Sustainable ledgers focus on environmentally and socially responsible accounting practices by integrating ESG (Environmental, Social, and Governance) data into financial records, while subledgers serve as detailed subsidiaries that track specific transactions supporting the general ledger. The sustainable ledger enhances transparency and accountability for corporate sustainability efforts, whereas subledgers improve accuracy and organization for financial reporting. Explore how these accounting systems transform financial management and drive responsible business practices.

Why it is important

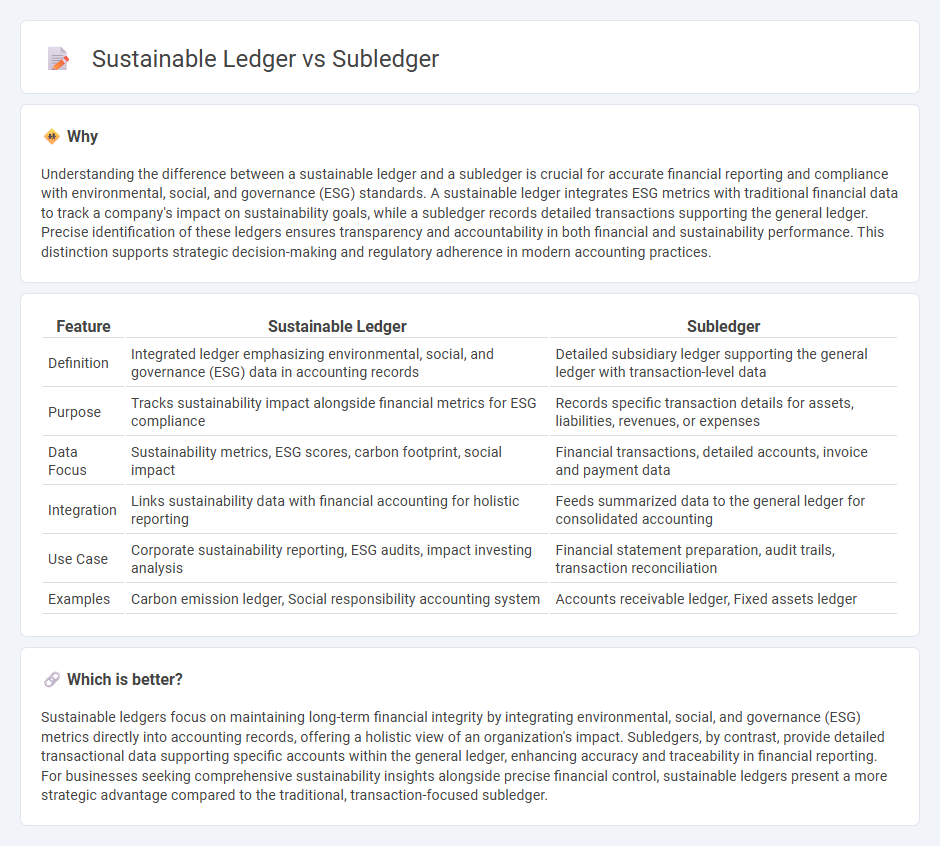

Understanding the difference between a sustainable ledger and a subledger is crucial for accurate financial reporting and compliance with environmental, social, and governance (ESG) standards. A sustainable ledger integrates ESG metrics with traditional financial data to track a company's impact on sustainability goals, while a subledger records detailed transactions supporting the general ledger. Precise identification of these ledgers ensures transparency and accountability in both financial and sustainability performance. This distinction supports strategic decision-making and regulatory adherence in modern accounting practices.

Comparison Table

| Feature | Sustainable Ledger | Subledger |

|---|---|---|

| Definition | Integrated ledger emphasizing environmental, social, and governance (ESG) data in accounting records | Detailed subsidiary ledger supporting the general ledger with transaction-level data |

| Purpose | Tracks sustainability impact alongside financial metrics for ESG compliance | Records specific transaction details for assets, liabilities, revenues, or expenses |

| Data Focus | Sustainability metrics, ESG scores, carbon footprint, social impact | Financial transactions, detailed accounts, invoice and payment data |

| Integration | Links sustainability data with financial accounting for holistic reporting | Feeds summarized data to the general ledger for consolidated accounting |

| Use Case | Corporate sustainability reporting, ESG audits, impact investing analysis | Financial statement preparation, audit trails, transaction reconciliation |

| Examples | Carbon emission ledger, Social responsibility accounting system | Accounts receivable ledger, Fixed assets ledger |

Which is better?

Sustainable ledgers focus on maintaining long-term financial integrity by integrating environmental, social, and governance (ESG) metrics directly into accounting records, offering a holistic view of an organization's impact. Subledgers, by contrast, provide detailed transactional data supporting specific accounts within the general ledger, enhancing accuracy and traceability in financial reporting. For businesses seeking comprehensive sustainability insights alongside precise financial control, sustainable ledgers present a more strategic advantage compared to the traditional, transaction-focused subledger.

Connection

Sustainable ledger and subledger integration enhances accurate financial tracking by ensuring that environmental and social responsibility data is meticulously recorded alongside traditional financial transactions. Subledgers provide detailed transaction records supporting the general ledger, enabling comprehensive sustainability accounting and reporting. This connection facilitates transparent, verifiable sustainability performance measurement within accounting systems.

Key Terms

Detail Accounts

Subledger systems provide detailed account-level transactions supporting the general ledger with granular data essential for accurate financial reporting and audit trails. Sustainable ledger frameworks extend beyond traditional accounting by integrating environmental, social, and governance (ESG) metrics into financial records, promoting transparency and corporate responsibility. Explore the differences between subledger and sustainable ledger and how detailed account management shapes financial sustainability.

Consolidation

Subledger systems record detailed financial transactions categorized by departments or cost centers, enabling granular tracking essential for accurate consolidation. Sustainable ledger frameworks integrate environmental, social, and governance (ESG) metrics with financial data, fostering holistic consolidation that reflects both financial and sustainability performance. Explore how combining traditional subledger precision with sustainable ledger transparency can revolutionize your consolidation process.

ESG Reporting

Subledger systems organize detailed transactional data crucial for ESG reporting, enabling accurate tracking of environmental, social, and governance metrics. Sustainable ledger platforms integrate ESG frameworks and real-time data analytics to support transparency and compliance with global sustainability standards such as GRI and SASB. Explore how leveraging these ledgers can enhance your organization's ESG performance and reporting accuracy.

Source and External Links

Subledger - A subledger provides detailed transaction information that rolls up into the general ledger, often used for specific accounts like accounts receivable or payable.

Subledger definition - A subledger is a detailed ledger containing a subset of transactions that are summarized and recorded in the general ledger.

Subledger - An accounting tool that simplifies financial data management by automating processes and integrating with existing financial tools.

dowidth.com

dowidth.com