ESG assurance focuses on verifying a company's environmental, social, and governance disclosures to ensure transparency and stakeholder trust, while risk assurance evaluates internal controls and processes to identify and mitigate potential business risks. Both services play critical roles in enhancing corporate accountability and decision-making. Explore more to understand how these assurance types drive sustainable and resilient business practices.

Why it is important

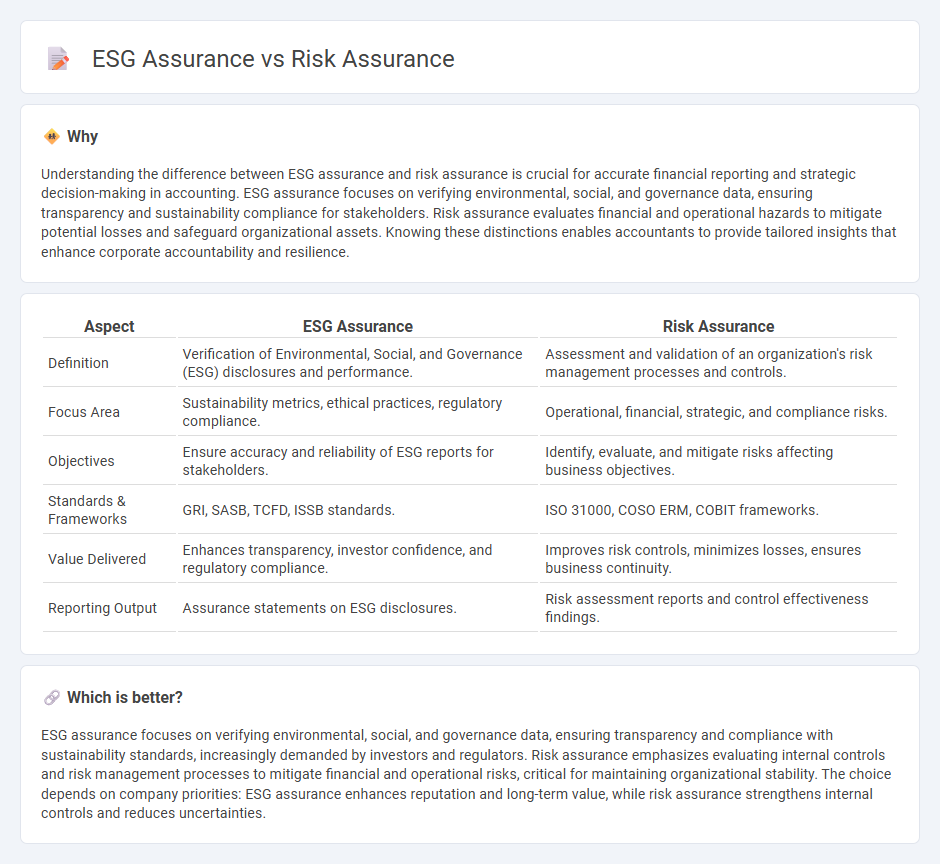

Understanding the difference between ESG assurance and risk assurance is crucial for accurate financial reporting and strategic decision-making in accounting. ESG assurance focuses on verifying environmental, social, and governance data, ensuring transparency and sustainability compliance for stakeholders. Risk assurance evaluates financial and operational hazards to mitigate potential losses and safeguard organizational assets. Knowing these distinctions enables accountants to provide tailored insights that enhance corporate accountability and resilience.

Comparison Table

| Aspect | ESG Assurance | Risk Assurance |

|---|---|---|

| Definition | Verification of Environmental, Social, and Governance (ESG) disclosures and performance. | Assessment and validation of an organization's risk management processes and controls. |

| Focus Area | Sustainability metrics, ethical practices, regulatory compliance. | Operational, financial, strategic, and compliance risks. |

| Objectives | Ensure accuracy and reliability of ESG reports for stakeholders. | Identify, evaluate, and mitigate risks affecting business objectives. |

| Standards & Frameworks | GRI, SASB, TCFD, ISSB standards. | ISO 31000, COSO ERM, COBIT frameworks. |

| Value Delivered | Enhances transparency, investor confidence, and regulatory compliance. | Improves risk controls, minimizes losses, ensures business continuity. |

| Reporting Output | Assurance statements on ESG disclosures. | Risk assessment reports and control effectiveness findings. |

Which is better?

ESG assurance focuses on verifying environmental, social, and governance data, ensuring transparency and compliance with sustainability standards, increasingly demanded by investors and regulators. Risk assurance emphasizes evaluating internal controls and risk management processes to mitigate financial and operational risks, critical for maintaining organizational stability. The choice depends on company priorities: ESG assurance enhances reputation and long-term value, while risk assurance strengthens internal controls and reduces uncertainties.

Connection

ESG assurance and risk assurance are interconnected through their focus on identifying, assessing, and mitigating potential risks that impact an organization's environmental, social, governance, and financial performance. Both assurance services enhance transparency and credibility by verifying the accuracy and reliability of non-financial and financial disclosures. Integrating ESG metrics with traditional risk frameworks strengthens organizational resilience and supports sustainable decision-making.

Key Terms

Materiality

Risk assurance emphasizes identifying and mitigating potential threats to an organization's operations and financial health, prioritizing areas with the highest risk exposure. ESG assurance centers on evaluating environmental, social, and governance factors material to stakeholders and regulatory requirements, ensuring transparency and accountability in sustainability reporting. Explore deeper insights into how materiality shapes assurance strategies across both domains.

Controls

Risk assurance emphasizes evaluating internal controls to mitigate financial, operational, and compliance risks, ensuring organizational reliability and accuracy. ESG assurance, on the other hand, concentrates on verifying controls related to environmental, social, and governance data to enhance transparency and stakeholder trust in sustainability reporting. Explore further to understand how control frameworks differ and complement in both assurance types.

Reporting

Risk assurance focuses on verifying the accuracy and reliability of financial and operational data to identify potential threats and ensure compliance with regulatory standards. ESG assurance evaluates the credibility of environmental, social, and governance disclosures, helping organizations build trust and demonstrate sustainable practices to stakeholders. Explore further to understand how tailored assurance approaches can enhance comprehensive and transparent reporting.

Source and External Links

The Ultimate Guide to Risk Assurance - Risk assurance is a systematic process evaluating and verifying that an organization's risk management strategies are effective and aligned with its overall objectives.

Risk assurance - Risk assurance involves internal processes to create a "checks and balances" system, identifying differences between risk appetite and real risk across various business risk types.

PwC Hong Kong: Risk Assurance - PwC's Risk Assurance helps companies digitally transform, build trust, and capitalize on risk by mitigating cybersecurity, privacy, and cloud transformation risks.

dowidth.com

dowidth.com