation that reflects shifting cash flow timing and risk profiles. Explore further to understand how dynamic discounting can optimize your cash flow management strategies.

Discount Rate

Static discounting applies a fixed discount rate throughout the evaluation period, ensuring consistency in present value calculations but potentially overlooking changes in market conditions or risk profiles. Dynamic discounting adjusts the discount rate over time based on evolving economic factors, risk assessments, or project-specific milestones, providing a more responsive and accurate valuation framework. Explore the advantages and applications of both methods to optimize your financial decision-making.

Source and External Links

What Is Dynamic Discounting? - Process, Benefits & Examples - Static discounting is a financial arrangement where buyers pay suppliers early to receive a fixed discount on the invoice, offering predictability and simplicity for buyers and improved cash flow for suppliers with a fixed discount rate that encourages early payment but may be restrictive due to cash flow constraints.

How do Static and Dynamic Discounts Differ in Terms of Benefits ... - Static discounts provide a set price reduction tied to payments made within a specific time frame, valued for their simplicity and predictability, though they lack flexibility to adapt to changing market conditions, which can lead to over-discounting and reduced profit margins.

If Static Discounting is Obsolete -- Why Do Companies Still Use It? - Static discounting often involves a fixed discount rate (like 2%) for early payment, but in many industries this discount is embedded into the product price, making it somewhat outdated and less relevant in today's financial environment, despite its long-standing use for simplicity and tradition.

dowidth.com

dowidth.com