Cryptotax involves reporting and paying taxes on cryptocurrency transactions, including capital gains and income from digital assets, while income tax covers earnings from traditional sources such as wages, salaries, and business profits. The IRS treats cryptocurrencies as property, requiring detailed tracking of transactions to calculate taxable gains or losses distinct from regular income. Explore more to understand how cryptotax regulations may impact your financial obligations.

Why it is important

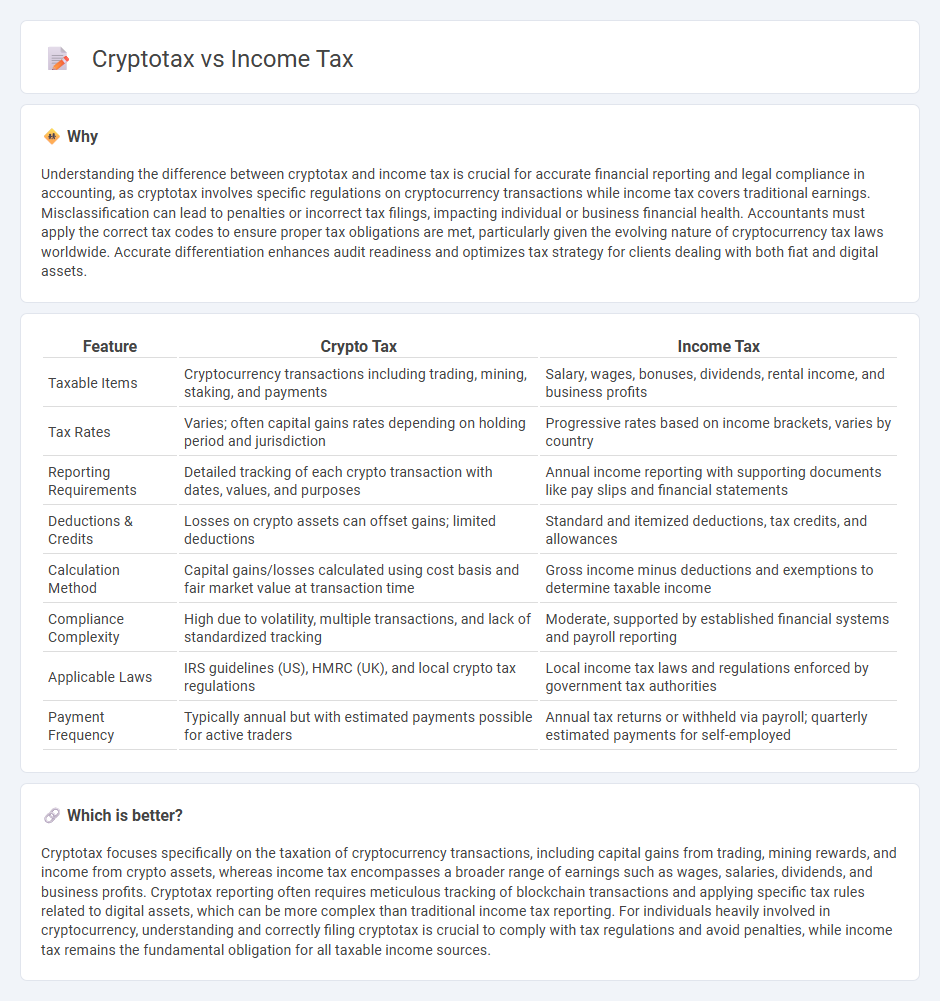

Understanding the difference between cryptotax and income tax is crucial for accurate financial reporting and legal compliance in accounting, as cryptotax involves specific regulations on cryptocurrency transactions while income tax covers traditional earnings. Misclassification can lead to penalties or incorrect tax filings, impacting individual or business financial health. Accountants must apply the correct tax codes to ensure proper tax obligations are met, particularly given the evolving nature of cryptocurrency tax laws worldwide. Accurate differentiation enhances audit readiness and optimizes tax strategy for clients dealing with both fiat and digital assets.

