Real-time expense recognition records costs as they occur, providing immediate financial accuracy and improved cash flow management. Depreciation systematically allocates the cost of tangible assets over their useful lives, aligning expenses with revenue generation periods. Explore deeper insights into how these accounting methods impact financial reporting and decision-making.

Why it is important

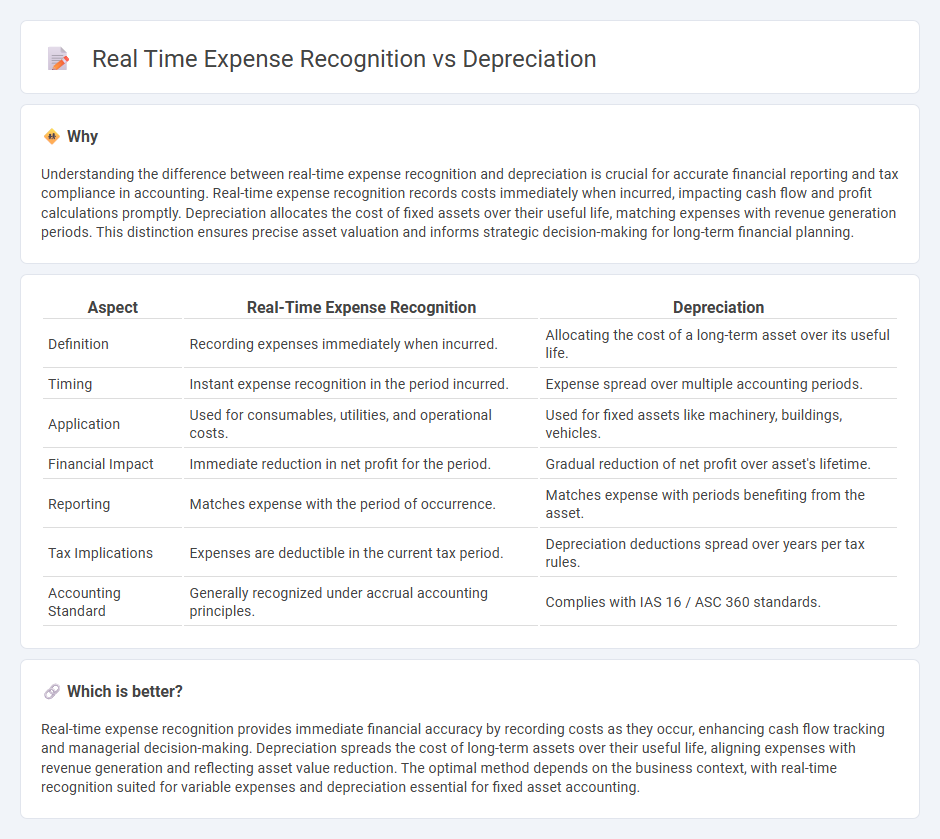

Understanding the difference between real-time expense recognition and depreciation is crucial for accurate financial reporting and tax compliance in accounting. Real-time expense recognition records costs immediately when incurred, impacting cash flow and profit calculations promptly. Depreciation allocates the cost of fixed assets over their useful life, matching expenses with revenue generation periods. This distinction ensures precise asset valuation and informs strategic decision-making for long-term financial planning.

Comparison Table

| Aspect | Real-Time Expense Recognition | Depreciation |

|---|---|---|

| Definition | Recording expenses immediately when incurred. | Allocating the cost of a long-term asset over its useful life. |

| Timing | Instant expense recognition in the period incurred. | Expense spread over multiple accounting periods. |

| Application | Used for consumables, utilities, and operational costs. | Used for fixed assets like machinery, buildings, vehicles. |

| Financial Impact | Immediate reduction in net profit for the period. | Gradual reduction of net profit over asset's lifetime. |

| Reporting | Matches expense with the period of occurrence. | Matches expense with periods benefiting from the asset. |

| Tax Implications | Expenses are deductible in the current tax period. | Depreciation deductions spread over years per tax rules. |

| Accounting Standard | Generally recognized under accrual accounting principles. | Complies with IAS 16 / ASC 360 standards. |

Which is better?

Real-time expense recognition provides immediate financial accuracy by recording costs as they occur, enhancing cash flow tracking and managerial decision-making. Depreciation spreads the cost of long-term assets over their useful life, aligning expenses with revenue generation and reflecting asset value reduction. The optimal method depends on the business context, with real-time recognition suited for variable expenses and depreciation essential for fixed asset accounting.

Connection

Real-time expense recognition ensures immediate recording of costs as they occur, aligning financial statements with actual business activities. Depreciation allocates the expense of tangible assets over their useful lives, reflecting gradual value reduction accurately in accounting periods. Integrating real-time expense recognition with depreciation enhances financial accuracy, enabling timely assessment of asset costs and improved decision-making.

Key Terms

Accrual Accounting

Depreciation allocates the cost of tangible assets over their useful lives, matching expenses with the periods benefiting from the assets in accrual accounting. Real-time expense recognition records costs as they are incurred, providing immediate reflection of financial transactions but may distort long-term asset valuation. Explore the nuances between these methods to optimize accurate financial reporting and asset management.

Capitalization

Depreciation systematically allocates the cost of a capitalized asset over its useful life, reflecting asset deterioration and usage in financial statements. Real-time expense recognition records costs immediately when incurred, which contrasts with capitalizing assets and expensing them gradually through depreciation. Discover how choosing between depreciation and real-time expense recognition impacts financial reporting and asset management strategies.

Matching Principle

Depreciation allocates the cost of a fixed asset over its useful life, aligning expenses with the periods that benefit from the asset's use, in accordance with the Matching Principle. Real-time expense recognition records expenses immediately as they occur, which may lead to timing mismatches between revenues and related costs. Explore how applying the Matching Principle can improve financial accuracy and decision-making in your business.

Source and External Links

Depreciation - Wikipedia - Depreciation is the process of allocating the cost of a tangible asset over its useful life, reflecting the decrease in asset value due to use and wear, with methods like units-of-production calculating expenses based on actual usage.

What is depreciation? | BDC.ca - Depreciation is an accounting method estimating the loss in value of tangible assets over time to match revenues with costs, spreading the expense over the asset's useful life rather than expensing it all at once.

Depreciation Methods - Corporate Finance Institute - Depreciation expense allocates the cost of assets over their life, with common methods including straight-line, units-of-production, and accelerated methods like double-declining balance that apply different rates and calculations based on usage or time.

dowidth.com

dowidth.com