Blockchain audit trail offers an immutable and transparent ledger that enhances accuracy and security compared to traditional double-entry accounting, which relies heavily on manual entries and reconciliation processes prone to errors. By enabling real-time transaction verification and traceability, blockchain reduces fraud risks and streamlines auditing functions. Explore how blockchain technology is revolutionizing accounting practices and improving financial integrity.

Why it is important

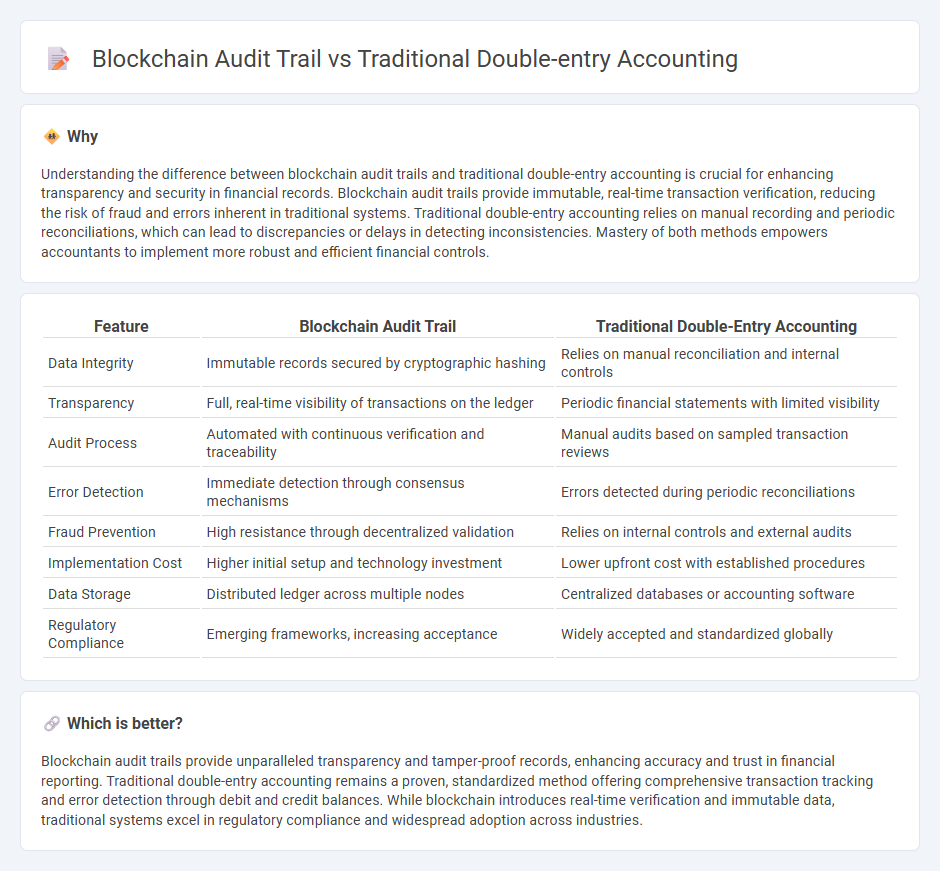

Understanding the difference between blockchain audit trails and traditional double-entry accounting is crucial for enhancing transparency and security in financial records. Blockchain audit trails provide immutable, real-time transaction verification, reducing the risk of fraud and errors inherent in traditional systems. Traditional double-entry accounting relies on manual recording and periodic reconciliations, which can lead to discrepancies or delays in detecting inconsistencies. Mastery of both methods empowers accountants to implement more robust and efficient financial controls.

Comparison Table

| Feature | Blockchain Audit Trail | Traditional Double-Entry Accounting |

|---|---|---|

| Data Integrity | Immutable records secured by cryptographic hashing | Relies on manual reconciliation and internal controls |

| Transparency | Full, real-time visibility of transactions on the ledger | Periodic financial statements with limited visibility |

| Audit Process | Automated with continuous verification and traceability | Manual audits based on sampled transaction reviews |

| Error Detection | Immediate detection through consensus mechanisms | Errors detected during periodic reconciliations |

| Fraud Prevention | High resistance through decentralized validation | Relies on internal controls and external audits |

| Implementation Cost | Higher initial setup and technology investment | Lower upfront cost with established procedures |

| Data Storage | Distributed ledger across multiple nodes | Centralized databases or accounting software |

| Regulatory Compliance | Emerging frameworks, increasing acceptance | Widely accepted and standardized globally |

Which is better?

Blockchain audit trails provide unparalleled transparency and tamper-proof records, enhancing accuracy and trust in financial reporting. Traditional double-entry accounting remains a proven, standardized method offering comprehensive transaction tracking and error detection through debit and credit balances. While blockchain introduces real-time verification and immutable data, traditional systems excel in regulatory compliance and widespread adoption across industries.

Connection

Blockchain audit trails enhance traditional double-entry accounting by providing immutable, time-stamped transaction records that increase transparency and reduce the risk of fraud. This integration ensures each financial entry is securely verified and traceable, improving audit accuracy and compliance with regulatory standards. Combining blockchain with double-entry systems streamlines reconciliation processes and strengthens data integrity in accounting practices.

Key Terms

Traditional double-entry accounting:

Traditional double-entry accounting meticulously records financial transactions through dual entries, ensuring accuracy and reducing errors by debiting one account and crediting another. This method forms the foundation of financial reporting and auditing, offering a standardized and time-tested framework for maintaining business records. Explore the detailed mechanics and benefits of traditional double-entry systems to understand their enduring relevance in finance.

Ledger

Traditional double-entry accounting relies on a centralized ledger recording debits and credits to ensure accuracy and detect errors, while blockchain audit trail uses a decentralized, immutable ledger secured by cryptographic consensus. Double-entry systems depend on manual reconciliation and periodic audits, whereas blockchain provides real-time transparency and automated validation through distributed nodes. Explore how blockchain technology revolutionizes ledger management for enhanced security and trust.

Journal Entries

Traditional double-entry accounting relies on manual journal entries to record debits and credits, ensuring accuracy through systematic checks and reconciliations. Blockchain audit trails offer immutable, time-stamped entries that enhance transparency and reduce the risk of fraud by securely recording transactions in a decentralized ledger. Discover how blockchain technology is revolutionizing journal entry processes for more efficient and reliable financial auditing.

Source and External Links

Understanding Double Entry And Triple Entry Accounting - CapActix - Traditional double-entry accounting records every transaction in two accounts with equal and opposite effects (one debit and one credit) ensuring the accounting equation (assets = liabilities + equity) always balances, reducing errors and fraud risk based on the duality principle formulated by Luca Pacioli.

Double Entry Accounting: A Comprehensive Guide for Modern ... - Double-entry accounting involves recording each financial transaction in at least two accounts with corresponding debits and credits to maintain accurate and balanced financial records, supporting the fundamental accounting equation.

A Comprehensive Guide to Double-Entry Accounting | NetSuite - This system requires that each financial event is recorded via journal entries affecting two or more accounts with equal debit and credit amounts, ensuring balanced ledgers aligned with the chart of accounts.

dowidth.com

dowidth.com