Integrated ESG reporting combines environmental, social, and governance metrics into a unified framework, providing a comprehensive view of a company's sustainability and ethical impact beyond traditional financial statements. Corporate social responsibility disclosure typically focuses on voluntary reporting of social and environmental efforts without standardized integration into financial reports. Explore the differences between these approaches to enhance your understanding of modern accounting practices.

Why it is important

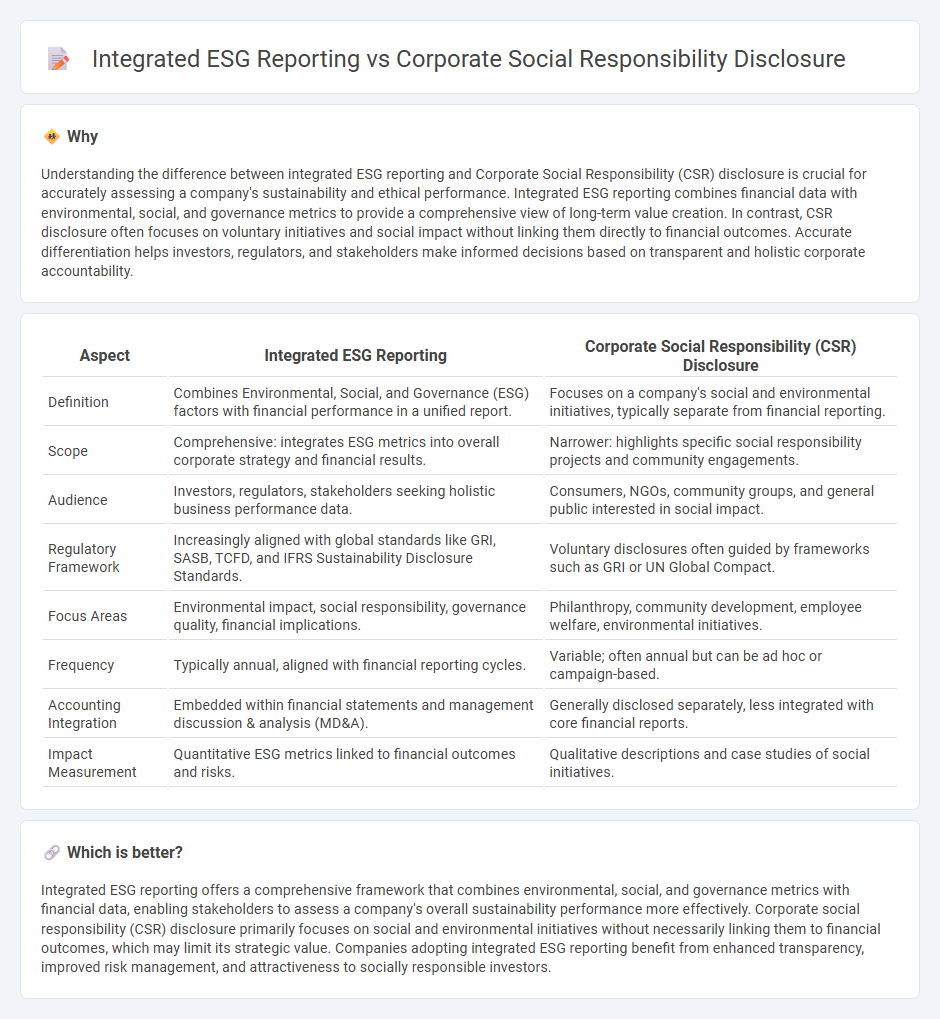

Understanding the difference between integrated ESG reporting and Corporate Social Responsibility (CSR) disclosure is crucial for accurately assessing a company's sustainability and ethical performance. Integrated ESG reporting combines financial data with environmental, social, and governance metrics to provide a comprehensive view of long-term value creation. In contrast, CSR disclosure often focuses on voluntary initiatives and social impact without linking them directly to financial outcomes. Accurate differentiation helps investors, regulators, and stakeholders make informed decisions based on transparent and holistic corporate accountability.

