ESG reporting focuses on environmental, social, and governance factors, providing companies with a framework to disclose non-financial performance metrics that influence sustainability and ethical impact. Statutory reporting is primarily driven by legal requirements, emphasizing accuracy and compliance in financial statements to meet regulatory standards. Explore how both reporting types intersect and diverge to enhance corporate transparency and accountability.

Why it is important

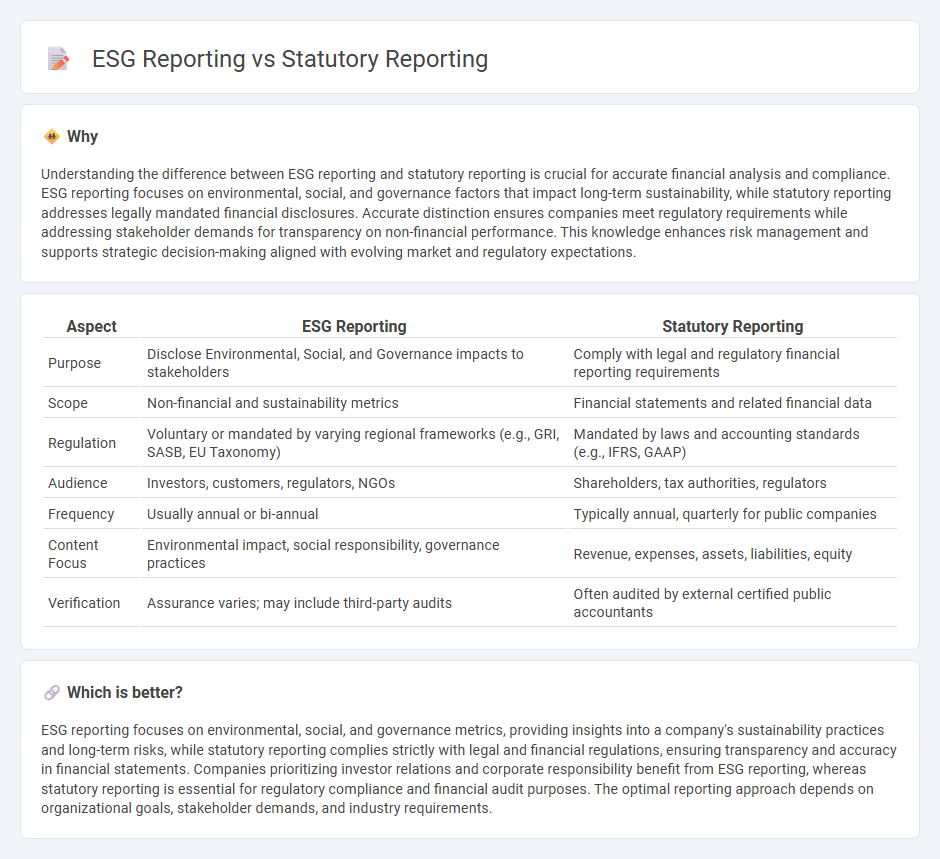

Understanding the difference between ESG reporting and statutory reporting is crucial for accurate financial analysis and compliance. ESG reporting focuses on environmental, social, and governance factors that impact long-term sustainability, while statutory reporting addresses legally mandated financial disclosures. Accurate distinction ensures companies meet regulatory requirements while addressing stakeholder demands for transparency on non-financial performance. This knowledge enhances risk management and supports strategic decision-making aligned with evolving market and regulatory expectations.

Comparison Table

| Aspect | ESG Reporting | Statutory Reporting |

|---|---|---|

| Purpose | Disclose Environmental, Social, and Governance impacts to stakeholders | Comply with legal and regulatory financial reporting requirements |

| Scope | Non-financial and sustainability metrics | Financial statements and related financial data |

| Regulation | Voluntary or mandated by varying regional frameworks (e.g., GRI, SASB, EU Taxonomy) | Mandated by laws and accounting standards (e.g., IFRS, GAAP) |

| Audience | Investors, customers, regulators, NGOs | Shareholders, tax authorities, regulators |

| Frequency | Usually annual or bi-annual | Typically annual, quarterly for public companies |

| Content Focus | Environmental impact, social responsibility, governance practices | Revenue, expenses, assets, liabilities, equity |

| Verification | Assurance varies; may include third-party audits | Often audited by external certified public accountants |

Which is better?

ESG reporting focuses on environmental, social, and governance metrics, providing insights into a company's sustainability practices and long-term risks, while statutory reporting complies strictly with legal and financial regulations, ensuring transparency and accuracy in financial statements. Companies prioritizing investor relations and corporate responsibility benefit from ESG reporting, whereas statutory reporting is essential for regulatory compliance and financial audit purposes. The optimal reporting approach depends on organizational goals, stakeholder demands, and industry requirements.

Connection

ESG reporting and statutory reporting are interconnected through their shared requirement for transparent and accurate financial disclosures that reflect a company's environmental, social, and governance performance alongside traditional financial metrics. Statutory reporting frameworks increasingly incorporate ESG criteria to meet regulatory compliance and investor demand for sustainability information. This integration enhances accountability by aligning corporate responsibility with legal reporting obligations, improving stakeholder trust and decision-making.

Key Terms

Compliance

Statutory reporting primarily emphasizes compliance with legal requirements and financial regulations mandated by government authorities, ensuring transparency and accountability in corporate operations. ESG reporting extends beyond statutory obligations by integrating environmental, social, and governance factors, addressing stakeholder expectations and promoting sustainable business practices. Discover how aligning statutory reporting with ESG frameworks enhances compliance and drives long-term value creation.

Materiality

Statutory reporting focuses on compliance with legal requirements, ensuring that financial and operational data meet regulatory standards, while ESG reporting emphasizes materiality related to environmental, social, and governance factors that impact long-term business sustainability and stakeholder value. Materiality in ESG reporting identifies the most significant issues that affect an organization's ability to create value over time, aligning with frameworks like SASB and GRI for transparent, strategic disclosure. Explore how integrating materiality principles enhances the effectiveness of both statutory and ESG reporting processes.

Stakeholders

Statutory reporting primarily addresses regulatory compliance and financial transparency to meet legal requirements set by government bodies and shareholders, emphasizing accuracy and timeliness. ESG reporting, on the other hand, focuses on environmental, social, and governance factors, engaging a broader range of stakeholders including investors, customers, and communities who seek sustainable and ethical business practices. Explore more to understand how each reporting type uniquely supports stakeholder engagement and decision-making.

Source and External Links

What is Statutory Reporting? Understand Its types & Importance - Statutory reporting involves legal requirements for companies to submit financial and non-financial information to government or regulatory bodies, ensuring compliance and transparency.

Prepare for Regulatory and Statutory Reporting - Trintech - This webpage provides guidance on handling statutory reporting by outlining key steps such as statutory account preparation, audit, and filing to ensure timely and accurate submissions.

Global Statutory Reporting Services - Deloitte - Deloitte offers services to manage statutory reporting efficiently, leveraging technology and industry experience to enhance compliance and stakeholder confidence.

dowidth.com

dowidth.com