Comparison Table

| Feature | Crypto Tax | Income Tax |

|---|---|---|

| Taxable Items | Cryptocurrency transactions including trading, mining, staking, and payments | Salary, wages, bonuses, dividends, rental income, and business profits |

| Tax Rates | Varies; often capital gains rates depending on holding period and jurisdiction | Progressive rates based on income brackets, varies by country |

| Reporting Requirements | Detailed tracking of each crypto transaction with dates, values, and purposes | Annual income reporting with supporting documents like pay slips and financial statements |

| Deductions & Credits | Losses on crypto assets can offset gains; limited deductions | Standard and itemized deductions, tax credits, and allowances |

| Calculation Method | Capital gains/losses calculated using cost basis and fair market value at transaction time | Gross income minus deductions and exemptions to determine taxable income |

| Compliance Complexity | High due to volatility, multiple transactions, and lack of standardized tracking | Moderate, supported by established financial systems and payroll reporting |

| Applicable Laws | IRS guidelines (US), HMRC (UK), and local crypto tax regulations | Local income tax laws and regulations enforced by government tax authorities |

| Payment Frequency | Typically annual but with estimated payments possible for active traders | Annual tax returns or withheld via payroll; quarterly estimated payments for self-employed |

Which is better?

Cryptotax focuses specifically on the taxation of cryptocurrency transactions, including capital gains from trading, mining rewards, and income from crypto assets, whereas income tax encompasses a broader range of earnings such as wages, salaries, dividends, and business profits. Cryptotax reporting often requires meticulous tracking of blockchain transactions and applying specific tax rules related to digital assets, which can be more complex than traditional income tax reporting. For individuals heavily involved in cryptocurrency, understanding and correctly filing cryptotax is crucial to comply with tax regulations and avoid penalties, while income tax remains the fundamental obligation for all taxable income sources.

Connection

Cryptotax regulations impact income tax reporting by requiring individuals to declare cryptocurrency transactions as taxable events, including capital gains and losses. Income tax authorities treat cryptocurrency earnings, such as mining rewards or staking income, as ordinary income, affecting overall tax liability. Accurate record-keeping and compliance with both cryptotax and income tax rules are essential for avoiding penalties and ensuring proper financial reporting.

Key Terms

Taxable Income

Income tax is levied on all sources of taxable income, including wages, salaries, interest, dividends, and capital gains, whereas cryptotax specifically targets income and gains derived from cryptocurrency transactions. Taxable income for cryptocurrencies includes capital gains from trading, income from mining, staking rewards, and earnings received in digital assets, all of which must be reported similarly to traditional assets. Learn more about how taxable income differs between income and cryptotax to ensure accurate tax reporting and compliance.

Capital Gains

Capital gains from income tax are typically generated through the sale of assets like stocks or real estate, taxed based on holding period and income brackets. Cryptotax regulations specifically address gains from cryptocurrency transactions, often requiring detailed record-keeping of each trade and applying short-term or long-term capital gains tax rates. Explore more to understand precise tax obligations and reporting requirements for both traditional and digital asset gains.

Reporting Requirements

Income tax reporting requires declaring all sources of income, including wages, investments, and business profits, with strict adherence to IRS forms such as Form 1040 and Schedule 1. Cryptocurrency tax reporting demands detailed records of all transactions, including buys, sells, trades, and exchanges, using forms like Form 8949 and Schedule D to capture capital gains or losses accurately. Explore comprehensive guides to master compliance with both income and crypto tax reporting requirements.

Source and External Links

Federal Income Tax Calculator (2024-2025) - SmartAsset - Provides detailed information on U.S. federal income tax brackets and rates for the 2024-2025 period.

United States - Individual - Taxes on personal income - Offers insights into personal income tax rates and additional taxes such as the Medicare contribution tax in the U.S.

Federal income tax rates and brackets | Internal Revenue Service - Explains how federal income tax works, including tax brackets and rates for individual taxpayers.

dowidth.com

dowidth.com