Comparison Table

| Aspect | Integrated ESG Reporting | Corporate Social Responsibility (CSR) Disclosure |

|---|---|---|

| Definition | Combines Environmental, Social, and Governance (ESG) factors with financial performance in a unified report. | Focuses on a company's social and environmental initiatives, typically separate from financial reporting. |

| Scope | Comprehensive: integrates ESG metrics into overall corporate strategy and financial results. | Narrower: highlights specific social responsibility projects and community engagements. |

| Audience | Investors, regulators, stakeholders seeking holistic business performance data. | Consumers, NGOs, community groups, and general public interested in social impact. |

| Regulatory Framework | Increasingly aligned with global standards like GRI, SASB, TCFD, and IFRS Sustainability Disclosure Standards. | Voluntary disclosures often guided by frameworks such as GRI or UN Global Compact. |

| Focus Areas | Environmental impact, social responsibility, governance quality, financial implications. | Philanthropy, community development, employee welfare, environmental initiatives. |

| Frequency | Typically annual, aligned with financial reporting cycles. | Variable; often annual but can be ad hoc or campaign-based. |

| Accounting Integration | Embedded within financial statements and management discussion & analysis (MD&A). | Generally disclosed separately, less integrated with core financial reports. |

| Impact Measurement | Quantitative ESG metrics linked to financial outcomes and risks. | Qualitative descriptions and case studies of social initiatives. |

Which is better?

Integrated ESG reporting offers a comprehensive framework that combines environmental, social, and governance metrics with financial data, enabling stakeholders to assess a company's overall sustainability performance more effectively. Corporate social responsibility (CSR) disclosure primarily focuses on social and environmental initiatives without necessarily linking them to financial outcomes, which may limit its strategic value. Companies adopting integrated ESG reporting benefit from enhanced transparency, improved risk management, and attractiveness to socially responsible investors.

Connection

Integrated ESG reporting and Corporate Social Responsibility (CSR) disclosure are interconnected through their shared focus on transparency in environmental, social, and governance factors within accounting practices. Both frameworks enable organizations to quantify and communicate non-financial performance metrics, enhancing stakeholder trust and supporting sustainable business strategies. The alignment of ESG metrics with CSR disclosures facilitates comprehensive risk assessment and long-term value creation in corporate financial reporting.

Key Terms

Stakeholder Engagement

Corporate social responsibility disclosure primarily highlights a company's voluntary actions to address social and environmental impacts, often focusing on transparency and compliance rather than strategic integration. Integrated ESG reporting encompasses a holistic framework that combines financial and non-financial data, emphasizing stakeholder engagement through comprehensive metrics and long-term value creation. Explore how deepening stakeholder relationships through integrated ESG reporting drives sustainable business practices and enhances corporate accountability.

Materiality Assessment

Materiality assessment in corporate social responsibility (CSR) disclosure primarily emphasizes identifying and communicating the social, environmental, and governance issues most relevant to stakeholders. Integrated ESG reporting, however, incorporates materiality assessment to align sustainability metrics with financial performance, offering a holistic view of value creation. Explore how materiality shapes transparency and strategic decision-making in advancing corporate accountability.

Triple Bottom Line

Corporate social responsibility (CSR) disclosure traditionally emphasizes environmental, social, and governance (ESG) data within a narrative framework, often highlighting philanthropic activities and compliance efforts aligned with the Triple Bottom Line (economic, social, and environmental performance). Integrated ESG reporting advances this approach by embedding measurable sustainability metrics directly into financial reports, promoting transparency and strategic value creation across all three dimensions of the Triple Bottom Line. Explore how adopting integrated ESG reporting enhances stakeholder engagement and drives long-term corporate sustainability goals.

Source and External Links

Corporate Social Responsibility Disclosure - This article discusses how CSR disclosure can boost market confidence and attract investors, improving financial outcomes for companies.

Corporate Social Responsibility Disclosure: Responding to Stakeholders - CSR disclosure serves as a tool for companies to communicate with stakeholders, though it often lacks regulatory oversight in many regions.

Determinants and Consequences of Corporate Social Responsibility Disclosure - This study synthesizes literature on CSR disclosure, highlighting its determinants and benefits, including improved reputation and financial performance.

dowidth.com

dowidth.com