Embedded lease accounting involves identifying lease components within broader contracts, enabling precise asset and liability recognition under accounting standards like IFRS 16. Operating lease accounting treats leases as off-balance-sheet items with lease expenses recognized on a straight-line basis over the lease term. Discover more about how accurate lease classification impacts financial statements and compliance.

Why it is important

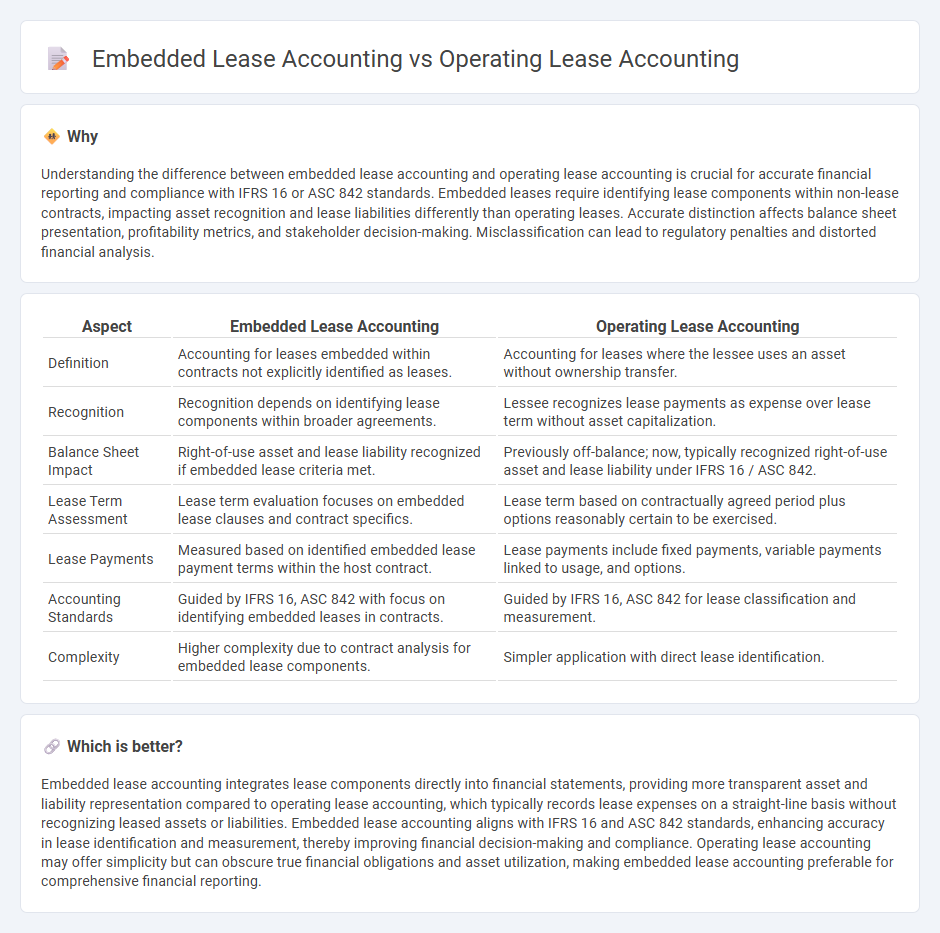

Understanding the difference between embedded lease accounting and operating lease accounting is crucial for accurate financial reporting and compliance with IFRS 16 or ASC 842 standards. Embedded leases require identifying lease components within non-lease contracts, impacting asset recognition and lease liabilities differently than operating leases. Accurate distinction affects balance sheet presentation, profitability metrics, and stakeholder decision-making. Misclassification can lead to regulatory penalties and distorted financial analysis.

