Payroll automation streamlines salary processing by reducing manual tasks and minimizing errors using software solutions, while cloud-based payroll systems enhance accessibility and data security through internet-based platforms. Integrating cloud technology with automated payroll allows real-time updates, remote access, and seamless compliance with tax regulations. Discover how these payroll innovations can transform your business operations efficiently.

Why it is important

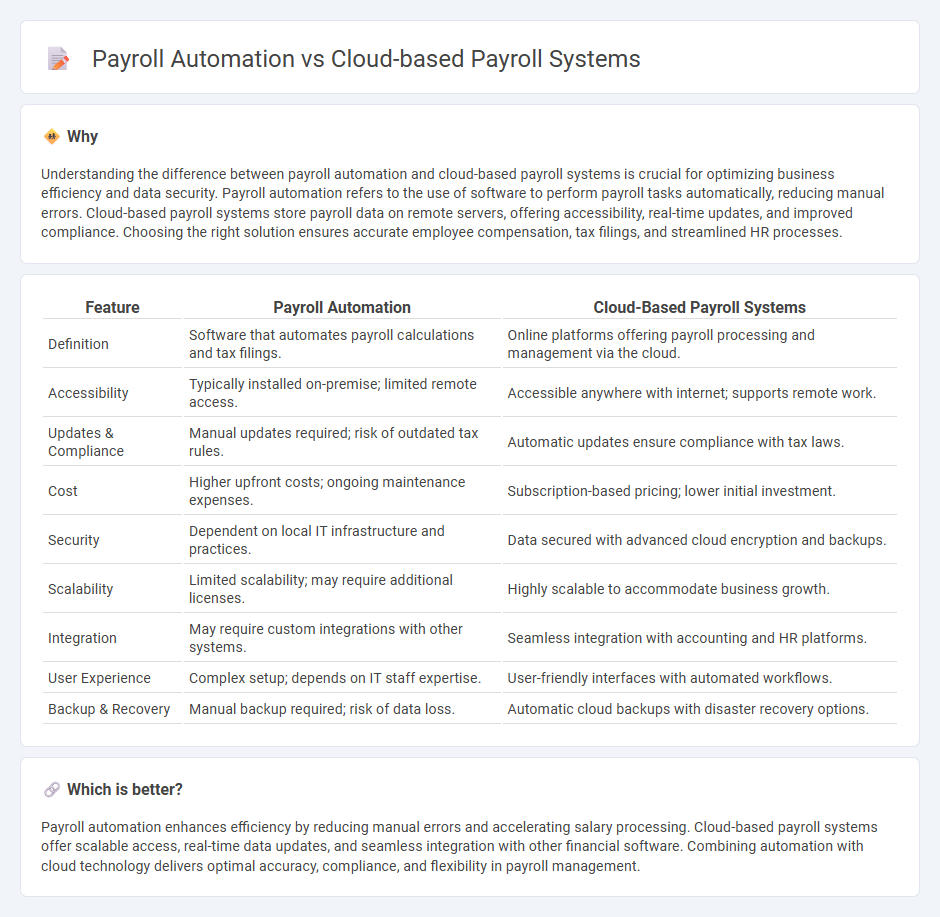

Understanding the difference between payroll automation and cloud-based payroll systems is crucial for optimizing business efficiency and data security. Payroll automation refers to the use of software to perform payroll tasks automatically, reducing manual errors. Cloud-based payroll systems store payroll data on remote servers, offering accessibility, real-time updates, and improved compliance. Choosing the right solution ensures accurate employee compensation, tax filings, and streamlined HR processes.

Comparison Table

| Feature | Payroll Automation | Cloud-Based Payroll Systems |

|---|---|---|

| Definition | Software that automates payroll calculations and tax filings. | Online platforms offering payroll processing and management via the cloud. |

| Accessibility | Typically installed on-premise; limited remote access. | Accessible anywhere with internet; supports remote work. |

| Updates & Compliance | Manual updates required; risk of outdated tax rules. | Automatic updates ensure compliance with tax laws. |

| Cost | Higher upfront costs; ongoing maintenance expenses. | Subscription-based pricing; lower initial investment. |

| Security | Dependent on local IT infrastructure and practices. | Data secured with advanced cloud encryption and backups. |

| Scalability | Limited scalability; may require additional licenses. | Highly scalable to accommodate business growth. |

| Integration | May require custom integrations with other systems. | Seamless integration with accounting and HR platforms. |

| User Experience | Complex setup; depends on IT staff expertise. | User-friendly interfaces with automated workflows. |

| Backup & Recovery | Manual backup required; risk of data loss. | Automatic cloud backups with disaster recovery options. |

Which is better?

Payroll automation enhances efficiency by reducing manual errors and accelerating salary processing. Cloud-based payroll systems offer scalable access, real-time data updates, and seamless integration with other financial software. Combining automation with cloud technology delivers optimal accuracy, compliance, and flexibility in payroll management.

Connection

Payroll automation enhances efficiency by streamlining salary calculations, tax deductions, and compliance management, while cloud-based payroll systems provide real-time access, centralized data storage, and seamless integration with accounting software. This connection ensures accurate, timely payroll processing and secure data management across multiple locations. Businesses leveraging cloud-based payroll automation reduce manual errors, improve reporting capabilities, and maintain regulatory compliance.

Key Terms

Data Accessibility

Cloud-based payroll systems offer seamless data accessibility by enabling real-time access to payroll information from any location with an internet connection, enhancing flexibility and collaboration. Payroll automation improves efficiency by reducing manual data entry errors and accelerating processing times but may rely on localized systems that limit remote data access. Explore how integrating cloud-based solutions with automation can optimize payroll operations and data accessibility.

Integration

Cloud-based payroll systems offer seamless integration with various HR, accounting, and time-tracking software, enabling real-time data synchronization and reducing manual data entry errors. Payroll automation emphasizes streamlining payroll processes through automated calculations, tax filings, and compliance checks, improving accuracy and efficiency. Explore how these technologies enhance workforce management by integrating payroll tasks smoothly within broader business operations.

Real-time Processing

Cloud-based payroll systems offer real-time processing by leveraging internet connectivity to update payroll data instantly across multiple devices and locations, ensuring accurate and timely salary disbursements. Payroll automation streamlines repetitive tasks such as tax calculations and compliance checks, but the integration with cloud platforms enhances the immediacy and accessibility of payroll information. Discover how real-time processing in cloud-based payroll systems transforms payroll accuracy and efficiency.

Source and External Links

What Is Payroll Software? - Cloud-based payroll systems manage and automate employee payments, scale easily with business complexity, simplify tax compliance, enhance security via automation and role-based access, and help during mergers and audits by providing integrated, up-to-date payroll data.

Enterprise Payroll System Software - Cloud-based payroll software offers flexible, automated payroll management with global integration, real-time analytics, employee self-service, continuous processing, and AI-driven accuracy to support shifting regulations and improve productivity worldwide.

APS Payroll: All-in-One Payroll and Core HR Technology - APS provides a cloud-based HR and payroll platform focused on automating payroll and HR processes to reduce errors and compliance risks, increase efficiency, streamline time tracking, scheduling, hiring, onboarding, and ACA reporting, while engaging managers and employees through accessible dashboards and tools.

dowidth.com

dowidth.com