Environmental, Social, and Governance (ESG) accounting integrates sustainability metrics and ethical considerations into financial reporting, emphasizing corporate responsibility in environmental impact, social equity, and governance practices. Ethical accounting focuses on adherence to moral principles and transparency in financial disclosures, ensuring integrity and fairness in all accounting practices. Explore deeper insights into how ESG accounting contrasts with traditional ethical accounting frameworks.

Why it is important

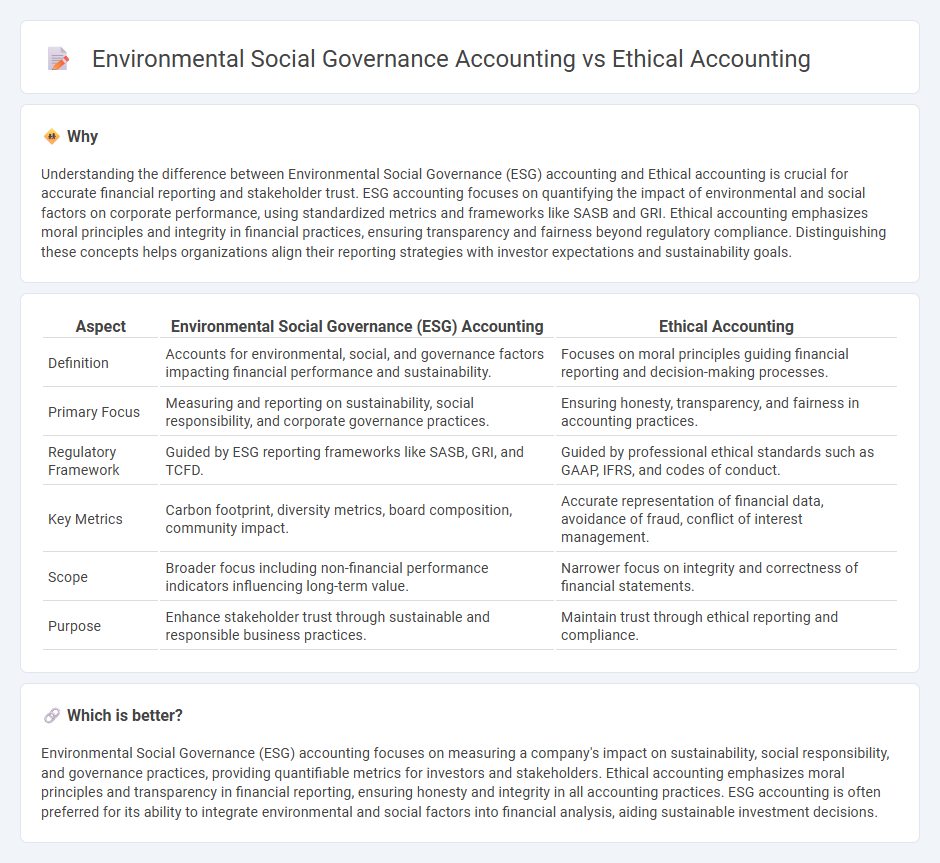

Understanding the difference between Environmental Social Governance (ESG) accounting and Ethical accounting is crucial for accurate financial reporting and stakeholder trust. ESG accounting focuses on quantifying the impact of environmental and social factors on corporate performance, using standardized metrics and frameworks like SASB and GRI. Ethical accounting emphasizes moral principles and integrity in financial practices, ensuring transparency and fairness beyond regulatory compliance. Distinguishing these concepts helps organizations align their reporting strategies with investor expectations and sustainability goals.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Ethical Accounting |

|---|---|---|

| Definition | Accounts for environmental, social, and governance factors impacting financial performance and sustainability. | Focuses on moral principles guiding financial reporting and decision-making processes. |

| Primary Focus | Measuring and reporting on sustainability, social responsibility, and corporate governance practices. | Ensuring honesty, transparency, and fairness in accounting practices. |

| Regulatory Framework | Guided by ESG reporting frameworks like SASB, GRI, and TCFD. | Guided by professional ethical standards such as GAAP, IFRS, and codes of conduct. |

| Key Metrics | Carbon footprint, diversity metrics, board composition, community impact. | Accurate representation of financial data, avoidance of fraud, conflict of interest management. |

| Scope | Broader focus including non-financial performance indicators influencing long-term value. | Narrower focus on integrity and correctness of financial statements. |

| Purpose | Enhance stakeholder trust through sustainable and responsible business practices. | Maintain trust through ethical reporting and compliance. |

Which is better?

Environmental Social Governance (ESG) accounting focuses on measuring a company's impact on sustainability, social responsibility, and governance practices, providing quantifiable metrics for investors and stakeholders. Ethical accounting emphasizes moral principles and transparency in financial reporting, ensuring honesty and integrity in all accounting practices. ESG accounting is often preferred for its ability to integrate environmental and social factors into financial analysis, aiding sustainable investment decisions.

Connection

Environmental social governance (ESG) accounting and ethical accounting are interconnected through their shared focus on transparency, accountability, and sustainable practices in financial reporting. ESG accounting quantifies a company's environmental and social impact, while ethical accounting ensures adherence to moral principles and integrity in financial decision-making. Both approaches drive responsible business behavior, enhance stakeholder trust, and promote long-term economic, social, and environmental value creation.

Key Terms

Ethical accounting:

Ethical accounting emphasizes transparency, integrity, and adherence to moral principles in financial reporting, ensuring stakeholders receive accurate and honest information. This approach prioritizes corporate responsibility and combats fraud, promoting trust and sustainable business practices. Explore how ethical accounting frameworks reshape corporate accountability and stakeholder confidence.

Integrity

Ethical accounting emphasizes transparency, honesty, and adherence to moral principles to ensure accurate financial reporting and maintain stakeholder trust. Environmental, Social, and Governance (ESG) accounting integrates sustainability metrics and ethical considerations into financial analysis, promoting corporate responsibility beyond traditional accounting. Explore the differences in integrity standards between these accounting approaches to understand their impact on business ethics.

Transparency

Ethical accounting centers on transparent financial reporting to ensure honesty and integrity in business practices, fostering trust among stakeholders. Environmental Social Governance (ESG) accounting emphasizes transparent disclosure of a company's environmental impact, social responsibility, and governance policies, aligning financial performance with sustainable and ethical standards. Explore how enhanced transparency in both approaches drives accountability and informed decision-making.

Source and External Links

Maintaining Ethical Standards in Accounting - Ethical accounting is built on the pillars of integrity, transparency, and accountability, which ensure the accuracy and reliability of financial information and prevent scandals like Enron and WorldCom that destroy trust and cause major financial losses.

The Importance of Ethics in Accounting: Why It Matters Article - Ethics in accounting ensure accurate financial reports and promote accountability and trust, which are crucial for businesses to maintain credibility with investors and avoid legal repercussions.

Ethical Considerations in Accounting: Navigating the Gray Areas - Ethical accounting involves applying decision-making models to resolve dilemmas and fostering a corporate culture that supports ethics, including whistleblower protections to detect and prevent financial misconduct.

dowidth.com

dowidth.com