Comparison Table

| Aspect | Embedded Lease Accounting | Operating Lease Accounting |

|---|---|---|

| Definition | Accounting for leases embedded within contracts not explicitly identified as leases. | Accounting for leases where the lessee uses an asset without ownership transfer. |

| Recognition | Recognition depends on identifying lease components within broader agreements. | Lessee recognizes lease payments as expense over lease term without asset capitalization. |

| Balance Sheet Impact | Right-of-use asset and lease liability recognized if embedded lease criteria met. | Previously off-balance; now, typically recognized right-of-use asset and lease liability under IFRS 16 / ASC 842. |

| Lease Term Assessment | Lease term evaluation focuses on embedded lease clauses and contract specifics. | Lease term based on contractually agreed period plus options reasonably certain to be exercised. |

| Lease Payments | Measured based on identified embedded lease payment terms within the host contract. | Lease payments include fixed payments, variable payments linked to usage, and options. |

| Accounting Standards | Guided by IFRS 16, ASC 842 with focus on identifying embedded leases in contracts. | Guided by IFRS 16, ASC 842 for lease classification and measurement. |

| Complexity | Higher complexity due to contract analysis for embedded lease components. | Simpler application with direct lease identification. |

Which is better?

Embedded lease accounting integrates lease components directly into financial statements, providing more transparent asset and liability representation compared to operating lease accounting, which typically records lease expenses on a straight-line basis without recognizing leased assets or liabilities. Embedded lease accounting aligns with IFRS 16 and ASC 842 standards, enhancing accuracy in lease identification and measurement, thereby improving financial decision-making and compliance. Operating lease accounting may offer simplicity but can obscure true financial obligations and asset utilization, making embedded lease accounting preferable for comprehensive financial reporting.

Connection

Embedded lease accounting integrates lease components within broader asset contracts, requiring detailed identification and measurement of lease liabilities and right-of-use assets under IFRS 16 or ASC 842 standards. Operating lease accounting focuses on recognizing lease expenses on a straight-line basis without capitalizing the underlying asset, primarily affecting the income statement. Both methods ensure accurate financial reporting by reflecting lease obligations and usage rights, but embedded lease accounting provides a more comprehensive balance sheet impact compared to operating lease accounting.

Key Terms

Right-of-Use Asset

Operating lease accounting recognizes the Right-of-Use (ROU) asset separately on the balance sheet, reflecting the lessee's right to use the leased asset over the lease term, while embedded lease accounting identifies lease components within larger contracts requiring similar ROU asset recognition. The key difference lies in how lease liabilities and ROU assets are measured and disclosed, impacting financial ratios and compliance with ASC 842 or IFRS 16 standards. Explore comprehensive guidance on lease classification and ROU asset treatment to optimize lease accounting accuracy.

Lease Liability

Operating lease accounting records lease payments as operating expenses without capitalizing the lease liability on the balance sheet, while embedded lease accounting identifies and separates lease components within contracts, recognizing a lease liability and right-of-use asset. Lease liability under embedded lease accounting reflects the present value of future lease payments, impacting financial ratios and debt covenants more transparently. Explore detailed differences in lease liability treatment to enhance your financial compliance strategies.

Non-lease Components

Operating lease accounting treats lease payments as rental expenses without capitalizing underlying assets, often separating lease and non-lease components based on lease terms. Embedded lease accounting identifies lease components within broader contracts, requiring allocation between lease and non-lease elements for accurate financial reporting under ASC 842 or IFRS 16. Explore detailed guidelines and implications of non-lease component treatment to optimize lease accounting compliance.

Source and External Links

Operating vs. finance leases: Journal entries & amortization - Netgain - Operating leases require the lessee to record a right-of-use (ROU) asset and lease liability on the balance sheet, with expenses recognized on a straight-line basis over the lease term without separately recording interest expense, reflecting the lessee's right to use the asset while ownership remains with the lessor.

Lease Accounting Policy - Harvard - Operating leases are recorded on the balance sheet as separate ROU assets and lease liabilities and remeasured annually, with rent or lease expenses recognized in the income statement, differing from finance leases which involve depreciation and interest expenses.

Operating Lease Accounting for ASC 842 Explained & Example - Finquery - Under ASC 842, operating leases must be recognized on the balance sheet with ROU assets and lease liabilities, and rent expense is recognized in a manner that reflects lease payments, often including adjustments for lease incentives and escalations.

dowidth.com

dowidth.com