Fractional CFO services provide strategic financial leadership, offering expertise in budgeting, forecasting, and financial planning without the cost of a full-time executive. Accounts payable management focuses on tracking and processing vendor invoices, optimizing cash flow, and preventing late payments to maintain strong supplier relationships. Discover how leveraging both can streamline your business operations and enhance financial health.

Why it is important

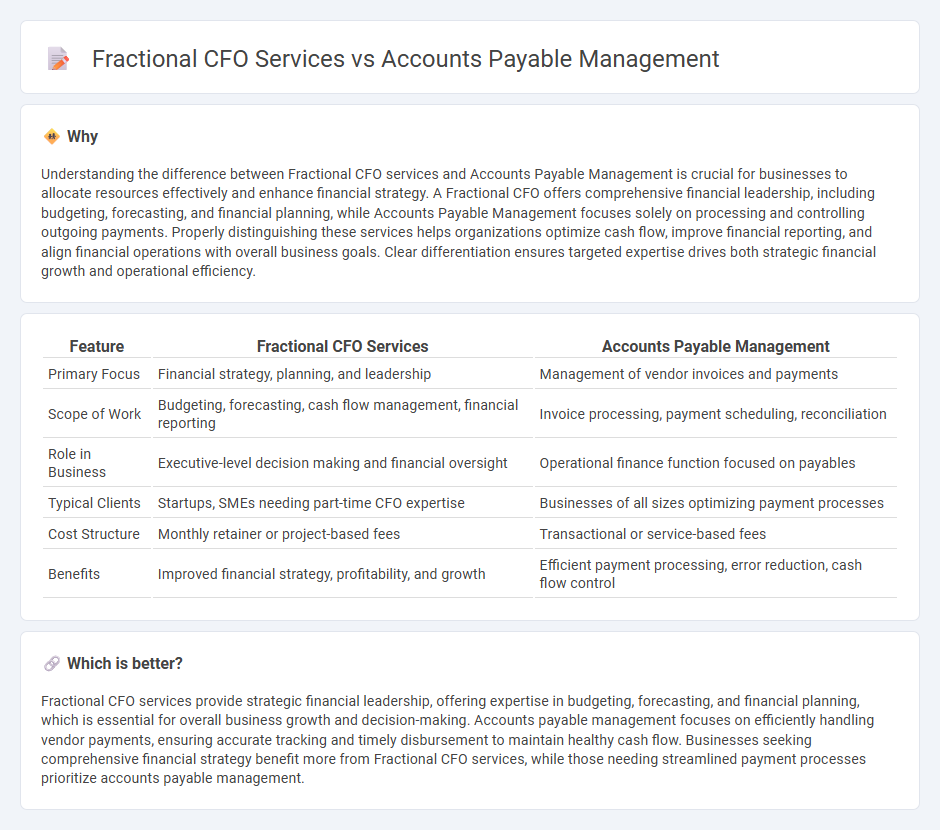

Understanding the difference between Fractional CFO services and Accounts Payable Management is crucial for businesses to allocate resources effectively and enhance financial strategy. A Fractional CFO offers comprehensive financial leadership, including budgeting, forecasting, and financial planning, while Accounts Payable Management focuses solely on processing and controlling outgoing payments. Properly distinguishing these services helps organizations optimize cash flow, improve financial reporting, and align financial operations with overall business goals. Clear differentiation ensures targeted expertise drives both strategic financial growth and operational efficiency.

Comparison Table

| Feature | Fractional CFO Services | Accounts Payable Management |

|---|---|---|

| Primary Focus | Financial strategy, planning, and leadership | Management of vendor invoices and payments |

| Scope of Work | Budgeting, forecasting, cash flow management, financial reporting | Invoice processing, payment scheduling, reconciliation |

| Role in Business | Executive-level decision making and financial oversight | Operational finance function focused on payables |

| Typical Clients | Startups, SMEs needing part-time CFO expertise | Businesses of all sizes optimizing payment processes |

| Cost Structure | Monthly retainer or project-based fees | Transactional or service-based fees |

| Benefits | Improved financial strategy, profitability, and growth | Efficient payment processing, error reduction, cash flow control |

Which is better?

Fractional CFO services provide strategic financial leadership, offering expertise in budgeting, forecasting, and financial planning, which is essential for overall business growth and decision-making. Accounts payable management focuses on efficiently handling vendor payments, ensuring accurate tracking and timely disbursement to maintain healthy cash flow. Businesses seeking comprehensive financial strategy benefit more from Fractional CFO services, while those needing streamlined payment processes prioritize accounts payable management.

Connection

Fractional CFO services enhance Accounts Payable Management by providing strategic oversight and financial expertise, ensuring timely payments and optimized cash flow. These services implement robust controls and analytics to reduce errors and improve vendor relationships. Integrating Fractional CFO guidance with Accounts Payable processes drives financial efficiency and supports informed decision-making.

Key Terms

**Accounts Payable Management:**

Accounts Payable Management involves the systematic control and optimization of a company's outstanding debts to suppliers, ensuring timely payments to maintain strong vendor relationships and avoid late fees. It focuses on streamlining invoice processing, enhancing cash flow management, and improving financial accuracy through automation and thorough reconciliation practices. Discover how effective Accounts Payable Management can transform your financial operations and support your business growth.

Invoice Processing

Accounts payable management streamlines invoice processing by ensuring timely verification, approval, and payment of vendor invoices, reducing errors and late fees. Fractional CFO services provide strategic oversight of invoice workflows, optimizing cash flow and aligning payment schedules with broader financial goals. Explore detailed comparisons to enhance your invoice processing efficiency today.

Payment Scheduling

Accounts payable management ensures timely payment scheduling to maintain healthy vendor relationships and avoid late fees by tracking invoices and setting automated reminders. Fractional CFO services incorporate strategic payment scheduling within broader financial planning, optimizing cash flow and aligning payments with business goals. Explore how integrating these approaches can enhance your company's financial efficiency and stability.

Source and External Links

Accounts Payable Management: 8 Effective Strategies - This article provides eight effective strategies for managing accounts payable, including maintaining accurate records, optimizing payment timings, and leveraging automation and AI for enhanced efficiency.

What Is Accounts Payable Management? - This page explains the concept of accounts payable management, highlighting strategies like centralizing AP systems, automating processes, and creating supplier portals to enhance efficiency and supplier relationships.

Accounts Payable Management: Best Practices & Solutions - This resource discusses best practices for accounts payable management, emphasizing the importance of centralization, automation, and strong governance practices to optimize working capital and reduce errors.

dowidth.com

dowidth.com