Transfer pricing analytics focuses on evaluating and optimizing intercompany transaction prices to ensure compliance with tax regulations and minimize global tax liabilities. Internal audit examines organizational processes, including transfer pricing controls, to assess risk management and regulatory adherence. Discover more about the integration of transfer pricing analytics and internal audit to enhance corporate governance and tax strategy.

Why it is important

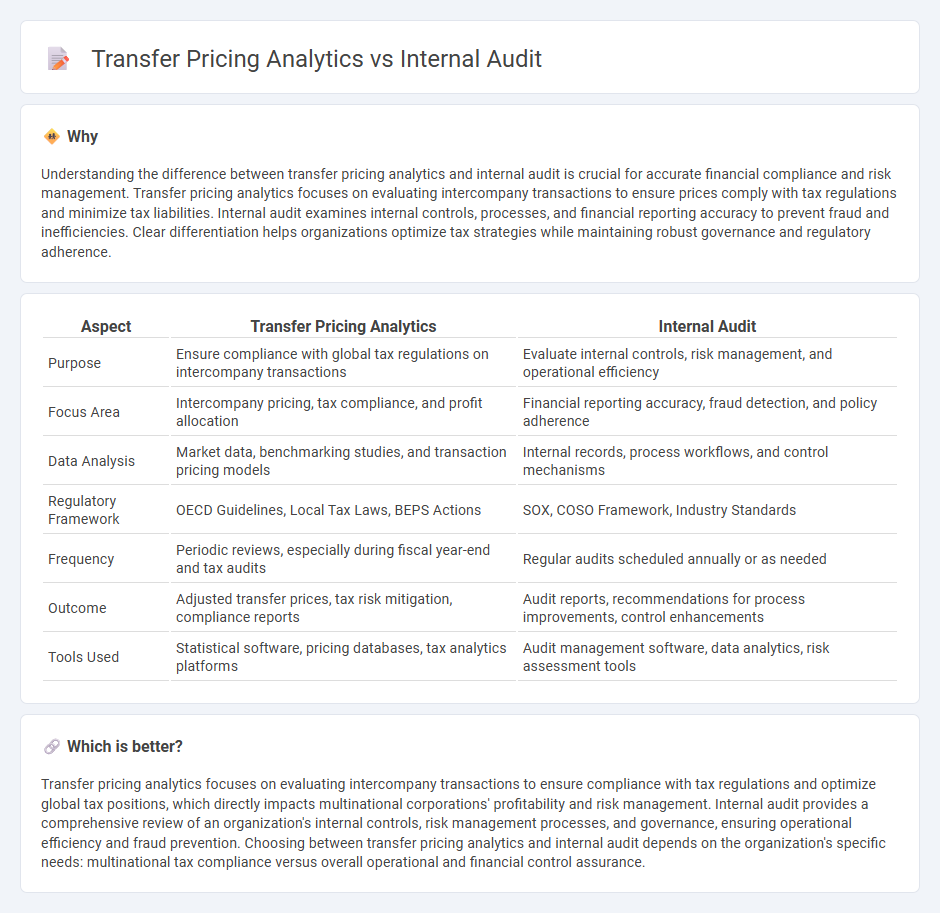

Understanding the difference between transfer pricing analytics and internal audit is crucial for accurate financial compliance and risk management. Transfer pricing analytics focuses on evaluating intercompany transactions to ensure prices comply with tax regulations and minimize tax liabilities. Internal audit examines internal controls, processes, and financial reporting accuracy to prevent fraud and inefficiencies. Clear differentiation helps organizations optimize tax strategies while maintaining robust governance and regulatory adherence.

Comparison Table

| Aspect | Transfer Pricing Analytics | Internal Audit |

|---|---|---|

| Purpose | Ensure compliance with global tax regulations on intercompany transactions | Evaluate internal controls, risk management, and operational efficiency |

| Focus Area | Intercompany pricing, tax compliance, and profit allocation | Financial reporting accuracy, fraud detection, and policy adherence |

| Data Analysis | Market data, benchmarking studies, and transaction pricing models | Internal records, process workflows, and control mechanisms |

| Regulatory Framework | OECD Guidelines, Local Tax Laws, BEPS Actions | SOX, COSO Framework, Industry Standards |

| Frequency | Periodic reviews, especially during fiscal year-end and tax audits | Regular audits scheduled annually or as needed |

| Outcome | Adjusted transfer prices, tax risk mitigation, compliance reports | Audit reports, recommendations for process improvements, control enhancements |

| Tools Used | Statistical software, pricing databases, tax analytics platforms | Audit management software, data analytics, risk assessment tools |

Which is better?

Transfer pricing analytics focuses on evaluating intercompany transactions to ensure compliance with tax regulations and optimize global tax positions, which directly impacts multinational corporations' profitability and risk management. Internal audit provides a comprehensive review of an organization's internal controls, risk management processes, and governance, ensuring operational efficiency and fraud prevention. Choosing between transfer pricing analytics and internal audit depends on the organization's specific needs: multinational tax compliance versus overall operational and financial control assurance.

Connection

Transfer pricing analytics enhances internal audit by providing detailed data on intercompany transactions, ensuring compliance with tax regulations and identifying pricing discrepancies. Internal audit leverages these analytics to assess risk, validate transfer pricing policies, and detect potential financial irregularities. This integration strengthens corporate governance and supports accurate financial reporting in multinational corporations.

Key Terms

**Internal Audit:**

Internal audit focuses on evaluating and improving the effectiveness of risk management, control, and governance processes within an organization, ensuring compliance with internal policies and regulatory requirements. It involves systematic examination of financial records, operational procedures, and adherence to standards to detect errors, fraud, and inefficiencies. Discover more about how internal audit enhances organizational integrity and supports strategic decision-making.

Risk Assessment

Internal audit in risk assessment involves evaluating financial controls and compliance to identify potential inaccuracies or fraud within an organization's operations. Transfer pricing analytics concentrates on analyzing intercompany transactions to ensure adherence to tax regulations and mitigate the risk of penalties from tax authorities. Explore more to understand how these functions complement each other in comprehensive risk management strategies.

Internal Controls

Internal audit prioritizes evaluating the effectiveness of internal controls to ensure compliance, risk management, and reliable financial reporting within an organization. Transfer pricing analytics focuses on analyzing intercompany transactions and documentation to comply with tax regulations and identify potential financial risks related to transfer pricing policies. Explore how integrating internal audit and transfer pricing analytics enhances governance and regulatory adherence.

Source and External Links

What is Internal Audit? Types, Value, Process & Standards - This webpage provides an overview of internal audits, including their types, such as financial, compliance, environmental, IT, operational, and performance audits, highlighting their value and processes.

Internal audit - This Wikipedia article explains that internal auditing is an independent assurance and consulting activity designed to improve an organization's operations by assessing risks and controls.

Internal Audit 101: Everything You Need to Know - This blog post covers the fundamentals of internal auditing, including its purpose, types, best practices, and essential components of internal audit reports.

dowidth.com

dowidth.com