Forensic accounting software specializes in detecting financial fraud, analyzing suspicious transactions, and supporting legal investigations with detailed audit trails. Treasury management software focuses on optimizing liquidity, managing cash flow, and mitigating financial risks within an organization's capital structure. Explore the distinct features and benefits of each software type to determine the best fit for your financial management needs.

Why it is important

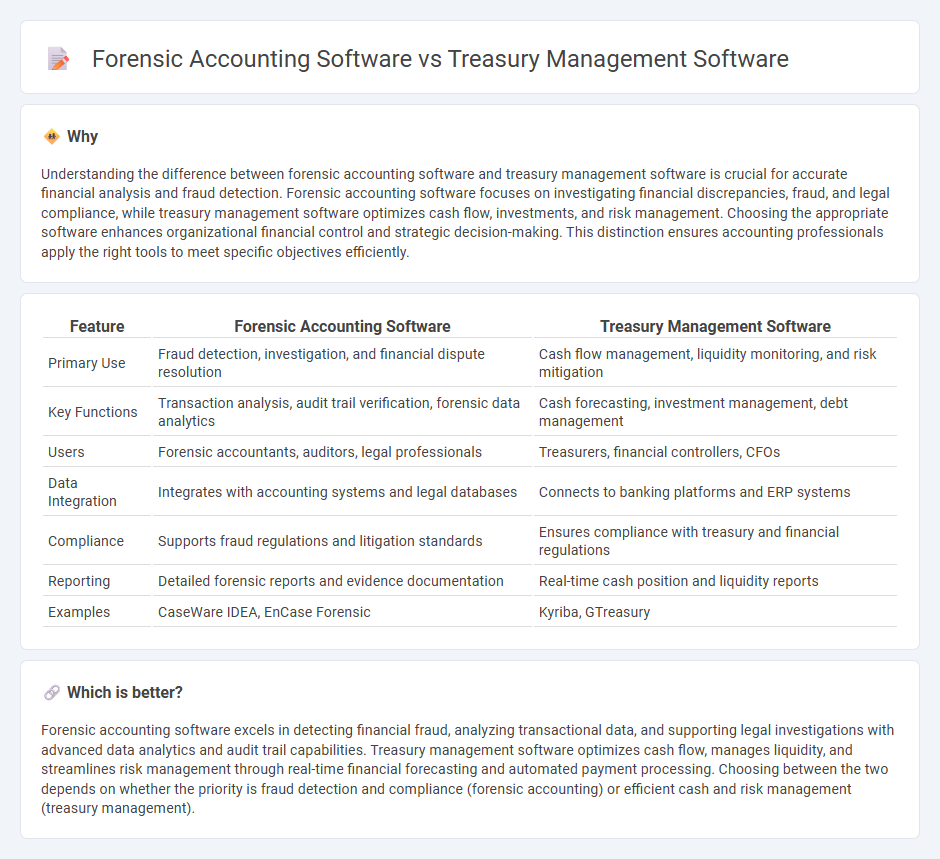

Understanding the difference between forensic accounting software and treasury management software is crucial for accurate financial analysis and fraud detection. Forensic accounting software focuses on investigating financial discrepancies, fraud, and legal compliance, while treasury management software optimizes cash flow, investments, and risk management. Choosing the appropriate software enhances organizational financial control and strategic decision-making. This distinction ensures accounting professionals apply the right tools to meet specific objectives efficiently.

Comparison Table

| Feature | Forensic Accounting Software | Treasury Management Software |

|---|---|---|

| Primary Use | Fraud detection, investigation, and financial dispute resolution | Cash flow management, liquidity monitoring, and risk mitigation |

| Key Functions | Transaction analysis, audit trail verification, forensic data analytics | Cash forecasting, investment management, debt management |

| Users | Forensic accountants, auditors, legal professionals | Treasurers, financial controllers, CFOs |

| Data Integration | Integrates with accounting systems and legal databases | Connects to banking platforms and ERP systems |

| Compliance | Supports fraud regulations and litigation standards | Ensures compliance with treasury and financial regulations |

| Reporting | Detailed forensic reports and evidence documentation | Real-time cash position and liquidity reports |

| Examples | CaseWare IDEA, EnCase Forensic | Kyriba, GTreasury |

Which is better?

Forensic accounting software excels in detecting financial fraud, analyzing transactional data, and supporting legal investigations with advanced data analytics and audit trail capabilities. Treasury management software optimizes cash flow, manages liquidity, and streamlines risk management through real-time financial forecasting and automated payment processing. Choosing between the two depends on whether the priority is fraud detection and compliance (forensic accounting) or efficient cash and risk management (treasury management).

Connection

Forensic accounting software and treasury management software are interconnected through their shared focus on financial accuracy, fraud detection, and cash flow optimization. Forensic accounting software analyzes transactions for irregularities and potential fraud, providing critical data that treasury management systems use to enhance liquidity management and risk assessment. Integrating these tools enables organizations to maintain robust internal controls and improve overall financial transparency.

Key Terms

Cash Flow Management

Treasury management software streamlines cash flow management by automating liquidity monitoring, forecasting, and optimization to ensure efficient fund allocation and minimize financial risk. Forensic accounting software, on the other hand, focuses on detecting and analyzing cash flow discrepancies and fraudulent activities through detailed transaction tracking and audit trails. Discover how each software enhances cash flow control by exploring their specialized features and applications.

Fraud Detection

Treasury management software primarily focuses on optimizing cash flow, managing liquidity, and ensuring financial compliance, but it includes basic fraud detection features such as transaction monitoring and anomaly alerts. Forensic accounting software, however, offers advanced fraud detection capabilities by leveraging data analysis, pattern recognition, and detailed audit trails to identify suspicious activities and support investigations. Explore how integrating specialized forensic tools with treasury systems can enhance your organization's fraud prevention strategies.

Reconciliation

Treasury management software streamlines reconciliation by automating the matching of bank statements with internal records, enhancing cash flow accuracy and reducing manual errors. Forensic accounting software specializes in detecting discrepancies and potential fraud during reconciliation by analyzing transaction patterns and providing audit trails. Explore how these tools optimize financial reconciliation processes to improve accuracy and compliance in your organization.

Source and External Links

8 Best Treasury Management Solutions - Provides an overview of the top treasury management solutions, including options like SAP and ION Group, highlighting their features and ideal use cases.

Treasury4 - Offers a cloud-native treasury management platform designed for speed, insight, and control, allowing for quick onboarding and unified financial management.

GTreasury - Features a complete treasury management system supporting cash visibility, forecasting, payments, risk management, and debt and investment management with adaptable solutions.

dowidth.com

dowidth.com